Press Releases - BFF Banking Group

Press Releases

• 9M23 Reported Profit at €115.0m, +24% YoY, Adjusted Net Profit at €122.5m, +16% YoY, a new 9M record high.

• Loan Portfolio at €5.3bn, +12% YoY, with double-digit growth in several countries,confirming positive trend.

• Loan/Deposit ratio at 71%, solid Balance Sheet with funding deriving primarily fromstable retail (4x YoY) and operational deposits.

• Reduction in Total Assets and increase in loan book YoY, with Leverage Ratio slightlyimproved.

• Strong asset quality with 0.1% Net NPLs/Loans ratio excluding Italian municipalities inconservatorship.

• Very solid capital position: CET1 ratio at 15.5% and TCR at 20.8%. €101m of excess capital vs. 12% CET1 ratio target, after payment in Sep-23 of €0.438 p.s. of 1H23 interim dividend.

• €40.5m (€0.218 p.s.) of accrued dividend in 3Q23, next semi-annual payment after AGM of Apr-24. No impact from windfall tax on dividends and payout ratio throughout Business Plan horizon.

Milan, 9th November 2023 – Today the Board of Directors of BFF Bank S.p.A. (“BFF” or the “Bank”) approved BFF’s first nine months 2023 consolidated financial accounts.

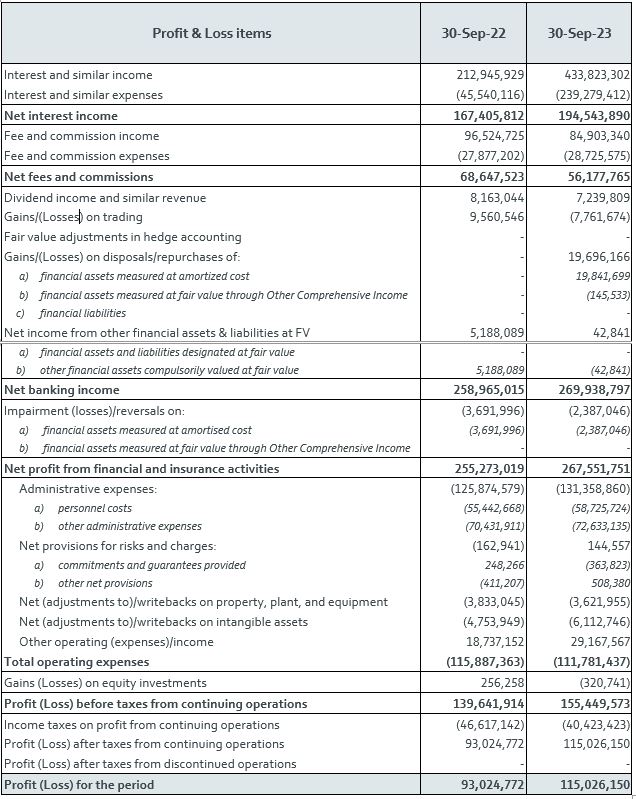

CONSOLIDATED PROFIT AND LOSS

9M23 Adjusted Total Revenues were €547.4m (+75% YoY), of which €293.7m coming from Factoring, Lending & Credit Management business unit, €45.7m from Payments, €18.9m from Securities Services and €189.1m from Other Revenues, of which €127.2m from the Government bond portfolio. 9M23 Cost of Funding was at €248.3m, with liabilities repricing faster than assets, and Adjusted Total Net Revenues were €299.1m (+9% YoY). Total Adjusted operating expenditures, including D&A, were €130.7m (€121.2m in 9M22), and Adjusted LLPs and provisions for risks and charges were -€2.6m.This resulted in an Adjusted Profit before taxes of €165.8m, and an Adjusted Net Profit of €122.5m, +16% YoY. 9M23 Reported Net Profit was €115.0m, +24% YoY.

With regard to the business units’ KPIs and adjusted Profit & Loss data, please refer to the “9M 2023 Results” presentation published in the Investors > Results > Financial results section of BFF Group’s website. Please note that the Corporate Center comprises all the revenues and costs not directly allocated to the three core business units (Factoring, Lending & Credit Management, Payments and Securities Services).

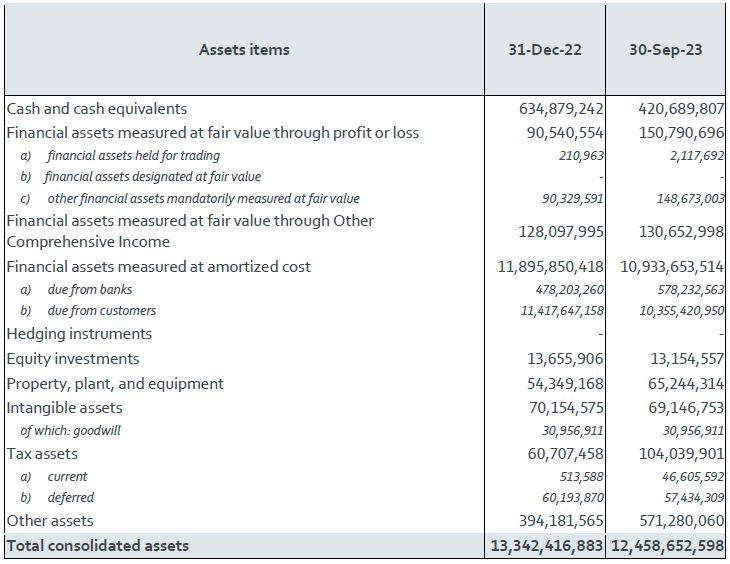

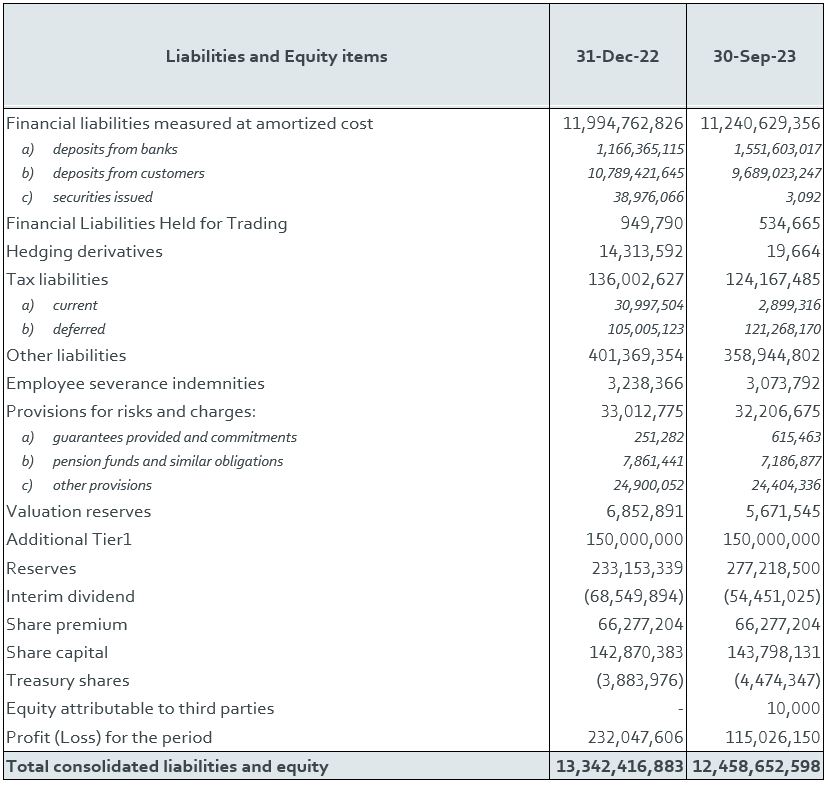

CONSOLIDATED BALANCE SHEET

As of 30th September 2023, the consolidated Balance Sheet amounted to €12.5bn down by €0.6bn (-4%) vs. the end of September 2022, despite the increase in Loan Book YoY.

The Loan Book was at €5,325m, up by €565m YoY (+12%), with double-digit growth in Italy (+12%), Greece (+37%), Spain (+18%) and Portugal (+13%).

At the end of September 2023, the Government bond portfolio was classified entirely as Held to Collect or “HTC”. The bond portfolio was equal to €5.3bn at the end 9M23, vs. €6.7bn at the end of September 2022, with a strong reduction of fixed bonds, at 20% of the total portfolio in 9M23 vs. 41% in 9M22. The fixed bond portfolio residual average life was 44 months, with a yield of 0.69%; the floater bond residual portfolio average life was 66 months, with a spread +0.90% vs. 6-month Euribor and a running yield of 4.52% as of 30th September 2023. Gross mark to market of fixed bond portfolio amounted to -€121.1m at the end of September 2023, while for floaters it was equal to -€51.5m. Cash and Cash Balances were €421m as of end of September 2023, up by €172m (69%) YoY.

On the Liabilities side, the main changes vs. end of September 2022 are the following:

• deposits from Transaction Services were €5.3bn at the end of September 2023, down by €1.2bn YoY (stable YoY excluding Arca), primarily due to Arca’s exit;

• on-line retail deposits at end of September 2023 amounted to €2,140m vs. €585m at the end of September 2022, up by €1,554m (>250%) YoY, primarily raised in Spain and Poland;

• Passive Repos (refinancing operations related to Italian Government Portfolio) amounted to €3.7bn at the end of September 2023, vs. €4.8bn at end of September 2022, down by 22% YoY;

• BFF did not have any outstanding Senior unsecured bonds at the end of September 2023 (vs. €39m at end of September 2022), due to the repayment at maturity of the residual amount of €39m of the senior preferred bond, with maturity May 23rd 2023.

Cost of funding in 9M23 was 2.99%, lower than the average market reference rates.

BFF does not have European Central Bank “ECB” funding to be refinanced (PELTRO, TLTRO, etc.).

The Group maintained a strong liquidity position, with Liquidity Coverage Ratio (LCR) at 177.2% as of 30th September 2023. At the same date, the Net Stable Funding Ratio (NSFR) was 171.9% and Leverage Ratio 4.7%, stable vs. 4.6% at YE22.

***

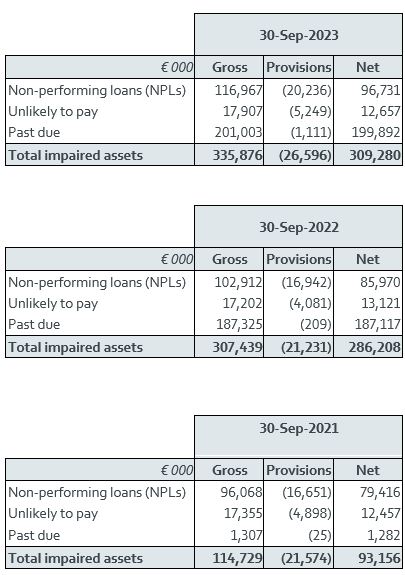

Asset quality

The Group continues to benefit from a very low exposure towards the private sector. Net nonperforming loans (“NPLs”), excluding Italian Municipalities in conservatorship (“in dissesto”), were €6.4m, at 0.1% of net loans, with a 76% Coverage ratio, improved vs. YE22 and vs. 9M22 when it was 74% and 69%, respectively. Italian Municipalities in conservatorship are classified as NPLs by regulation, despite BFF is entitled to receive 100% of the principal and late payment interests at the end of the conservatorship process.

Negligible annualized Cost of Risk at 6.3 basis points at end of September 2023.

At the end of September 2023 net Past Due amounted to €199.9m, increased vs. €185.3m as of YE22 and vs. €187.1m as of end of September 2022. In September 2022 Bank of Italy issued more stringent interpretation criteria on the DoD (Guidelines on the application of the definition of default under Art. 178 of Regulation (EU) no. 575/2013), determining a step up in Past Due exposure, with no impact on the Group underlying credit risk: 91% of NPE exposure is towards Public Administration in 9M23.

Total Net impaired assets (non-performing, unlikely to pay, and past due) were €309.3m as of 30th September 2023, vs. €283.8m as of YE22, and €286.2m as of end of September 2022, primarily as a consequence of an increase in municipalities in conservatorship and in public sector Past Due.

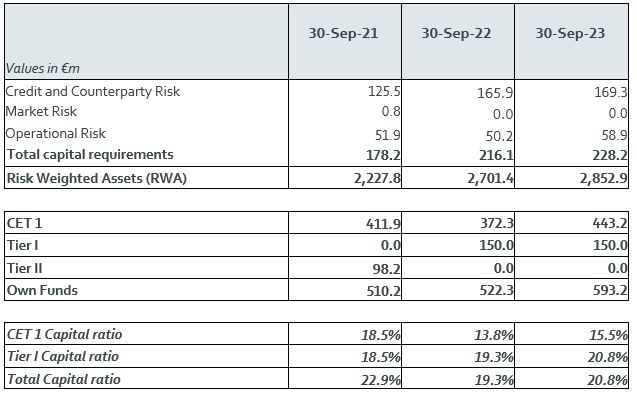

Capital ratios

The Group maintains a strong capital position with a Common Equity Tier 1 (“CET1”) ratio of 15.5% vs. a SREP of 9.0%. The Total Capital ratio (“TCR”) is at 20.8%, vs. a SREP of 12.5%. Both ratios exclude €40.5m of accrued dividends, which, if included, would bring CET1 ratio and TCR at 17.0% and 22.2% respectively. BFF has €101m of excess capital vs. 12% CET1 ratio target, already excluding €81.9m of 1H23 interim dividend paid in Sept-23. The target capital ratio, as announced on 29-Jun-23 during BFF Capital Market Day, has moved from 15% TCR to 12% of CET1 ratio, to align it with other banks main capital target. Distribution of dividends remains, as before, subject to the fulfillment of all the regulatory capital requirements, with dividend confirmed twice a year, based on 1H and full year Adjusted Net Income.

Risk Weighted Assets (“RWAs”) calculation is based on the Basel Standard Model. As of end of September 2023 RWAs were €2.9bn, increased vs. €2.7bn at YE22 and vs. €2.7bn at end of September 2022, with a density of 42%, vs. 42% at YE22 and 45% at end of September 2022.

***

Significant events after the end 9M23 reporting period

Late Payment Interest rate

On October 26th, the ECB kept interest rates unchanged. Therefore, due to the previous increases

and considering no further changes, from 1-Jan-24, Eurozone Late Payment Interest (“LPI”)

statutory rate is likely to increase by 0.5%, to 12.5% from previous 12.0%.

Board of Directors appointment process

As announced in the press release published on 26th October 2023, BFF Board of Directors (“BoD”) approved the Guidelines for Shareholders on the quali-quantitative composition of the BoD. The appointment of the new BoD will take place at the Annual General Meeting in April 2024 approving the Financial Statements as of 31 December 2023, coinciding with the maturity of the term of office of the current Board of Directors.

The same day Mr. Salvatore Messina, Chairman of the BoD, having already completed nine yearsin office, which makes the independence requirement no more applicable, informed the BoD of his intention not to stand for re-election, in line with the best corporate governance practices.

BFF announces it holds a 7.7% stake in the share capital of Generalfinance S.p.A

Following a purchase of shares in a block trade, BFF has reached a 7.7% stake in the share capital of Generalfinance S.p.A., as announced to the market with the press release dated 4th October 2023. The transaction represents an investment in a financial intermediary – offering Factoring services mainly to distressed, financially-constrained companies – with a high growth potential, operating in a fast-growing market.

One-off windfall tax on the increase of Italian banks’ Net Interest Income

BFF gives notice that the one-off tax calculated on the increase in net interest income, as provided by Decree Law no. 104 dated 10th August 2023 converted with amendments by Law no. 136 dated 9th October 2023, would be c. €10m. Today, BFF's BoD, resolved to propose to the AGM in Apr-24, as alternative option to the tax payment, the allocation to non-distributable reserves of c. €24.4m, equivalent to 2.5 times the theoretical tax amount of c. €10m, taking up the option provided by the above-mentioned law. This decision will have no impact on the dividend distribution policy and payout ratio throughout all the business plan horizon. In line with its 2028 strategy, BFF is focused on the creation of significant value for all stakeholders, and continues to support initiatives addressing social needs, elimination of inequalities, and enhancement of financial, social, and cultural inclusion.

Social Bond Framework

As announced with the press release dated 29th September 2023, BFF published its first Social Bond Framework, which serves as the reference document for all the Social Bond issues by BFF. The Framework defines the Bank’s commitment to sustainable finance, with a particular focus on social topics, further strengthening the link between sustainability and its financial strategies.

***

Statement of the Financial Reporting Officer

The Financial Reporting Officer, Giuseppe Manno, declares, pursuant to paragraph 2 of article 154-bis of the Legislative Decree n° 58/1998 (“Testo Unico della Finanza”), that the accounting information contained in this press release corresponds to the document results, accounting books, and records of the Bank.

***

Earnings call

9M 2023 consolidated results will be presented today, 9th November, at 15:00 CET (14:00 WET) during a conference call, that can be followed after registering at this link. The invitation is published in the Investors > Results > Financial results section of BFF Group’s website.

***

Consolidated Balance Sheet (Values in €)

Consolidated Income Statement (Values in €)

Consolidated capital adequacy

Asset quality