Press Releases - BFF Banking Group

Press Releases

- New business in Greece increased by 93.2% YoY

- Non-recourse factoring volumes in Greece reach €43 Mln

- Factoring services are the preferred method to generate immediate liquidity, according to the survey administered by BFF in 1Q

Athens, 20th May 2022 – The Board of Directors of BFF Bank S.p.A. (“BFF” or the “Bank”) has approved the consolidated financial results for 1Q 2022, with the Group recording adjusted net profit of €38.1 Mln, +37% YoY, and strong factoring growth.

In 1Q 2022 new business in Greece recorded a robust increase, 93.2% YoY, with non-recourse factoring volumes reaching €43 Mln. As the only bank in Greece specialized in financial solutions to the public sector suppliers, with an undisputed expertise in the health care sector in Europe, BFF has designed a number of services to answer to the very specific features and needs of Greece, where the Group started its activities in 2017, to open a branch in 2020. This makes BFF the leading name in non-recourse factoring towards NHS and the Public Administrations with a total turnover in Greece of more than €283 Mln since 2017.

***

According to the survey administered by BFF in 1Q 2022 that analyses the commercial relation between companies and public administrations, including NHS, in the Greek market, factoring is the preferred service (35%) for suppliers of the PA in Greece to generate immediate liquidity and improve balance ratios. Non-recourse factoring provides in fact the necessary liquidity to companies without burdening balance sheets with additional debt.

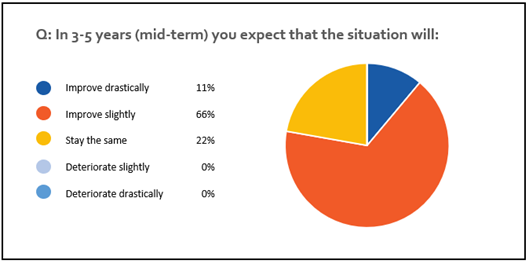

Companies also say that trends in payments terms have remained stable since last year, and most of interviewees (66%) expect that the current situation will “slightly improve” in the near future.

Among challenges that companies face in dealing with the public sector, we find timing between the provision of goods until invoicing, reconciliation process, time consuming administration activities, as well as some additional ones such as commercial disputes, payment mandates, lack of e-services and the claw back and rebate legislation.

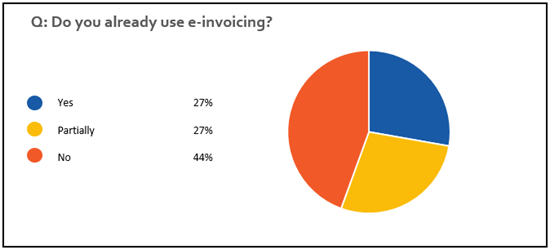

Top-3 initiatives that were suggested for improving efficiency and simplify processes are i) Authorities interconnectedness (IRS, EFKA etc.), ii) E-invoicing, iii) Web portals.

E-invoicing – which is not or just partially diffused today – could be a huge driver to speed up activities.

The survey was conducted in 1Q by BFF among its clients, to investigate new trends, further improve the quality of services and create tailor-made solutions to support companies in their commercial relations with Public Administrations.

"Our presence in Greece – that started in 2017 and was improved in 2020 with a branch, to stay closer to our clients in a high-instable environment, precisely during a pandemic – continues to grow, as our commitment to further understand our clients’ needs. The survey we decided to run in 1Q proves exactly this.” stated Mr. Christos Theodossiou, Head of Greece at BFF Banking Group.

Press Release about BFF Banking Group’s Financial Results in 1Q 2022 is available on-line on BFF Group’s website www.bff.com within the Investors > PR & Presentations section.