Press Releases - BFF Banking Group

Press Releases

- FY2022 Reported Profit at €232.0m, + 17.6% YoY. 2022 Adjusted Net Profit +16.6% YoY, at €146.0m.

- Strong growth in loan portfolio, at €5.4bn, +45% YoY, a new historical high.

- Strong asset quality with 0.1% Net NPLs/Loans ratio excluding Italian municipalities in conservatorship. Public Sector’s Past Due stable vs 3Q22.

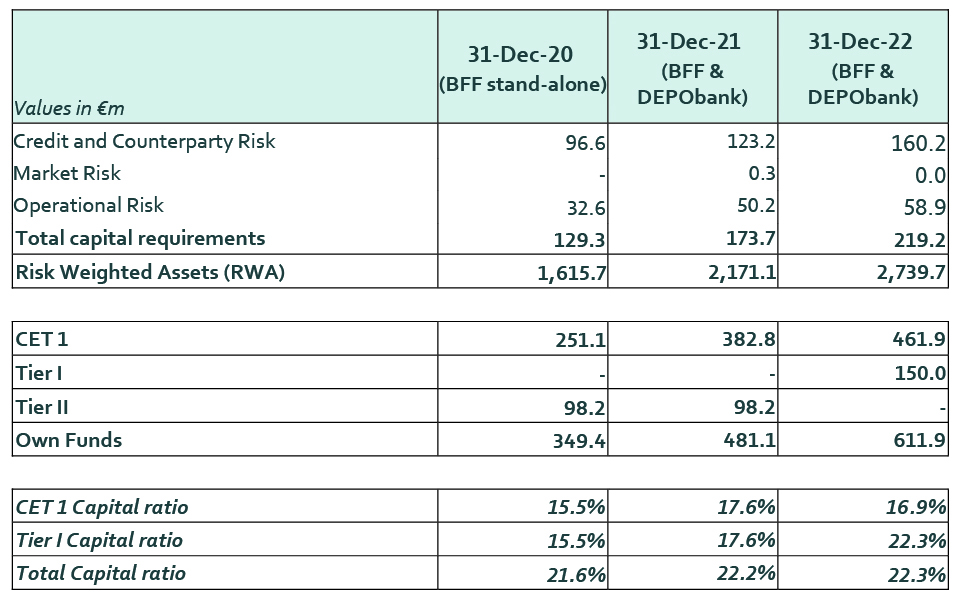

- Very solid capital position: CET1 ratio at 16.9% and TCR at 22.3%.

- From 31-Dec-22: (i) “Recovery Cost” rights accounted on an accrual basis, and (ii) change in Late Payment Interest’s (“LPI”) recovery rate accrual to 50% from 45%. Positive €100m capital one-off at YE22, along with an increase in yearly profits from 2023. €530m of off-balance sheet reserves.

- FY22 dividends at €146.0m, including €68.5m of interim dividend paid in Aug-22. €77.5m final 2022 dividend (approx. €0.42 per share) to be paid in Apr-23. Upcoming interim dividend in Aug-23 based on 1H23 results.

- Increase in LPI statutory rate at 10.50%, following Jan-23 refixing, further increase expected in 2023. Significant interest rates upside still unlocked.

- 2023 Net Income Adj. Target up to €180/190m from previous €170/180m. New medium-term targets will be communicated with new Strategic Plan before the 1H23 results.

Milan, 9th February 2023 – Today the Board of Directors of BFF Bank S.p.A. (“BFF” or the “Bank”) approved BFF’s full year 2022 consolidated financial accounts .

Massimiliano Belingheri, BFF Group CEO, commented: “The year 2022 brought double-digit growth in Group’s profits, delivering full synergies of DEPObank acquisition one year ahead of schedule, and expectations of increasing profitability. We are pleased to announce a new Adjusted Net Profit Target for 2023, increased to €180-190m, with significant unlocked potential related to rising interest rates for the year ahead. We are proud of the growth in our loan portfolio, which recorded a new all-time high, and of the solid capitalisation of the Group.”

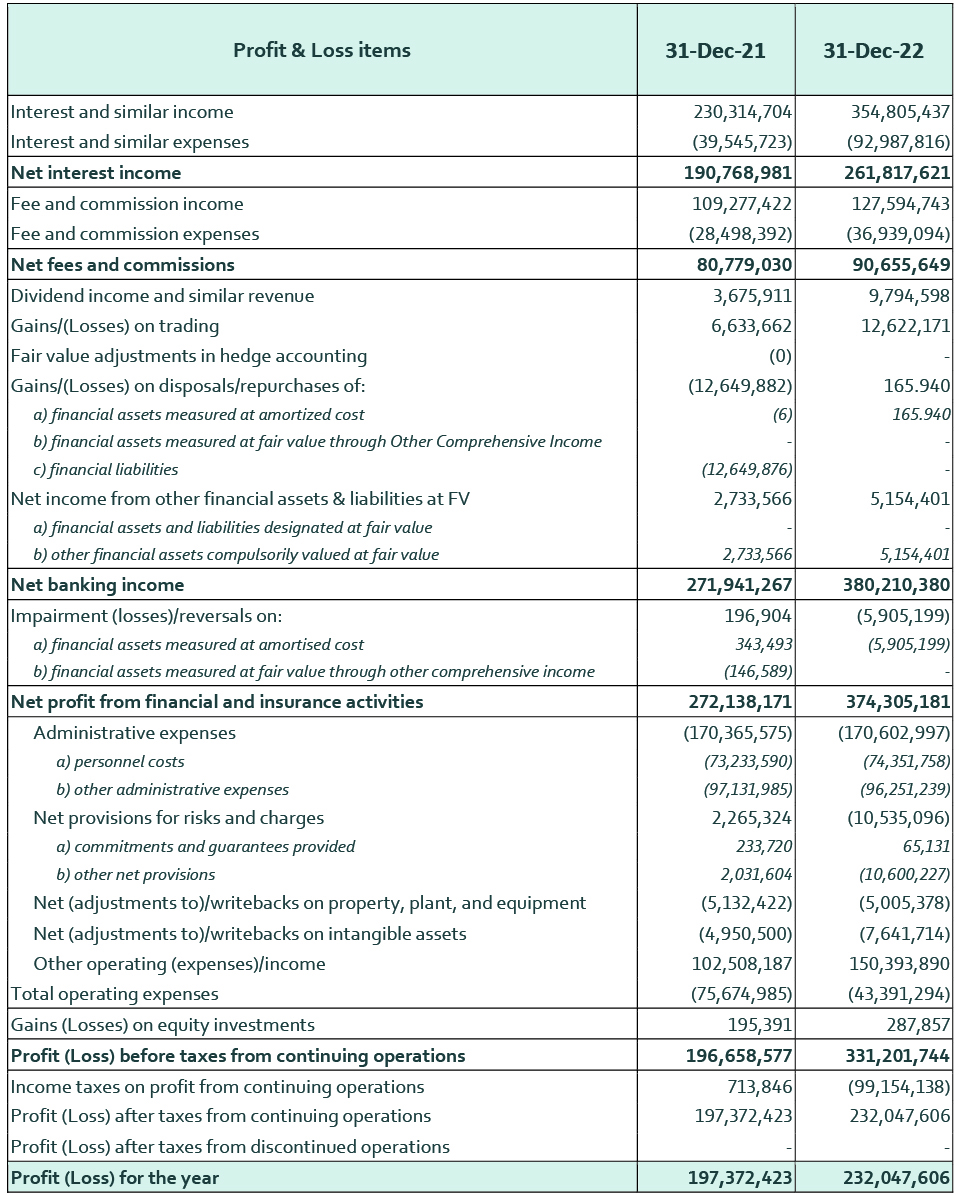

CONSOLIDATED PROFIT AND LOSS

FY22 Adjusted Net Revenues were €379.1m, of which €170.1m coming from Factoring, Lending & Credit Management business unit, €52.5m from the Securities Services, €63.3m from Payments, and €93.2m from the Corporate Center (including synergies). Total Adjusted operating expenditures, including D&A, were €167.6m, and Adjusted LLPs and provisions for risks and charges were €6.2m.

This resulted in an Adjusted Profit before taxes of €205.4m, and an Adjusted Net Profit of €146.0m, +16.6% YoY. FY22 Reported Net Profit was €232.0m (for details, see footnote n° 2).

At the end 2022, the employees at Group level were 841 (vs. 862 at the end of 2021), of which:

- 358 in the Factoring & Lending business unit (366 in FY21),

- 168 in the Securities Services (180 in FY21),

- 52 in Payments (49 in FY21), and

- 263 in the Corporate Center (staff, control functions, finance & administration, technology and processes improvement) vs. 267 in FY21.

With regard to business units’ KPIs and adjusted Profit & Loss data, please refer to the “FY 2022 Results” presentation published in the Investors > Results > Financial results section of BFF Group’s website. Please note that the Corporate Center comprises all the revenues and costs not directly allocated to the three core business units (Factoring, Lending & Credit Management, Securities Services and Payments).

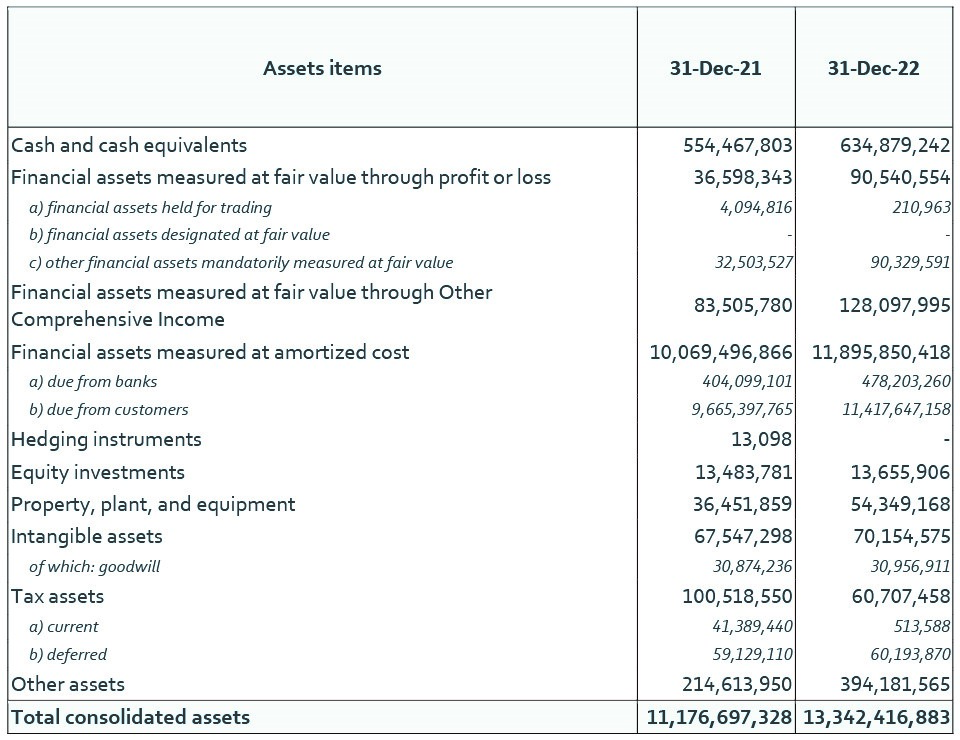

CONSOLIDATED BALANCE SHEET

As of 31st December 2022, the consolidated Balance Sheet amounted to €13.3bn up by €2.2bn, +19% vs. YE21. With respect to Total Assets, at the end of December 2022 the Loan Book was at €5,442m , at historical highs, up by €1.7bn YoY (+45% YoY, at €3,763m as of YE21), with strong performance of Italy, up by +59% YoY.

At the end of December 2022, the Government bond portfolio was classified entirely as Held to Collect or “HTC”. The bond portfolio amounts to €6.1bn at the end of Dec-22, vs. €5.8bn at YE21, with €4.2bn floating rate bonds, and €1.9bn fixed rate bonds, following a rebalancing portfolio strategy, aimed at increasing floaters to benefit from raising interest rates. The Fixed bond portfolio residual average life was 31 months, with a yield of 0.35%; the floater bond residual portfolio average life was 64 months, with a spread +0.96% vs. 6-month Euribor and a running yield of 3.03% as of 31-Dec-22. Cash and Cash Balances were €0.6bn as of YE22, up by €0.1bn (+14.5%) YoY.

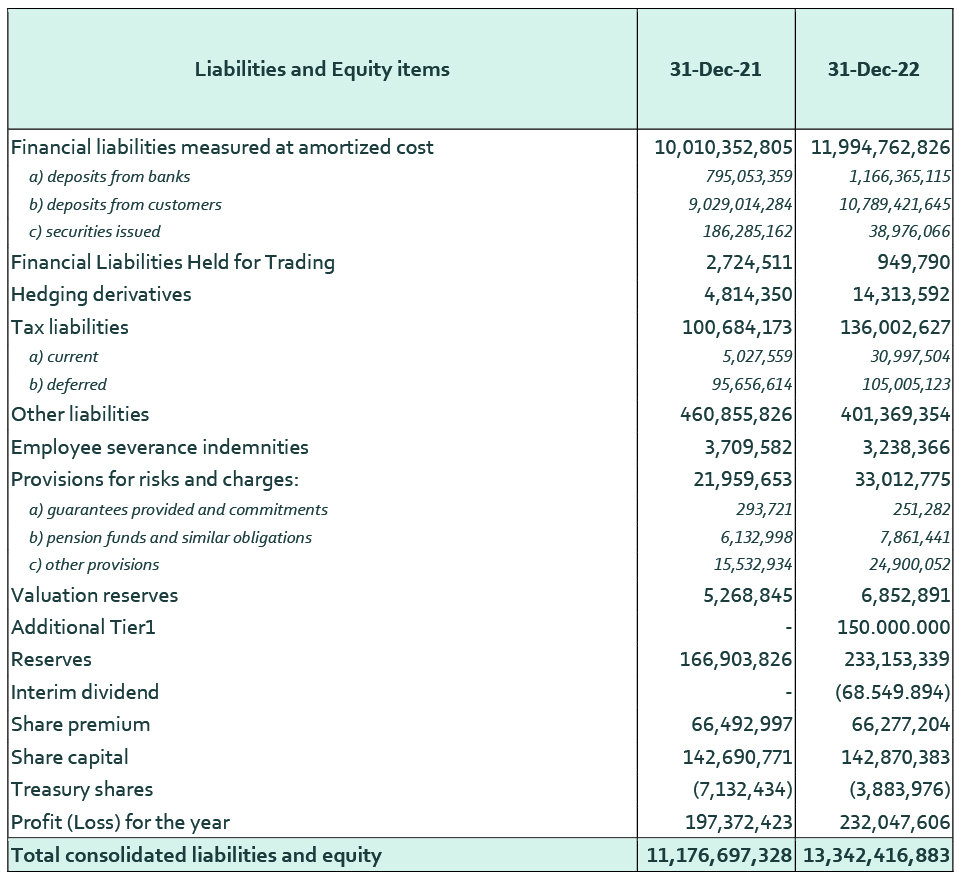

On the Liabilities side the main changes vs. YE21 are the following:

- Deposits from Transaction Services were €5.9bn at YE22, down by €2.6bn YoY (€0.6bn net of Arca YoY), primarily due to Arca’s migration to another Depositary Bank which was completed in November 2022;

- on-line retail deposits at YE22 amounted to €1,283m vs. €230m at the YE21, up by €1,053m (+457%) YoY, increasing in Poland and Spain;

- Passive Repos (refinancing operations related to Italian Government Portfolio) increased to €4.4bn at the end of December 2022, from €1.1bn at YE21, due to higher loan book and lower deposits from transaction services, partially offset by the increase in on-line retail deposits;

- a €150m perpetual NC 5 AT1 Bond was issued in January 2022, with a fixed rate annual coupon of 5.875% to be paid on a semi-annual basis, allowing for higher capital flexibility, large exposure limit and leverage ratio;

- BFF outstanding bonds decreased to €39m, vs. €182m at YE21 (-79% YoY), due to the maturity of €43.2m Senior Bonds during the year and to the repayment of the Tier II in March 2022, following the exercise of the call option.

The Euro cost of funding was -40bps over 1-month Euribor in 4Q22, vs. -17bps over 1-month Euribor in 3Q22.

BFF does not have European Central Bank “ECB” funding to be refinanced, nor ordinary (OMO) neither extraordinary (PELTRO, TLTRO…).

The Group maintained a strong liquidity position, with Liquidity Coverage Ratio (LCR) at 297.8% as of 31st December 2022. The Net Stable Funding Ratio (NSFR) and the Leverage Ratio, at the same date, were equal to 161.1% and 4.6% respectively.

***

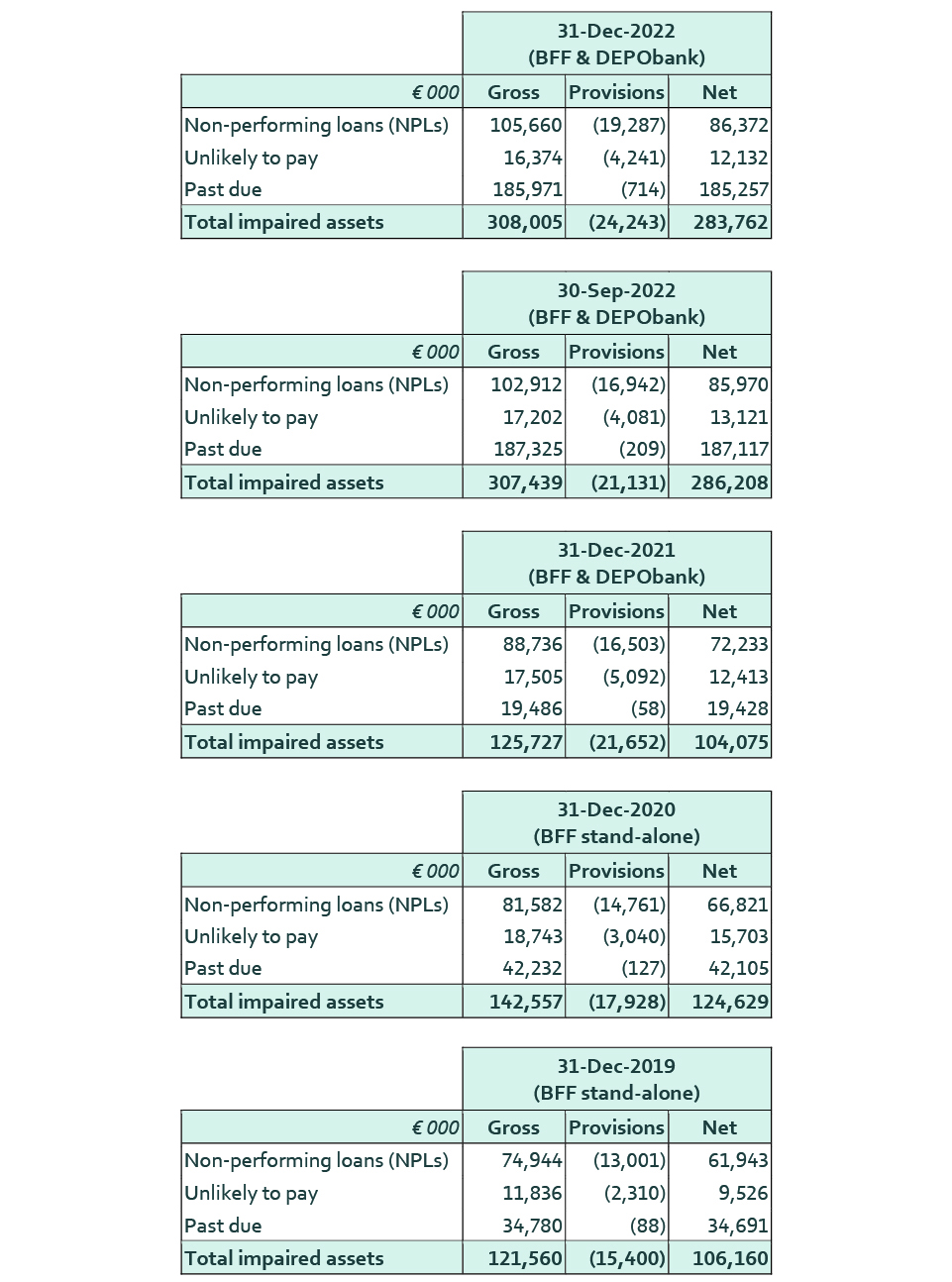

Asset quality

The Group continues to benefit from a very low exposure towards the private sector. Net non-performing loans (“NPLs”), excluding Italian Municipalities in conservatorship (“in dissesto”), were €6.7m, at 0.1% of net loans, with an improved 74% Coverage ratio vs. 9M22 and vs. YE21. Italian Municipalities in conservatorship are classified as NPLs by regulation, despite BFF is entitled to receive 100% of the principal and late payment interests at the end of the conservatorship process.

Annualized Cost of Risk on loans was 11.2 basis points at YE22, with an increase vs. the previous periods mostly due to specific provisions on private exposures in Poland.

At the end of December 2022 net Past Due amounted to €185.3m, stable vs. €187.1m as of 30-Sept-22 when they increased due to more stringent interpretation criteria on the New DoD (Guidelines on the application of the definition of default under Art. 178 of Regulation (EU) no. 575/2013) issued by Bank of Italy on 23rd September 2022.

Total Net impaired assets (non-performing, unlikely to pay, and past due) were €283.8m as of YE22 stable vs. 30-Sept-22 with 92% towards public sector.

On Balance Sheet Recognition of Recovery Costs and Change in LPI Accrual Rate

Starting from the end of 2022 BFF, based upon its collection track record, changed its collection estimate on (i) “Recovery Cost” rights to 50% (previously cash accounted), (ii) LPI’s recovery rate accrual to 50% from 45% (iii) LPI collection days at 2,100 days, based on new long-term collection trends. These changes still leave €530m of off-balance sheet reserves still not recognized in BFF accounts (€410m of off-balance sheet LPIs fund and €120m of off-balance sheet Recovery Costs fund) and were the main drivers of a positive €100m one off profit.

Capital ratios

The Group maintains a strong capital position with a Common Equity Tier 1 (“CET1”) ratio of 16.9% vs. a SREP of 9.00% (increased from the previous requisite of 7.85% as communicated to the market with the press release of 8th August 2022). The Total Capital ratio (“TCR”) is at 22.3%, well above both the Bank’s TCR target of 15.0%, and the SREP of 12.50% (prior to 8th August 2022, the SREP was 12.05%), with €201m of capital in excess of 15.0% TCR target. Both ratios exclude the €77.5m dividends to be paid after the Annual General Meeting of 13th April 2023.

FY22 dividends are €146.0m, including €68.5m of interim dividend paid in Aug-22. BFF has repaid since IPO more than €615m in dividends to its shareholders, c. 77% of the IPO market capitalization.

Risk Weighted Assets (“RWAs”) calculation is based on the Basel Standard Model. As of YE22 RWAs were €2.7bn (vs. €2.2bn at YE21 and €1.6bn at YE20 of BFF stand-alone), with a density of 42%, vs. 45% at YE21 and 39% at YE20. In 2022 the growth in loan book drove the decline in RWA density vs. FY21, despite the new DoD implementation.

***

Significant events after the end of 2022 full year reporting period

Increase in LPIs rate

From 1-Jan-23, Eurozone LPI statutory rate increased by 2.5%, to 10.5% from previous 8%, generating a step up in the gross yield on overdue loan portfolio of 1.25% at a 50% accrual recovery rate. It is expected a further increase to 11.75% at the next refixing date (1-Jul-23), of which 11.00% has been already locked-in with the rates’ increase of 2nd February 2023.

BFF does not longer qualify as Small Medium Enterprise

As announced in the press release published of 4th January 2023, BFF does not longer qualify as Small Medium Enterprise ("SME") pursuant to Article 1, paragraph 1, letter w-quarter. 1 ) of Legislative Decree No. 58 of 24 February 1998 ("Consolidated Law on Finance" or “TUF”). It should be noted that the loss of BFF's SME qualification requires the application of an additional threshold for the disclosure obligations of significant shareholdings equal to 3% of the capital, pursuant to Article 120 of the Consolidated Law on Finance. Accordingly, shareholders who hold shareholdings higher than the new threshold of 3% and less than 5% of BFF share capital, must notify Consob and BFF Bank in accordance with Articles 117, paragraph 2-bis, and 121, paragraph 3-bis, of the Issuers' Regulations.

Authorization for the shares’ buy-back programme

At the beginning of February 2023, BFF received the authorization from the Bank of Italy for the Bank’s shares’ buy-back, up to a maximum amount of €2.8 million, as communicated in the press release of 1st February 2023.

The shares’ buy-back programme aims at providing the Bank with a stock of financial instruments necessary to fulfil the obligations of the remuneration and incentive systems related to BFF’s “Banking Group remuneration and incentive Policy” in force.

The starting date, timing, exact amount and other details of the shares’ buyback program, will be the subject of subsequent communication to the market.

***

REVISED 2023 ADJ. NET INCOME TARGETS

2023 Net Income Adj. Target increased to €180-190m from €170-180m. New medium- term Targets review will be published before the 1H23 Result announcement.

The upward revision is driven mainly by the positive impact deriving from the change in LPIs accrual accounting at 50% (from previous 45%), the accrual accounting of the “Recovery cost” rights, previously cash accounted, the increase in LPI rate from 1-Jan-23, and despite the impact of Arca’s exit, of the factoring repricing time-lag, of the lengthening of LPI collection times and of cost inflation.

***

Statement of the Financial Reporting Officer

The Financial Reporting Officer, Giuseppe Manno, declares, pursuant to paragraph 2 of article 154-bis of the Legislative Decree n° 58/1998 (“Testo Unico della Finanza”), that the accounting information contained in this press release corresponds to the document results, accounting books, and records of the Bank.

Consolidated Balance Sheet (Values in €)

Consolidated Income Statement (Values in €)

Consolidated capital adequacy

Asset quality