Press Releases - BFF Banking Group

Press Releases

Adjusted Net Profit at €183.2m, +25% YoY, a new record high. FY23 Reported Profit at €171.7m.

• Loan Portfolio at €5.6bn, a new historical high.

• Solid Balance Sheet at €12.3bn, with smaller bond portfolio, lower Repos and improved Leverage Ratio.

• Improved Loan/Deposit ratio at 62%, with funding deriving primarily from stable retail deposits (2x YoY) and operational deposits.

• Strong asset quality with 0.1% Net NPLs/Loans ratio excluding Italian municipalities in conservatorship.

• Very solid capital position: CET1 ratio at 14.2% and TCR at 19.1%. €68m of excess capital vs. 12% CET1 ratio target.

• FY23 dividends at €183.2m (€0.979 p.s.), of which €81.9m (€0.438 p.s.) of interim dividend paid in Sep-23 and €101.2m (€0.541 p.s.) of 2023 balance, to be paid after AGM of Apr-24. Upcoming interim dividend in Sep-24 based on 1H24 results.

Milan, 8th February 2024 – Today the Board of Directors of BFF Bank S.p.A. (“BFF” or the “Bank”) approved BFF’s full year 2023 consolidated financial accounts.

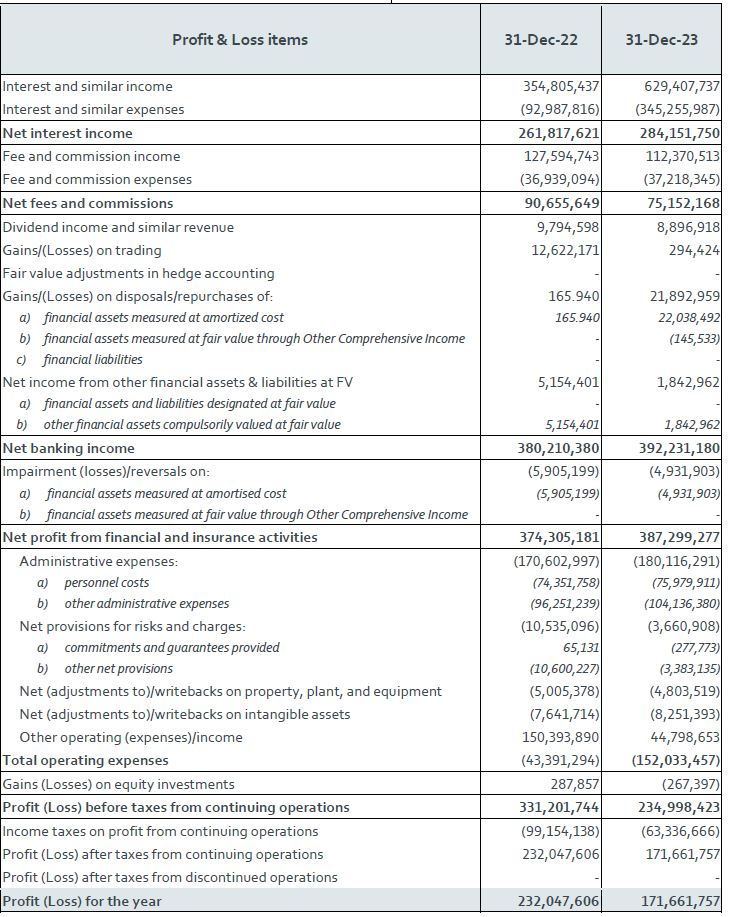

CONSOLIDATED PROFIT AND LOSS

FY23 Adjusted Total Revenues were €791.9m (+71% YoY), of which €437.3m coming from Factoring, Lending & Credit Management business unit, €63.1m from Payments, €23.6m from Securities Services and €268.0m from Other Revenues, of which €180.5m from the Government bond portfolio. FY23 Cost of Funding was at €354.9m, with liabilities repricing faster than assets, and Adjusted Total Net Revenues were €437.0m (+15% YoY). Total Adjusted operating expenditures, including D&A, were €178.4m (€167.6m in FY22), and Adjusted LLPs and provisions for risks and charges were -€8.9m.

This resulted in an Adjusted Profit before taxes of €249.8m, and an Adjusted Net Profit of €183.2m, +25% YoY. FY23 Reported Net Profit was €171.7m (for details, see footnote n° 1).

With regard to the business units’ KPIs and adjusted Profit & Loss data, please refer to the “FY 2023 Results” presentation published in the Investors > Results > Financial results section of BFF Group’s website. Please note that the Corporate Center comprises all the revenues and costs not directly allocated to the three core business units (Factoring, Lending & Credit Management, Payments and Securities Services).

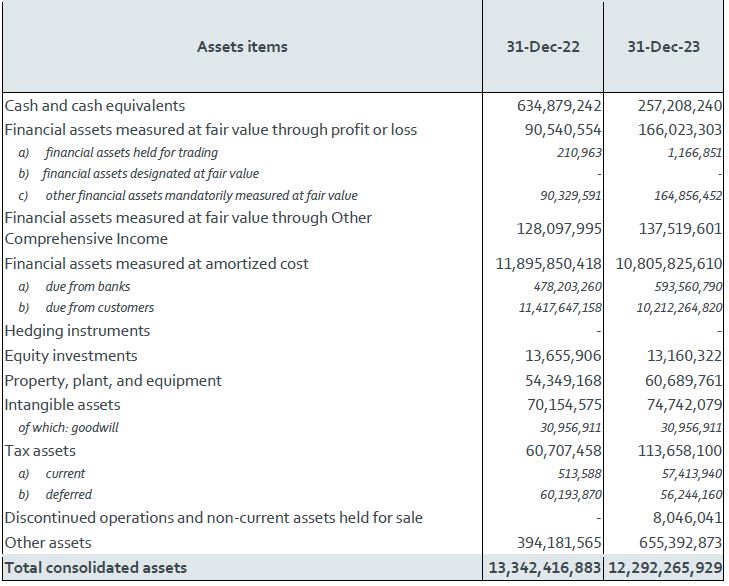

CONSOLIDATED BALANCE SHEET

As of 31st December 2023, the consolidated Balance Sheet amounted to €12.3bn down by €1.1bn (-8%) vs. the end of December 2022, despite the increase in Loan Book YoY.

The Loan Book was at €5,617m2, up by €175m YoY (+3%), partially impacted by injections of liquidity by the government in Spain and Portugal, with volumes up by 10% YoY at €8,114m.

At the end of December 2023, the Government bond portfolio was classified entirely as Held to Collect or “HTC”. The bond portfolio was equal to €5.0bn at the end FY23, vs. €6.1bn at the end of December 2022, with a strong reduction of fixed bonds, at 22% of the total portfolio in FY23 vs. 32% in FY22. The fixed bond portfolio residual average life was 41 months, with a yield of 0.68%; the floater bond residual portfolio average life was 67 months, with a spread +0.90% vs. 6-month Euribor and a running yield of 5.16% as of 31st December 2023. Gross mark to market of fixed bond portfolio amounted to -€76.0m at the end of December 2023, and to €10.8m for floaters. Cash and Cash Balances were €257m as of end of December 2023, down by €378m (59%) YoY.

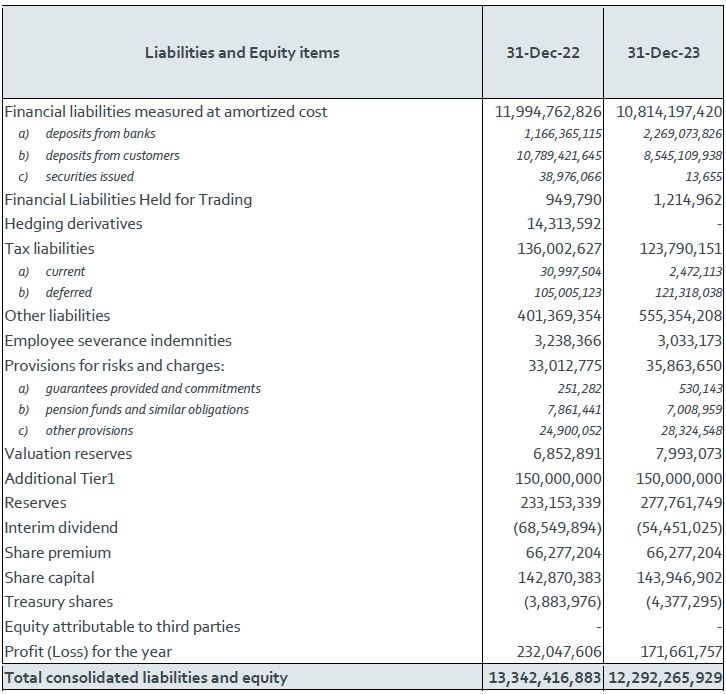

On the Liabilities side, the main changes vs. end of December 2022 are the following:

• deposits from Transaction Services were €6.4bn at the end of December 2023, up by €0.5bn YoY;

• on-line retail deposits at end of December 2023 amounted to €2,744m vs. €1,283m at the end of December 2022, up by €1,461m (>100%) YoY, raised primarily in Spain and Poland;

• Passive Repos (refinancing operations related to Italian Government Portfolio) decreased significantly to €1.7bn at the end of December 2023, vs. €4.4bn at end of December 2022, down by 62% YoY;

Cost of funding in FY23 was 3.22%, lower than the average market reference rates. BFF does not have European Central Bank “ECB” funding to be refinanced (PELTRO, TLTRO, etc.).

The Group maintained a strong liquidity position, with Liquidity Coverage Ratio (LCR) at 297.7% as of 31st December 2023. At the same date, the Net Stable Funding Ratio (NSFR) was 192.4% and Leverage Ratio 4.8%, improved vs. 4.6% at YE22.

***

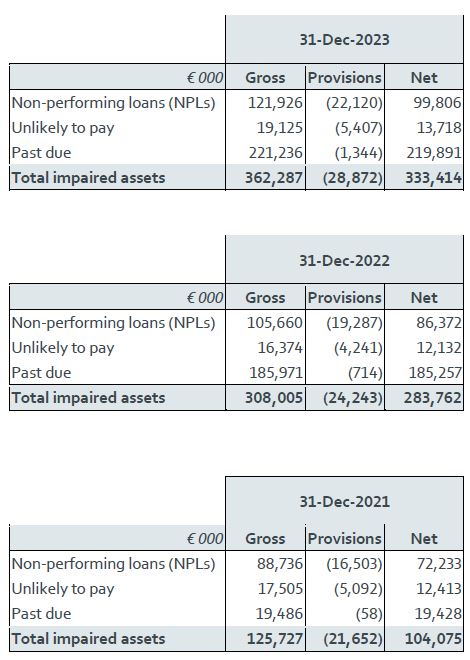

Asset quality

The Group continues to benefit from a very low exposure towards the private sector. Net nonperforming loans (“NPLs”), excluding Italian Municipalities in conservatorship (“in dissesto”), were €7.2m, at 0.1% of net loans, with a 75% Coverage ratio, in line vs. YE22 and vs. 9M23 when it was 74% and 76%, respectively. Italian Municipalities in conservatorship are classified as NPLs by regulation, despite BFF is entitled to receive 100% of the principal and late payment interests at the end of the conservatorship process.

Negligible annualized Cost of Risk at 9.4 basis points at end of December 2023.

At the end of December 2023, net Past Due amounted to €219.9m, increased vs. €199.9m as of end of September 2023 and €185.3m as of YE22. In September 2022, Bank of Italy issued more stringent interpretation criteria on the DoD (Guidelines on the application of the definition of default under Art. 178 of Regulation (EU) no. 575/2013), determining a step up in Past Due exposure, with no impact on the Group underlying credit risk: 90% of NPE exposure is towards Public Administration in FY23.

Total Net impaired assets (non-performing, unlikely to pay, and past due) were €333.4m as of 31st December 2023, vs. €309.3m as of end of September 2023 and €283.8m as of YE22, primarily as a consequence of an increase in municipalities in conservatorship and in public sector Past Due.

Capital ratios

The Group maintains a strong capital position with a Common Equity Tier 1 (“CET1”) ratio of 14.2% vs. a SREP of 9.0%. The Total Capital ratio (“TCR”) is at 19.1%, vs. a SREP of 12.5%. Both ratios exclude €101.2m of accrued dividends, which, if included, would bring CET1 ratio and TCR at 17.5% and 22.4% respectively. BFF has €68m of excess capital vs. 12% CET1 ratio target, already excluding €101.2m of 2H23 dividend balance to be paid in Sep-24. The target capital ratio, as announced on 29-Jun-23 during BFF Capital Market Day4, has moved from 15% TCR to 12% of CET1 ratio, to align it with other banks main capital target. Distribution of dividends remains, as before, subject to the fulfillment of all the regulatory capital requirements, with dividend confirmed twice a year, based on 1H and full year Adjusted Net Income.

Risk Weighted Assets (“RWAs”) calculation is based on the Basel Standard Model. As of end of December 2023, RWAs were €3.1bn, increased vs. €2.7bn at YE22 and vs. €2.9bn at end of September 2023, with a density6 of 43%, vs. 42% at YE22 and 42% at end of September 2023.

***

Late Payments Directive 2011/7/EU Revision

The ongoing proposed revision of Late Payments Directive outlines a favourable scenario for BFF. European Commission Proposal and European Parliament Draft Report, if confirmed, would imply:

a) the switch to a regulation from the current directive;

b) payment terms to 30 days across all sectors, including NHS, increasing outstanding, LPIs

and overdue invoices;

c) Recovery Costs from €40 to at least €50 per invoice in the European Commission proposal,

up to average €100 per invoice according to European Parliament Draft Report.

In Jan-24, c. 400 amendments to the European Commission Proposal were tabled and the final

text of the European Parliament is expected to be submitted for approval in Apr-24.

Significant events after the end FY23 reporting period

Late Payment Interest rate

Since 1-Jan-24, Eurozone Late Payment Interest (“LPI”) statutory rate increased by 0.5%, to 12.5%

from previous 12.0%.

BFF wins Cassa di Previdenza e Assistenza Forense tender for depositary services

BFF has been selected by Cassa di Previdenza e Assistenza Forense for the depositary bank service and for the services related to Cassa Forense’s assets, equal to c. €13bn, confirming its leadership in the Italian welfare system.

Guidelines for Shareholders on the qualitative and quantitative composition of the Board of Directors and of the Board of Statutory Auditors

It is also announced that, following the guidelines issued by the Bank of Italy on 13th November 2023, relating to the assessment of the requirements and criteria for the suitability of corporate bodies of LSI banks, financial intermediaries, credit institutions, electronic money institutions, payment institutions, trust companies and depositor guarantee, have been available the updated formats of the questionnaires for the verification by the Board of Directors and the Board of Statutory Auditors of the requisites of its members - respectively annexes "D" and "C" to the "Guidelines for Shareholders on the Qualitative and Quantitative Composition of the Board of Directors and for the Preparation of the List of the Board of Directors" and the "Guidelines for Shareholders on the Qualitative and Quantitative Composition of the Board of Statutory Auditors", published on BFF's website.

***

Statement of the Financial Reporting Officer

The Financial Reporting Officer, Giuseppe Manno, declares, pursuant to paragraph 2 of article 154-bis of the Legislative Decree n° 58/1998 (“Testo Unico della Finanza”), that the accounting information contained in this press release corresponds to the document results, accounting books, and records of the Bank.

***

Earnings call

FY 2023 consolidated results will be presented today, 8th February, at 15:00 CET (14:00 WET) during a conference call, that can be followed after registering at this link. The invitation is published in the Investors > Results > Financial results section of BFF Group’s website.

***

Consolidated Balance Sheet (Values in €)

Consolidated Income Statement (Values in €)

Consolidated capital adequacy

Asset quality