Report macro perspectives Spain 3Q2020 - BFF Banking Group

Macro perspectives on Spain

and its regional governments’ finances

Q3 2020: Spanish regions & municipalities

will face an unprecedented fiscal challenge in 2021

Executive Summary

An unprecedented GDP decline in 2Q20

According to the provisional estimates released by the National Statistics Institute (INE), the Spanish GDP fell by c.-18.5% Q/Q (- 22% Y/Y) in 2Q20, with a broad-based decrease across all sectors and components of demand. Thus, Spain was the most affected among the developed economies, as leisure- related sectors make up an oversized share of consumption (restaurants, hospitality and tourism), which were hardest hit both by the lockdowns and the time it takes the economy to return to some form of normality.

All these factors may help to explain that Spain (like other peripheral economies) is particularly vulnerable to this context (the - 18.5% Q/Q drop in 2Q20 is much worse than the -10% Q/Q in Germany, the -13.8% Q/Q in France, -12.4% Q/Q in Italy and the drop of c.- 12% Q/Q in the EMU as a whole in the quarter).

The Spanish economy will face significant challenges ahead in 2020-2021

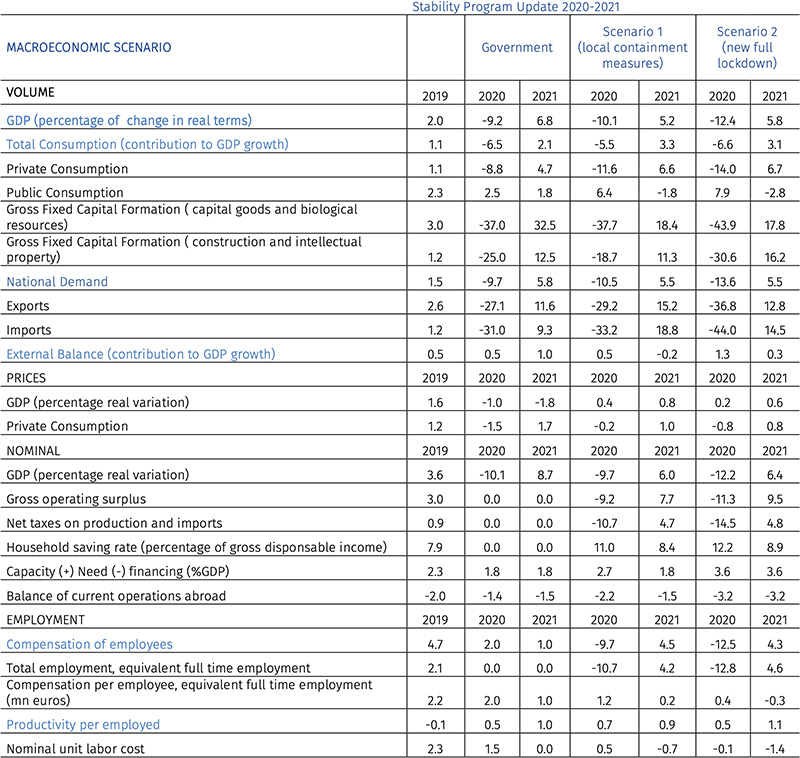

Most international institutions and organizations have revised the Spanish GDP growth forecasts downwards in the last weeks. The new projection for the period 2020-2021 by the independent fiscal monitor (AIReF) contemplates a decline of the Spanish GDP growth in 2020 between -10.1 % and - 12.4% Y/Y, depending on the duration of the pandemic, compared to the contraction of around -9% Y/Y anticipated in June.

All the main macro forecasters estimate a double-digit GDP decline in 2020. As an example, FUNCAS downgraded their base case scenario regarding the national GDP growth expected in 2020 by 3.2pp, up to a decline of 13% in GDP. In 2021, the economy would recover by 7.9% Y/Y, but it would not return to the pre-Covid level until 2023, or even 2024, a year later than previously estimated.

Moreover, the Bank of Spain estimates a GDP decline of 10.5% in 2020 in the more benign scenario (local containment measures) followed by a recovery of 7.3% GDP in 2021 (vs a 9.1% Y/Y growth in the previous scenario) and a sharper decline of up to 12.6% (100bp more than the previous forecast of 11.6%) in the second scenario in case of a more negative evolution of the pandemic and harsher containment measures, followed by a milder increase of 4.1% in 2022. Regarding 2022, and although it is subject to a significant degree of uncertainty, GDP growth would range between 1.9 and 3.3%.

This downward revision is mainly due to the greater contraction of the GDP estimated for the second quarter of 2020 on the back of the adverse evolution of some activities of high importance in the productive structure of Spain, which continue to be very negatively affected by the social distancing measures and the contraction of international tourism flows.

Furthermore, the combination of four factors particularly affect the Spanish economy: a) the prolonguing of the containment measures for a longer period than expected; b) the greater impact of the restrictions on domestic demand; c) the greater reduction in expenditure on domestic production; and d) the contraction of the tourism sector.

All the components of demand would show very large declines in 2020, with the exception of public consumption. The decrease in private consumption is notable due to the increase in forced savings during the confinement period and savings of a precautionary nature due to the deterioration in confidence in the market and employment prospects. Business investment is also expected to register a significant decline in a context of high uncertainty about the prospects for demand and liquidity difficulties.

The recovery in 2021 will be of a moderate and incomplete nature, with a Y/Y GDP increase of 5.1% in the first scenario and 5.8% in the second scenario, according to AIReF estimates. A potential positive note could be the positive impact that can be derived from the European Recovery Plan agreed by the EU leaders in mid-July.

The reasons behind our moderate and incomplete recovery scenario for 2021 are various. Firstly, the temporary characteristics that hinder a more dynamic recovery (distance measures, reduction of capacity, sanitation, etc.) are added to the structural ones (high participation in the productive structure of the activities with greater social interaction, temporality of employment and business demographics with a greater participation of small and medium-sized enterprises more vulnerable to financing difficulties), in a global context where the pandemic still continues to advance worldwide, certainly affecting the speed of the global recovery. At the national level, the scenario of continuous outbreaks could end up affecting the confidence of families and companies, weighing down the reactivation of consumption and employment. (fig. 1)

Figure 1 | 2020-2021 GDP estimates by sector and component

Source: AIReF 2020

Despite the expected economic recovery to take place, the GDP level at the end of 2021 is estimated to remain more than 5% below the GDP level observed before the pandemic in both scenarios, a common finding among other institutions and that gives an idea of the magnitude of the crisis. In overall terms, the recovery of 2019 GDP levels would not occur until 2022.

To sum up, the 2020-2021 biennium can already be counted as a lost one in terms of growth and will also leave deep scars in production, employment and income. The management of the recovery, the design of national aid and the proper use of the support from Europe that are being implemented, together with the needed reforms in Spain to maximize their impact, will mark the economic recovery; but it is important to internalize that demand policies are not going to be enough; supply policies will also be necessary for the recovery to be significant.

Heterogeneous and asymmetric impact on regional GDPs

The regions with the greatest weight in the agricultural sector could be less affected and could grow faster than Spain in 2020, as well as some industrial regions in the north where the recovery of economic activity after the confinement could be faster and where the spending of households have been less affected.

The autonomous communities with an economic structure more oriented to the production of tradable goods or services and with higher bias to foreign markets are better positioned to emerge out faster from the economic crisis. Among this group we would include the northern regions of Spain: Aragon, Navarre, La Rioja and the Cantabrian axis. In these regions, the return to normality could be faster, which implies that, in 2020, their GDP decline will be lower than the national average.

The Autonomous Communities most dependent on social consumption (the islands, Madrid and the Mediterranean ones) will have a more negative evolution than the average in 2020. On the other hand, the rebound in their economic activity will be more intense next year, although not enough to recover the pre-crisis levels.

Looking ahead to 2021, the rebound in tourism and consumption will push, above all, the most affected regions in 2020, particularly the most tourism-orientated regions. The regions with the highest exposure to the agricultural sector, which will be the least affected in 2020, could experience on the other hand a lower economic rebound in 2021.The recovery of the EU could particularly benefit the more export- oriented regions, particularly in the agri-food sector.

Systematically high deficits and rising public debt will be the common theme in 2020-2022

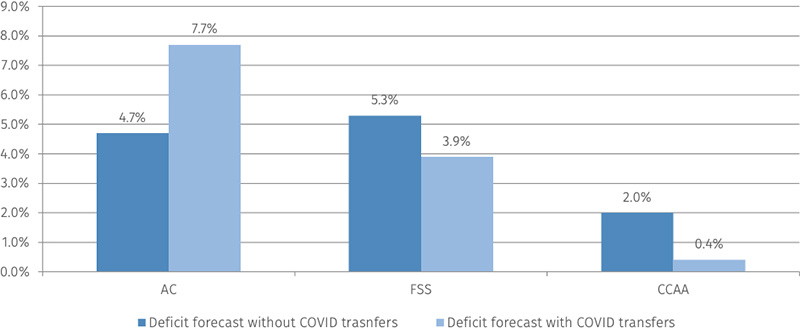

AIReF estimates a 2020 aggregated fiscal deficit of the Spanish public administrations for 2020 of 11.9%, which could reach 14.4% if the most adverse scenario materializes. (fig. 2)

Figure 2 | Deficit of the Central Administration, Social Security Fund and Autonomous Communities, with and without transfers of the Central Administration due to the COVID-19 crisis for 2020 (AIReF forecast) % GDP

Source: AIReF 2020

The distribution of the impact of the COVID-19 crisis by public administration highlights that the bulk of the deficit generated in 2020 will be borne by the central administration, since it absorbs through transfers part of the deterioration suffered by other subsectors. On the one hand, the Government has approved additional transfers to the Social Security Funds (FSS) amounting to EUR 15,700 million and the government has also approved the COVID - 19 Fund for the Autonomous Communities for the amount of EUR 16,000mn, as mentioned in the last quarterly report.

AIReF estimates that the Autonomous Communities could reach a deficit of between 0.4% and 0.9% of GDP in 2020, once the transfers from the COVID-19 Fund have been incorporated (1.4%-1.5% of GDP). COVID-19 direct impact on regional accounts is estimated in a 1.5-2.0% GDP range.

Up to the month of June, the last data available, the regional administration has registered a deficit of EUR 6,710 million, which represents 0.60% of GDP, compared to the deficit of 0.67% of GDP registered a year ago, roughly a 10% Y/Y decline. This positive evolution has been driven by the various measures adopted by the Government to guarantee the resources of the regions and respond to the emergency caused by COVID- 19.

Regional deficits face a significant deterioration in 2021-2022. Regional revenues will be impacted by the crisis in 2021 with the update of the State transfers from the financing system to the real macroeconomic scenario and the non-repetition of the extraordinary transfers of 2020. In 2022, the normal-status Autonomous Communities will have to face the definitive liquidation of the financing system.

Regarding the evolution of the public debt ratio, AIReF projects an increase in the debt- to-GDP ratio of between 22.1 and 27.7 points in 2020, implying a debt-to-GDP ratio in a range between 117.6 and 123.2% of GDP in 2020, depending on the macro scenario considered and an additional increase of 1.1 and 2.5 points in 2021. Even if one assumes an annual reduction in the public deficit of 0.5 points of GDP from the level projected for 2021, returning to the debt level of 95.5% registered at the end of 2019 will require at least two decades.

AIReF estimates a significant increase in the regional debt ratios, which would be in a range between 26.7 and 27.9% in 2020 and between 27.2 and 28.7% in 2021 (23.7% as of 2019YE).The situation may worsen from 2021, due to the effects on the regional debt volume of the expected fiscal deterioration in 2021 and 2022. Although the expected recovery in terms of GDP from 2021 would have a positive impact in the debt ratio (denominator), the deterioration of the fiscal balance expected in 2021 and 2022 will cause a considerable increase in the volume of regional debt, which will cause the already high regional debt ratios to increase even more.

The extraordinary liquidity mechanisms will disburse up to EUR31bn to the Spanish regions in 2020

During the first three quarters of the year, the distribution made through the Financing Fund of the Autonomous Communities (FFCA) amounts to EUR 27,072.7 mn. In addition, on May 14, an additional EUR 4,152 mn was approved by the government to address the pending financing originated by the deviations from the 2019 deficit target.

Once again, the role of the Financing Fund for Autonomous Communities is reaffirmed, providing liquidity to the regions at a very low cost, even at times like the current economic and financial difficulties derived from the sanitary crisis caused by COVID-19.

A challenging period ahead for local entities

We maintain our forecast regarding the local entities sector reaching budgetary equilibrium in 2020. The deterioration from the budgetary surpluses achieved during the previous years is a combination of the extension in time of the measures adopted by the local entities in terms of exemption and or suspension of the collection of certain local taxes, in order to mitigate the effects of the pandemic and the expected decrease in net resources to be received in 2020 by the local entities.

The positive trend of reduction in the level of debt of the municipalities continued during the first quarter of 2020, where the debt-to- GDP ratio of the local entities reached 1.8% of GDP. However, April data show , a significant increase in local debt of more than EUR 1,300 million in a single month due to the full effect of the state of alarm, which points to a change in the trend of this ratio, as a consequence of the reduction in the surplus of the local subsector as a whole, given the context of generalized crisis that the pandemic has caused.

Therefore, and on the back of the expected dilution of the local surplus, during 2020 the local debt will stabilize or grow slightly, reaching around 2% of GDP at the end of the year.

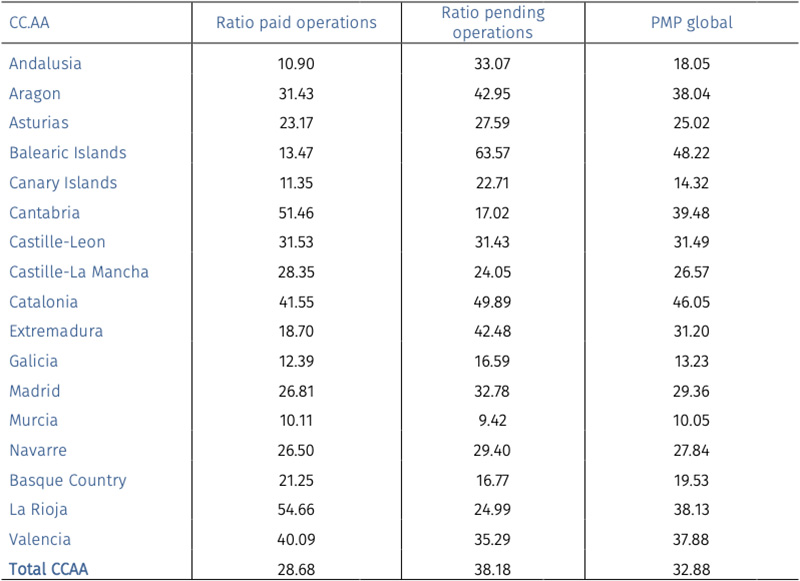

Average Payment time to suppliers (PMP): stable figures in the regions, significant deterioration in the municipalities

As a consequence of the support of the Spanish government to the regions in 2020,we have not seen any increase in the regional average payment time to suppliers (PMP), which usually is a very good bellwether indicator of financial stress in the treasury/liquidity situation of the regions and precedes an increase in regional deficits thereafter. The average APP of the regions, at 32.88 days, is in the low end of the historical range of this variable. As of June, no single region is above the critical 60 days threshold. (fig. 3)

Figure 3 | APP reported by the Spanish regions as of June 2020 (days)

Source: Ministry of Finance 2020

The evolution of the APP and the commercial debt are affected by the increase in the last months of operations of a commercial nature, especially in the healthcare area, because of the COVID-19 pandemic. Commercial operations linked to the healthcare sector originated between March and June have increased with respect to the same period of 2019 by 11.75% Y/Y.

On the other hand, the average APP of Spanish municipalities have increased by 9.35 days, up to 76,11 days, from 1Q20 to 2Q20. The average APP of the largest municipalities in Spain, is now at 99 days, its highest ever recorded level, highlighting the least supportive stance towards the local entities liquidity position and the legal difficulties to make use of the EUR14bn aggregate savings accumulated by the municipal bonds and deposited in banks accounts, as the Budget Stability Law (LOEOSF) bans the effective use of these savings if they are not employed to reduce the financial debt levels.

Local entities treasury surplus utilization remains unsolved

The original Royal Decree Law presented by the government on the use of the surpluses accumulated by the municipalities has been rejected by Parliament and right now it is uncertain when the parliamentary procedure on this matter will begin, although the most likely outcome -at least in the short-term - is a new and more limited Royal Decree which contains some of the aspects of the original proposal where there is more consensus but that excludes the contentious point of the municipalities treasury surplus.

Request the full report by sending an email to [email protected]