Macro outlook in 4Q21: a much slower recovery than initially estimated - BFF Banking Group

4Q 2021

Macro outlook in 4Q21: a much slower recovery than initially estimated

Executive Summary

The Spanish economy shows robust growth, but lower than initially estimated

The Spanish economy is recovering from the deep recession caused by the COVID pandemic. Timely and decisive policy support has helped protect jobs, household incomes, and firm balance sheets. A highly successful vaccination campaign, with almost 90 percent of the target population now fully vaccinated, helped limit the impact of infections on hospitalizations, mobility, and economic activity in 2021. Employment has rebounded robustly and is already above pre-crisis levels. After falling by 10,8 percent in 2020, economic growth resumed in the second quarter of this year, although output remains well below its pre-pandemic level, in part due to the lingering impact of the pandemic on contact-intensive sectors and persistent global supply bottlenecks.

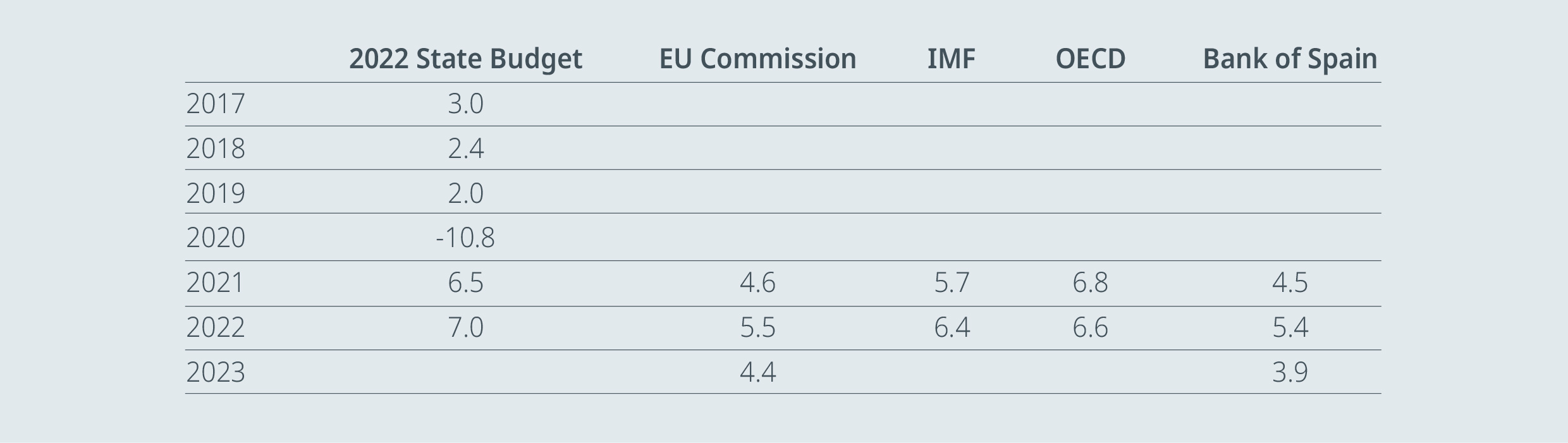

Despite this positive tone in economic activity, the downward revision continues both by official bodies and by the main analysis houses regarding the macroeconomic scenario for Spain in 2021-2022 (Figure 1), a process began in early September following the significant downward revision by the INE of Spain’s GDP growth in 2Q21 from 2.8% to 1.1% qoq and the lower growth than expected in 3Q21, 2% qoq according to the initial estimate of the INE, subsequently revised up to 2.6% it in the last week of December.

FIGURE 1 Macro Outlook 2021-2022: 2022 State Budget vs updated forecasts

Source: Expansión

This development confirms a key feature of recent economic events, namely that employment is recovering faster and more robustly than GDP. In any event, available indicators suggest that the pace of economic growth has moderated somewhat in Q4compared with the previous months. From the productive sector standpoint, the weakness is somewhat more marked in the case of manufacturing, as borne out, for example, by the sectoral PMI, which has continued to reflect a gradual loss of momentum in the output of these sectors since August, albeit still at levels consistent with growth in the sector’s value added.

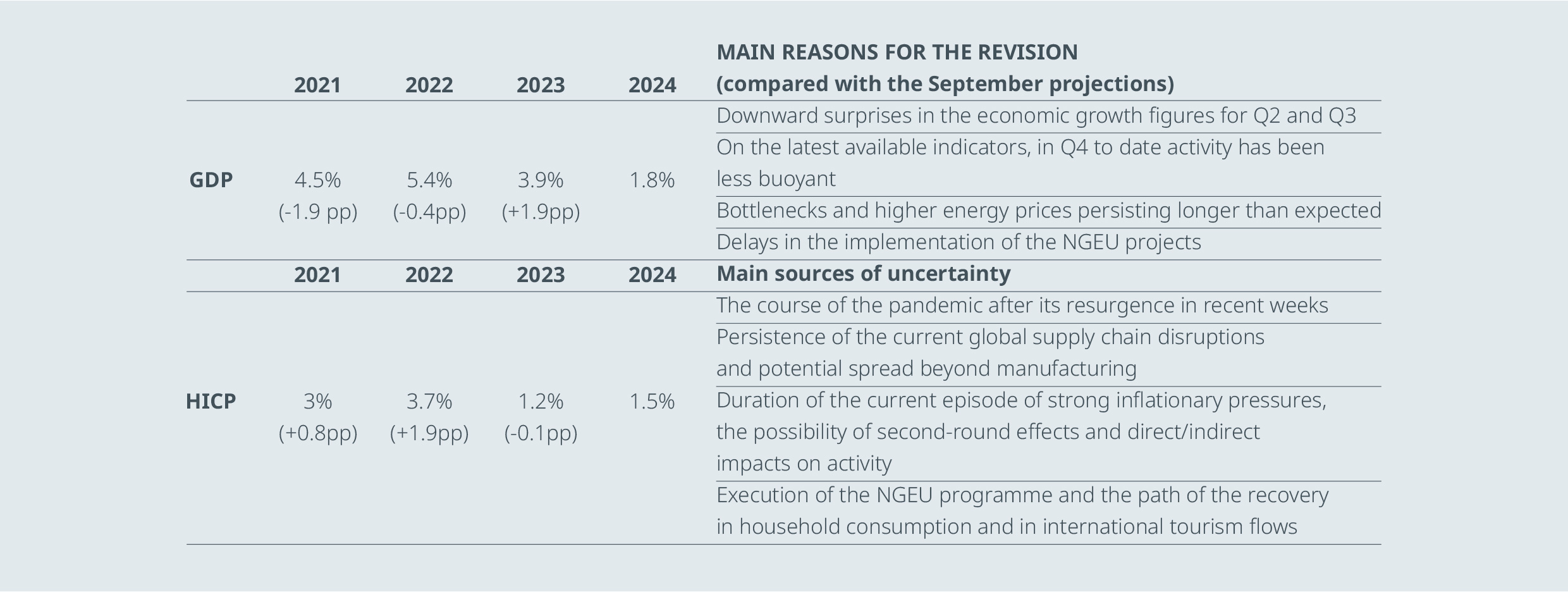

Drawing on the information available, it is estimated that GDP growth in 2021 Q4 could have amounted to 1.6% quarter-on-quarter, leading to average annual growth of 4.7% in 2021 (Figure 2), 1.6% below the central range of our September estimates (6.1-6.5%). This deterioration in the outlook still implies a robust recovery, but also reflects the appearance, or a greater permanence than expected, of various negative factors such as the lower growth compared to that initially forecast in the second and third quarters of 2021, the high price of energy, bottlenecks in the manufacturing sector and delays in the execution of European funds (NGEU) and assuming a negligible impact in economic terms of the Omicron variant However, there is considerable uncertainty surrounding this estimation, as the quantitative data available for this period are still limited. Additionally, the information on the execution of projects under the Next Generation EU (NGEU) program is incomplete, making it difficult to accurately estimate their contribution to growth.

Regarding 2022, our baseline scenario includes a forecast for GDP growth of around 5.8%, which would mean an acceleration vs. the estimated growth in 2021 and a downward revision of around one percentage point compared to our September report, due to a more persistent inflation than expected and bottlenecks that would drain around one percentage point of growth in 2022. The impact of these two factors would be more relevant in the first half of 2022, since the prices of energy should moderate with rising temperatures and bottlenecks should be cleared as supply dynamics recover.

In any case, the strength shown by household spending ensures that the recovery continues in the short term. By 2022 it will be key that the uncertainties that now hover over the behavior of the activity are resolved favorably as soon as possible.

FIGURE 2 Summary of the macro estimates for the Spanish economy (2021-2024)

Source: Bank of Spain

Uncertainty around the outlook is high, with the evolution of the pandemic remaining a key risk. The ongoing wave of infections highlights the continued risks that the pandemic poses to activity, especially if new variants reduce the effectiveness of vaccines. The pace of recovery will also depend on the duration and magnitude of supply disruptions. On the upside, a faster unwinding of households’ accumulated savings could lead to a stronger recovery of domestic demand. The pace of absorption of EU funds and how effectively they are used will shape the path of growth in the coming years. Finally, it is important that wage-setting negotiations continue to internalize the transitory nature of the current drivers of inflation and avoid a vicious cycle of higher wages leading to higher inflation.

Developments since the summer of 2020 point to activity recovering more slowly in Spain than in the euro area, despite the pandemic-induced contraction in output also being sharper in our country. Specifically, in Q3 the gap compared with the pre-crisis GDP level was 5.9 pp in Spain and 0.3 pp in the euro area. The less favorable performance of activity compared with our peers’ economies is partly due to the greater share of international tourism, a demand component that has been hit hard by the pandemic. However, domestic demand is also displaying less momentum in Spain.

Fiscal scenario of the Spanish Public Administrations in 2021-2022

The public deficit is improving, and it is possible that the year will end at 7% of GDP (7.6% in cumulative terms of the previous twelve months in September 2021), less than expected at the beginning of the year. However, so far, most of the recovery has come from the boost in private spending.

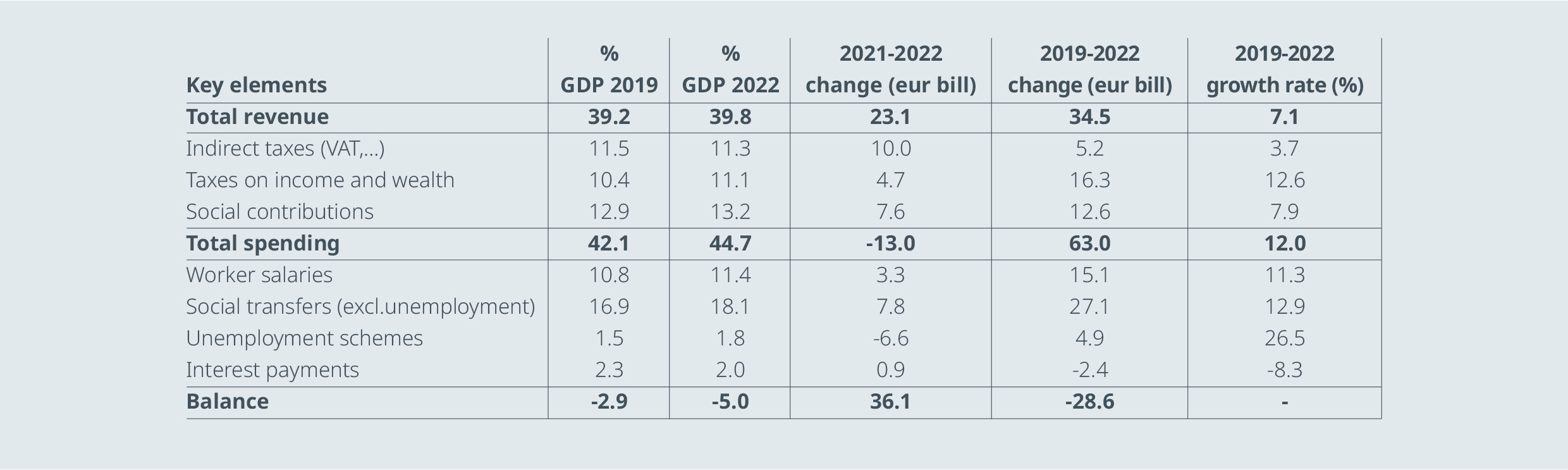

FIGURE 3 Government's draft budgetary plan for 2022 (excluding NGEU)

Source: 2022 State Budget

The budget balance of the Public Administrations (Public Administrations) will improve throughout the projection horizon. The reduction in the public deficit as a percentage of GDP will be due both to the temporary nature of some of the discretionary measures adopted to face the consequences of the pandemic and to the cyclical improvement. In any case, the imbalance in public accounts would remain at still very high levels at the end of the projection horizon.

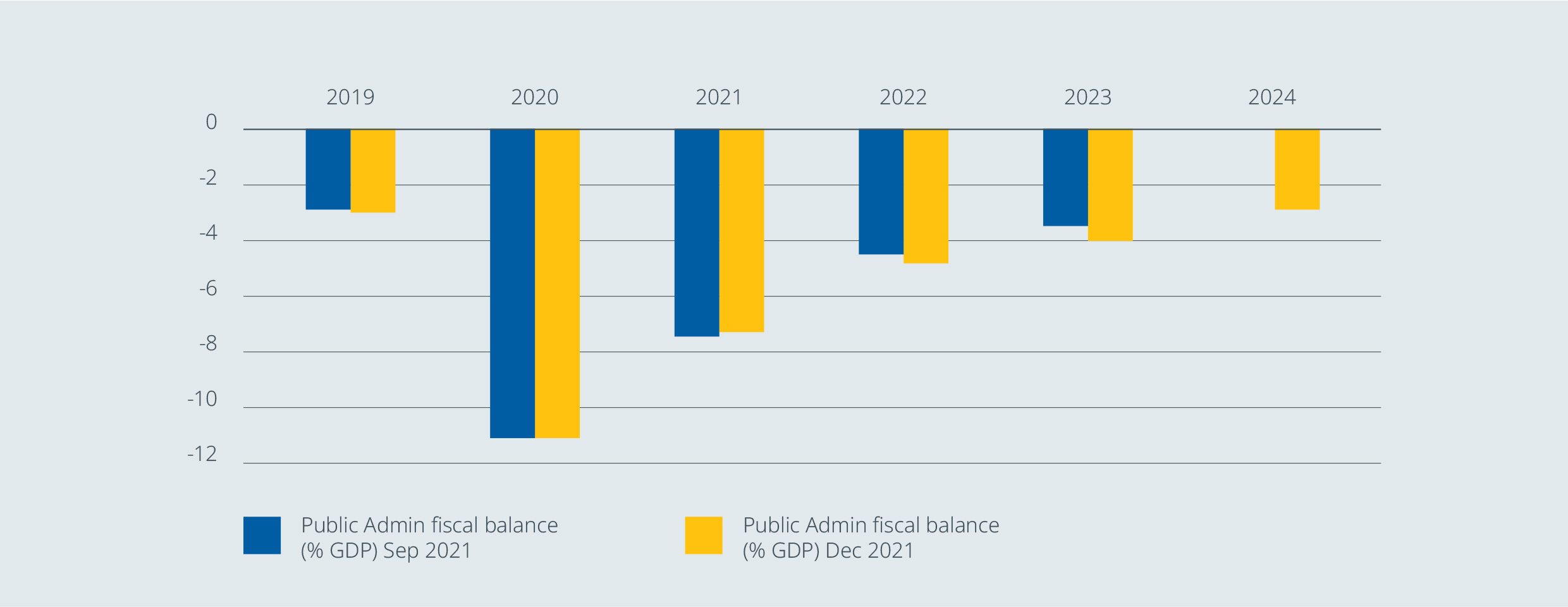

In our opinion, the public deficit target set by the government at 5% of GDP is feasible (Figure 4), in fact, as the European Commission has just pointed out in its evaluation of the budget plan for Spain carried out within the European Semester, the tone of fiscal policy in 2022 will be slightly contractionary, once policies financed by European NGEU funds are excluded, although the lack of measures to contain the increase in structural spending is a factor of concern. Everything indicates that Spain will emerge from the COVID-19 crisis with a structural deficit close to 4%, above the one existing in 2019.

FIGURE 4 Expected aggregate fiscal deficit in 2021-2024 (% GDP)

Source: Bank of Spain

Over time, Spain will need to bring debt levels down to more prudent levels and create space for responding to future shocks. In the absence of discretionary measures, the fiscal deficit is expected to remain above pre-crisis levels over the medium term. A sustained gradual fiscal consolidation process should be initiated once the output gap is closed, and the economy is on a sustained growth path. Under the baseline scenario, these conditions would be met by 2023. The fiscal adjustment should be growth-friendly, which will require preserving space for public investment and education spending and accompanying the process with growth-enhancing structural reforms. At the EU level, it would be desirable to complete the reform of the fiscal framework prior to the deactivation of the general escape clause, or to have a transitional arrangement until a reform becomes effective.

In our opinion and about structural reforms, the balance is incomplete, for the moment. The tax reform has been subject to first knowing the proposals of the Committee of Experts, scheduled for February 2022. The labor reform is still under discussion by the social agents, but what is known to date does not invite us to think that it is all how ambitious an inefficient and unfair labor market like the Spanish one needs.

Inflation will gradually moderate in 2022

One of the constraints on the growth of demand in the final stretch of the year has been the marked rise in inflation rates, which has proven to be much stronger than anticipated in the recent projections of the Bank of Spain and other institutions. Annual consumer price inflation, measured via the HICP, has risen from -0.6% in December 2020 to 5.6% in November2021, its highest level since September 1992. This upsurge has mainly been attributable to the sharp rise in energy prices (and, especially, electricity prices) and, to a lesser degree, higher services prices.

Over the course of 2022, the factors that have fueled the increase in inflation throughout 2021 are expected to be dispelled. First, the pandemic-related positive base effects will gradually ease in the coming months, disappearing completely as from spring 2022. Second, bymid-2022 the production chain disruption is expected to start to gradually ease; if confirmed, this will help correct the growth in intermediate production prices. Lastly, based on electricity prices on the futures markets, a considerable portion of the increase in wholes and electricity market prices should be expected to reverse from spring 2022.

Risks and uncertainties of our baseline scenario

The economic recovery is subject to two great unknowns: the new fiscal framework after the deactivation of the escape clause, possibly in 2023, and the impact of the Recovery, Transformation and Resilience Plan (PRTR) funds and their multiplier impact on the activity of the projects associated with the NGEU program, as well as their temporal distribution (which has a significant impact on the GDP growth profile).

Moreover, there are two other uncertainties that have been increasing: the intensity and persistence of inflationary pressures.

Therefore, the macroeconomic outlook remains subject to a high level of uncertainty. First, the projections assume that the impact of the pandemic on economic activity will continue to fade in the coming quarters, before eventually disappearing. However, in view of the recent pick-up in the incidence of the virus (despite the major progress made in the vaccination campaign) and the emergence of the Omicron variant, other more adverse epidemiological scenarios – linked to a potential spread of more infectious and, in the worst-case scenario, vaccine-resistant variants of the virus – that would require the re imposition of more stringent containment measures cannot be ruled out.

A series of additional sources of uncertainty, already present in the previous quarterly reports, also remain. These include the doubts surrounding the degree of persistence of the current increase in inflation and production bottlenecks, the use that consumers may make of the savings accumulated since the start of the pandemic, the speed of the recovery in foreign tourism, the rate of execution of the NGEU program (and the characteristics of the projects funded by it) and the possible scarring effects of the crisis on the business sector.

The ECB has begun the withdrawal of stimuli and announced that it will stop increasing the balance of public debt on its balance sheet. Although some flexibility has been allowed, the recent increase in risk premiums in peripheral countries may be a preview of what we will see in 2022. In the absence of central banks, it will be private investors who will have to finance companies. Will Public Administrations settle for negative returns in the short term or close to zero in the long term? To answer this question, it is very likely that you will look at what the country has done during this time to improve prospects for the sustainability of public finances. Here, they will find that Spain has put the accelerator on the approval of reforms, and that most of them have the approval of the European Commission. However, they will also see that although quantity is important, the quality of some that are key has not lived up to expectations. For example, that of pensions; Or that others, such as reducing the structural deficit, have been postponed. What will happen with the labor reform is also expected with uncertainty. In any case, the lack of consensus on these key issues (not to mention education) is striking, which can generate mistrust abroad.

Budget execution of the Public Administrations in 2021

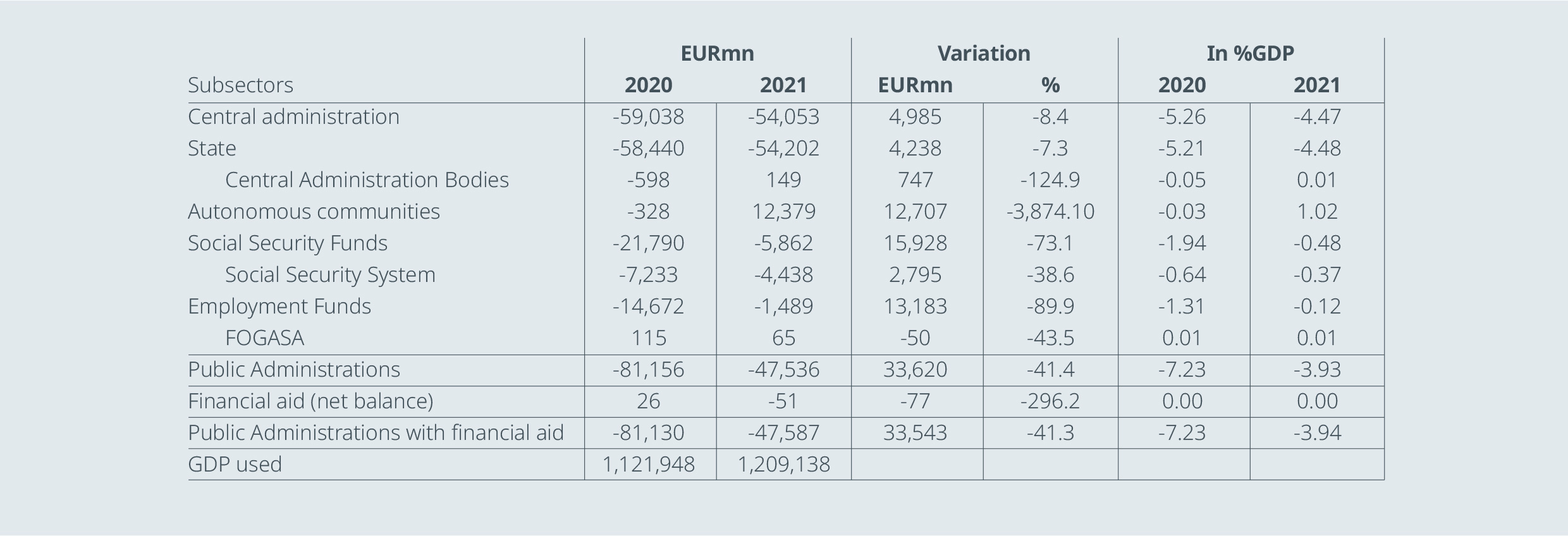

Until October, the deficit of the Public Administrations (excluding local entities) improves three tenths compared to the previous month to 3.9% GDP (Figure 5), that is, a non-financial balance of -47,587 million euros. Compared to the same period in 2020, this figure represents a reduction of more than 40% and, in relative terms, an acceleration of the deficit improvement of 3.3 percentage points. The cost associated with COVID-19 at the end of September 2021, according to the available information, amounts to 22,293 million euros, with a reduction of 30% in year-on-year terms.

All in all, the deficit forecast for the whole of the Public Administrations at the end of 2021 would be around -7.1% of GDP. This would reduce the budgetary consolidation effort in 2022 to 3.3 points of GDP.

Regarding 2022, AIReF estimates for its central scenario a deficit of Public Administrations of 4.8% of GDP in 2022, which represents a reduction in 2022 of 2.3 points; excluding the impact of the REACT -EU funds, this would imply a reduction of 1.9% vs 2021.

FIGURE 5 Deficit (-) / Surplus (+) of financing by Public Administration: October 2020-2021 (% GDP)

Source: Ministry of Finance

Regarding the Autonomous Communities, at the end of October, the regional sector once again presented another rebound in its surplus, reaching 1.02% of GDP (EUR12,379mn, +3,241 million euros compared to October). In relative terms, this amount represents an improvement of almost three tenths of GDP in the last month.

The tax collection dynamics of the foral territories and Canary Islands communities stand out, which, due to their different income management system, have managed to clean up their public finances and improve the high deficits registered up to October 2020 by more than two percentage points.

Given this situation, and although November and December are usually months in which the public balance deteriorates significantly, we improved our deficit forecast for the regions now at 0.2% of GDP, and with a high possibility that the figure is even closer to budget balance.

The autonomies will close 2021, predictably, with their first fiscal surplus of the historical series of the Treasury, which starts in 1995. In any case, the improvement in regional accounts is not due to a reduction in spending, but to an increase in revenues. These are being pushed by an “exceptional tax collection” of the ceded taxes, in part due to the rebound effect and to the extraordinary funds from the central Administration.

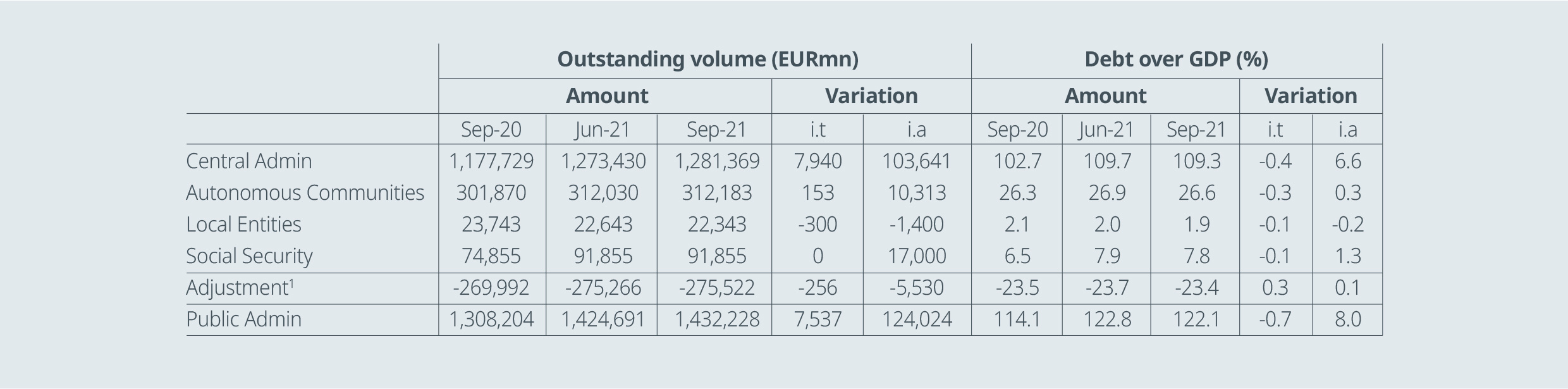

Public Debt of Spanish Public Administrations 2021-2022

The aggregate of public debt until September 2021 amounts to 1.43 trillion euros (Figure 6), an increase of 9.5% compared to the same period of fiscal year 2020. During the first nine months of 2021, the debt has registered an increase of 86,440 million euros, of which only 7,540 million were concentrated during the third quarter. This growth in the debt stock is mainly explained by the Central Administration, which has been absorbing, since the beginning of the pandemic, the collateral damage that affects the economy and has continued to accelerate the issuance of debt during the first part of the year.

FIGURE 6 Breakdown of Spanish Public debt by Administration (EURmn, % GDP)

1) The methodology for calculating the level of total public debt in terms of the Excessive Deficit Protocol assumes the sum of the debt of each of the amounts adjusted for financial assets against Public Administrations.

Source: AFI and Bank of Spain

In relative terms, the aggregate of Public Administrations registered a debt/GDP ratio of 122.1% in 3Q21, remaining practically stable compared to the levels of the previous quarter.

The improvement in GDP, the recovery of the cyclical component of the deficit and the gradual disappearance of measures related to the pandemic, project a reduction of 4.3 points in the Debt ratio for the year 2022, placing it at 115.7% of the GDP, although AIReF notes unfavorable dynamics in the medium and long term under a constant policy scenario.

Regions: Average payment time and commercial debt

With the latest available data on APT (average payment time to Suppliers) corresponding to the month of October (Figure 29), APT in the Autonomous Communities has decreased in October by 1.10 days, a mom decrease of 3.97%, up to 26.59 days; the regions have been eleven consecutive months below the 30 days threshold, the legal limit established in the regulations. Regarding the sectorial scope of operations, given the volume of operations that it represents in the autonomous sphere, it is necessary to distinguish in a specific way, the Global Average Payment Period to providers in the health field, which at the end of October 2021 It stands at 28.31 days, 1.72 days higher than the global APT if all the operations considered.

At the end of October 2021, the commercial debt of the Autonomous Communities, defined as pending payment operations according to the provisions of Royal Decree 635/2014, amounted to a global amount of 3,496.81 million euros, equivalent to 0.29% of the national GDP. 90% of commercial debt is concentrated in current operations with an amount of 3,147.06 million euros, while the remaining 10%, equivalent to 349.75 million euros, corresponds to capital operations.

In this way, payments of a commercial nature made in the first nine months of 2021 have amounted to 45,871.53 million euros. Of these, 29,928.02 million euros correspond to health payments, resulting in an increase of 4.37% in payments of a commercial nature and 2.16% in health payments compared to the same period of the previous year.

First steps for a new regional financing system: a new proposal for the calculation of the adjusted populations parameter

The Government’s proposal considers that the adjusted population is the most representative variable of spending needs, something about which there is considerable consensus, improving the calculation formula and distribution by type of spending, more and better statistical data is available than when the model in force in 2009 was approved, so that a more realistic, sophisticated and stratified adjusted population calculation is proposed.

In the case of health spending, the current indicator in the adjusted population is the equivalent protected population variable, which is divided into 7 age groups and where coefficients are applied that reflect the costs that health has based on the years of its beneficiaries. In the new proposal put forward to the Autonomous Communities, the groups are divided into five-year age groups, which means going from 7 to 20 groups. The weight of health spending in the adjusted population would increase with respect to the current system and would go from having a weighting of 38% to one between 40% and 45%.

Regarding education spending, the current model of the autonomous financing system assesses the needs in education, taking as a variable the population from 0 to 16 years old. Therefore, other academic stages such as university or vocational training, which are incorporated in the proposal sent by the Ministry of Finance, were excluded. The weighting of education spending would also increase from the current 20,5% to a range that varies between 25% - 30%, with non-university education being 75-80% of it and university education the rest.

There are no relevant changes in the financing of social services and in the rest of services, although for the latter the weighting of this indicator would be reduced from the current 30% to a range between 18% and 22%.

The proposal also includes non-population corrective variables, weighing between 3% -4%, in four main variables: a) Area, b) Depopulation, c) Dispersion (novelty), d) Insularity and e) Fixed costs (novelty).

Request the full report by sending an email to [email protected]