3Q 2022 - BFF Banking Group

3Q 2022

Spain and its territorial entities in 3Q2022: prepared for the slowdown, but Spain could avoid the recession

Executive Summary

Persistence of high inflation rates on a global scale

The global economy continues to face major challenges, shaped by the lingering effects of three powerful forces: the Russian invasion of Ukraine, a cost-of-living crisis caused by persistent and rising inflationary pressures, and the slowdown in China.

Global economic activity has continued to lose dynamism in the summer months, as a result of a series of adverse factors that interact with each other. The rise in world inflation has intensified to levels not seen in several decades, which is prompting a strong reaction from central banks, which, in turn, is giving rise to a tightening of financial conditions.

The updated IMF estimates (October 2022) project that global growth will remain flat in 2022 at 3.2 percent vs the previous projection in July and will further slow to 2.7 percent in 2023, 0.2 percentage point lower than the July forecast, with a 25 percent chance that the global GDP growth could drop below 2 percent in 2023. More than a third of the world economy will contract this year or next, while the three largest economies (the United States, the European Union and China) will

remain stagnant. In short, for the IMF the worst is yet to come.

As of September, there has been a notable deterioration in growth prospects in the United States, China and all the European economies as a result of the cut in the supply of Russian gas and the uncertainty about the course of the war in Ukraine, as and as reflected in the most recent forecasts of the OECD and other public and private institutions. The downward revisions in the expected growth are notable in the case of Germany, which is remarkable given the close interrelations of this country with the rest of the European economies and, in particular, its weight in Spanish exports (approximately 10 % of merchandise exports and 11% of services exports in 2021).

In China, frequent lockdowns under its zero-COVID policy have hit the economy, especially in the second quarter of 2022. In addition, the real estate sector, which accounts for about a fifth of economic activity in China, is rapidly weakening. Given the size of China’s economy and its importance to global supply chains, this will weigh heavily on global trade and activity.

Too much tightening risks pushing the world economy into an unnecessarily harsh recession. Financial markets may also find it difficult to cope with too rapid a pace of adjustment. However, the cost of these policy errors is not symmetric. Misjudging the stubborn persistence of inflation once again could prove far more detrimental to future macroeconomic stability, by seriously undermining the hard-earned credibility of central banks.

Risks to the outlook remain unusually high and to the downside. Monetary policy could be tightened more than necessary (or less than necessary) to reduce inflation. Monetary policy paths in the largest economies could continue to diverge, leading to further appreciation of the US dollar and cross-border tensions. More tension in energy and food prices could make inflation persist for longer. The global tightening of financial conditions could trigger a widespread debt problem in emerging markets.

Central Banks will continue tightening monetary policy

The US Federal Reserve raised its official interest rates by 75 basis points (bp) both at its July and September meetings, setting its target range at 3%-3.25% and it is expected a new increase of 75 bps at the next meeting on November 2 that would place them in the 3.75%-4% range. The market manages a Fed terminal rate for this cycle in the range of 4.5-4-75%, which would be reached between the first and second quarters of 2023.

In recent months, interest rate increases have also been significant by the European Central Bank (ECB), 50 bp in July and 75 bp in September, and another 75 bp is expected at the end of October meeting, while the Bank of England increased rates by 50 bp in both its meetings in August and September, up to 2.25%, and a further hike of up to 100 bp could be in the cards in the next meeting amid an extremely volatile scenario that will hinge on who is elected as the next UK PM and the fiscal plans to be implemented by the new cabinet.

Spain is more resilient to the deterioration of economic activity, but signs of loss of dynamism in Q3 are evident

The slowdown in activity in Spain is already being observed and it is driven to the loss of purchasing power that has been experienced. Analyzing the latest trade dynamics (the prices of exports compared to those of imports), or the GDP deflator compared to consumption dynamics (the price of what we produce compared to what we consume), an impoverishment is observed that will hardly be reversed short term. This same scenario is faced by households and companies in the eurozone. Therefore, an adjustment is expected on the demand side throughout Europe, which should reduce the contribution of exports to growth in Spain, in addition to containing the evolution of domestic consumption.

It is possible that during the coming quarters there will be a stagnation or even a one-off intense drop in activity. The deterioration in the outlook has to do with the increasingly probable scarcity of some raw materials, the increase in their price and the translation that has been observed of this increase in the cost of production towards inflation. In addition, the financial burden of companies and families is expected to increase as the European Central Bank (ECB) advances in the withdrawal

of monetary stimuli.

Various factors would put downward pressure on the outlook for the growth rate of economic activity in the coming quarters. In addition to the persistence of inflation, the reduction in agents’ confidence and the maintenance of a high degree of uncertainty, all of which are highly influenced by the consequences of the current energy crisis and the armed conflict in Ukraine, it is likely that Inbound tourism loses some dynamism once the bulk of the demand dammed up after the pandemic

has been satisfied.

Additionally, a weakening of external demand can be expected in a context of simultaneous tightening

of monetary policy in numerous jurisdictions.

Our macro scenario for Spain for 2022-2024

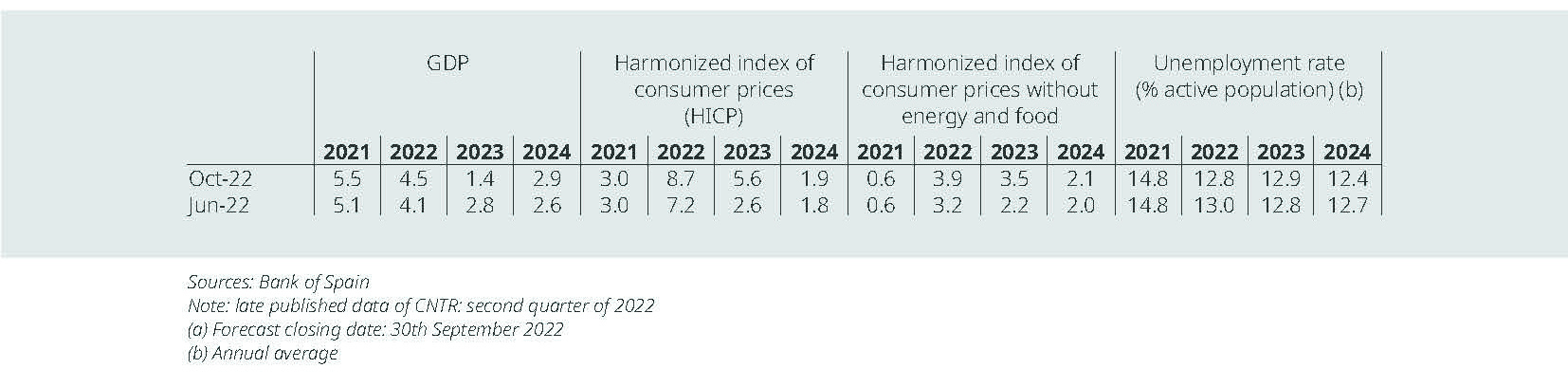

In short, the most recent monthly indicators for the Spanish economy point to a slowdown. Under these conditions, after growing 4.5% this year, the GDP of the Spanish economy is expected to slow down to 1.4% in 2023 and resume greater dynamism in 2024, advancing 1.8% (the Bank of Spain is much more optimistic about this with a growth forecast of 2.9%, Figure 1).

FIGURE 1 Macro projections of the Spanish economy in 2022-2024 (a)

For comparison purposes, the macroeconomic scenario that will be included in the General State Budget project for 2023 (PGE 2023) contemplates real GDP growth of 4.4% in 2022 and 2.1%

in 2023. In the macro table of the 2023 PGE and by components, the slowdown vs 2022 is based on a lower contribution of the foreign balance to growth which, after contributing 2.9 pp in 2022,

would go on to have a negative contribution in 2023 (-0.3 pp).

Returning to our base scenario, we cannot rule out the possibility of a more adverse hypothetical scenario, which would include, among other factors, the total loss of access to Russian gas, an intensification of supply problems, for example, as a result of a colder-than-usual winter—and an increase in economic and financial uncertainty, which would give rise to a rise in bank financing costs.

The activity will regain a growing momentum from spring, when it will be driven by the combination of various factors. These include a gradual easing of the prevailing tensions in the energy markets, which would bring with it a progressive recovery of agents’ real income, an improvement in confidence and a strengthening of foreign demand, the gradual resolution of the alterations that persist in global supply chains and a greater relative deployment of funds linked to the Next

Generation EU (NGEU) program.

On the other hand, the greater economic dynamism from the spring of 2023 will gradually intensify, which will allow GDP growth to reach 1.8% in 2024. The recovery to the pre-pandemic level of output would probably be delayed until the first quarter of 2024, that is, about two quarters later than projected in our report from June.

It is important to highlight that in this backdrop, the Spanish economy is better prepared than in other recent recessive periods and continues its recovery, which favors sectors with a relevant weight in GDP and intensive in the use of labor. Inflation has become the greatest risk, so it is necessary to make decisions that help distribute costs equitably and prevent it from becoming entrenched, which would increase the risk of recession.

Risks for our 2022-2024 base scenario in GDP growth and inflation

The risks to these projections are oriented downwards for activity and upwards for inflation. In particular, the main risk derives from the materialization of developments in the energy markets

that may differ significantly from those contemplated in the central scenario. These risks, which, in principle, would be located fundamentally in the gas market, could manifest themselves both through

the evolution of prices, which may follow a lower or higher path than that of the central scenario, and through the quantities, so that greater supply problems than those considered or a complete

absence of restrictions on the use of gas can be observed.

Domestically, the deterioration in household purchasing power and confidence is another source of downside risks. Despite the favorable behavior of employment, the deterioration in the purchasing power that Spanish households are registering as a result of the decline in real wages is a relevant one. In the first half of 2022 there has been a contraction in compensation per real employee of close to 6%, thus exceeding the contraction observed in the fourth quarter of 2012, of 5.2%.

Another source of uncertainty is associated with the degree of pass-through of recent price and cost increases to the rest of the prices in the economy and to wages. In this sense, the intensity with which the transmission of higher production costs to final prices has been taking place in recent months would have raised the probability of triggering significant second-round or feedback effects between prices and wages, and therefore an additional aggravation of the inflationary process, with adverse consequences on foreign competitiveness and on activity and employment.

The rate at which investment projects associated with the NGEU program could filter into the economy is also a source of additional uncertainty going forward, after the delays that appear

to have occurred in recent quarters. Also, in the current context of high uncertainty, a possible rebound in saving for precautionary reasons that weighs down household spending and the

dynamism of aggregate consumption cannot be ruled out.

Fiscal consolidation of the Spanish Public Administrations in 2022 (data until July)

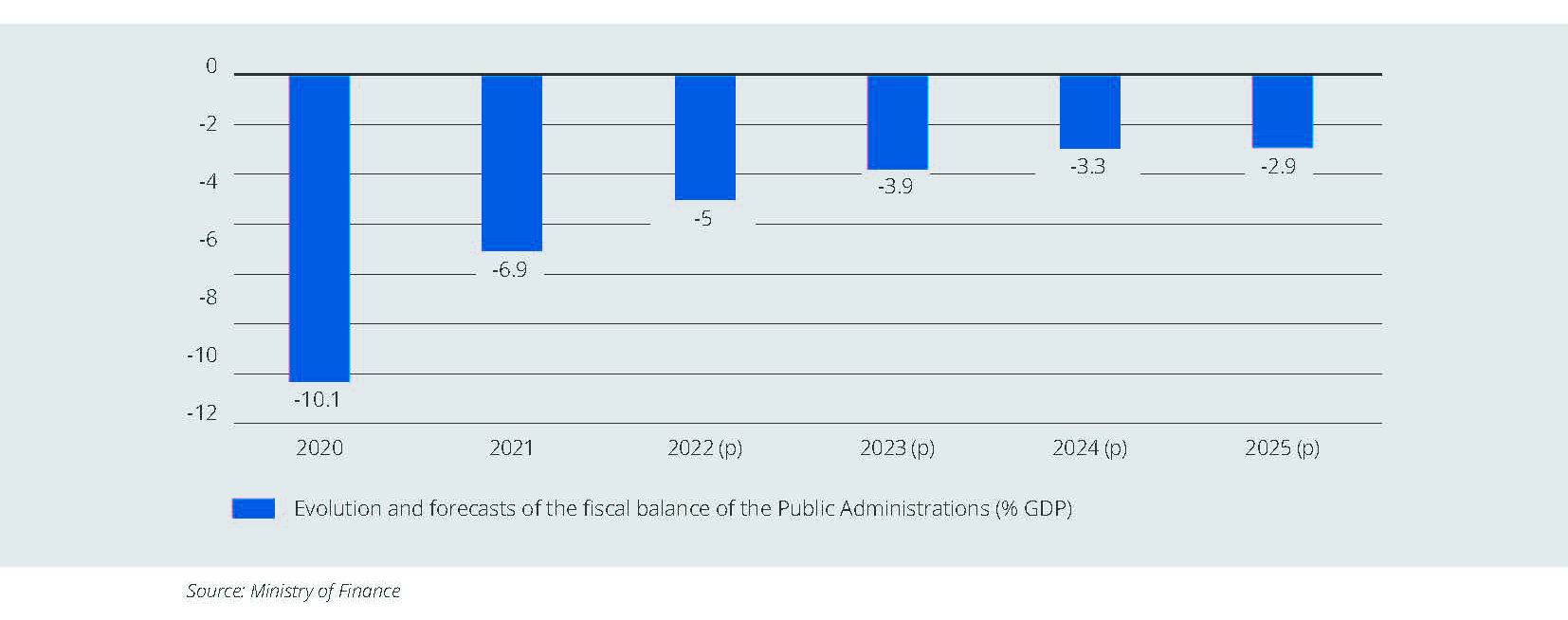

Despite the extension of the suspension of fiscal rules for 2023, the Spanish government expects an improvement in the deficit path up to 3.9% GDP thanks to the positive dynamics expected for tax collection (Figure 2). This would imply an improvement of more than one percentage point compared to the deficit at the end of 2022, in line with the forecasts brought to Brussels in the Stability Program, which contains a downward deficit trend until it is below the 3% mark in 2025.

FIGURE 2 Evolution and forecasts of the fiscal balance of the Public Administrations (% GDP)

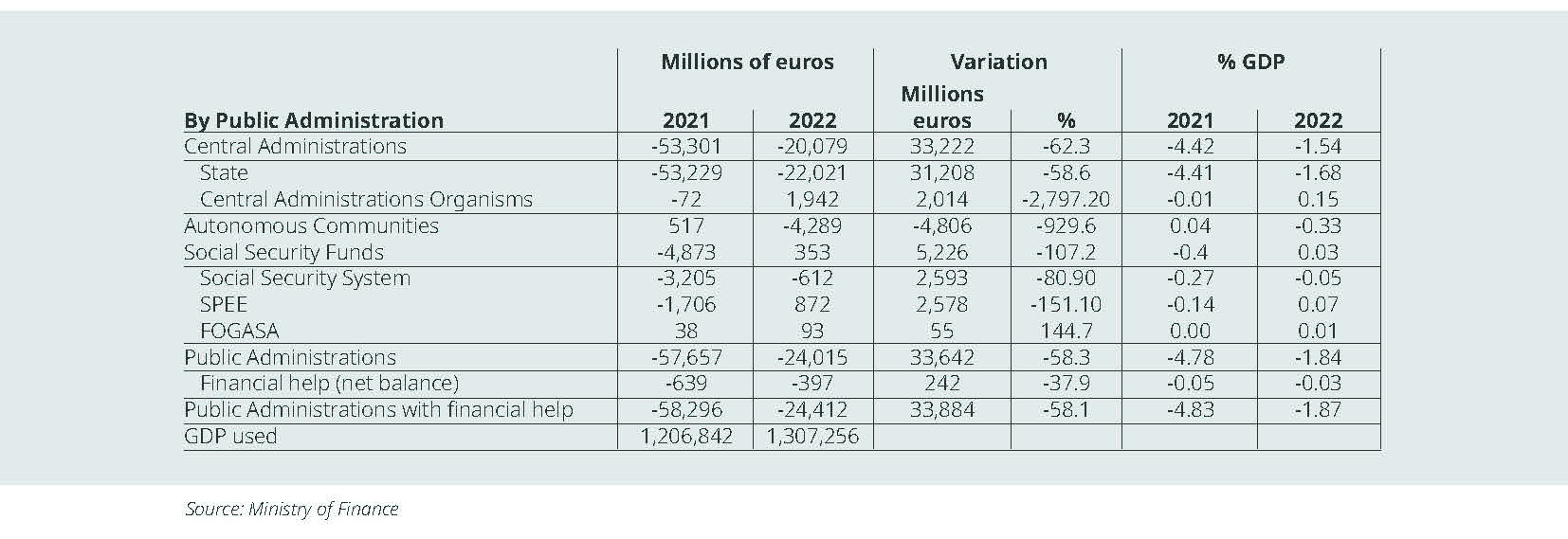

Specifically, the State (Central Administration) deficit in the first eight months of 2022 has been reduced by 57%yoy. Until August 2022, the Central Administration has registered a deficit

equivalent to 1.82% of GDP, compared to 4.59% in August 2021. In this way, the deficit stands at 23,833 million, which represents a decrease of 57 % compared to the 55,413 million in the same period of the previous year.

In the aggregate of Public Administrations (data up to July 2022, Figure 3), the overall deficit of the Central Administration, the Social Security Funds and the Autonomous Communities, excluding financial aid, stands at 24,015 million, equivalent to 1 .84% of GDP. If the balance of the aid to financial institutions is included for an amount of 397 million, the deficit stands at 1.87% of GDP.

FIGURE 3 Fiscal Deficit (-)/ Surplus (+) of the Public Administrations: July 2021-2022

Regarding the public debt/GDP ratio, it is revised downwards in the forecast horizon, mainly due to the increase in nominal GDP and the improvement in the primary balance, so that we consider a feasible debt/GDP ratio in the range of 110% in mid-2024 from the peak figure of 120% in the second quarter of 2020.

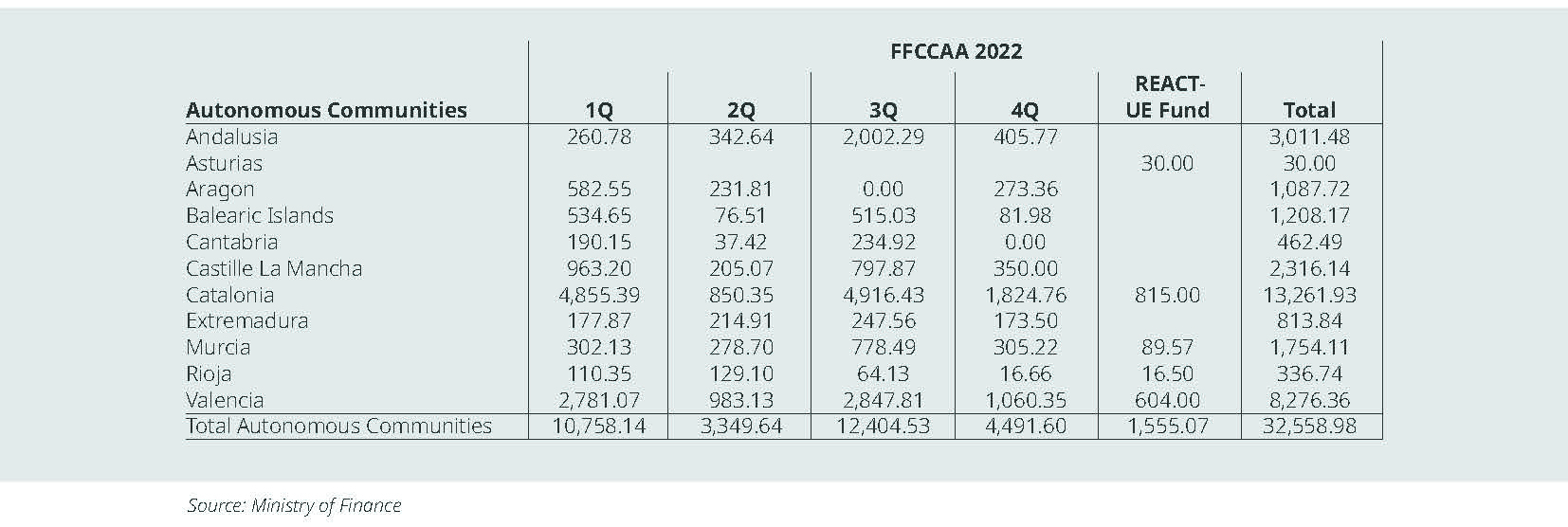

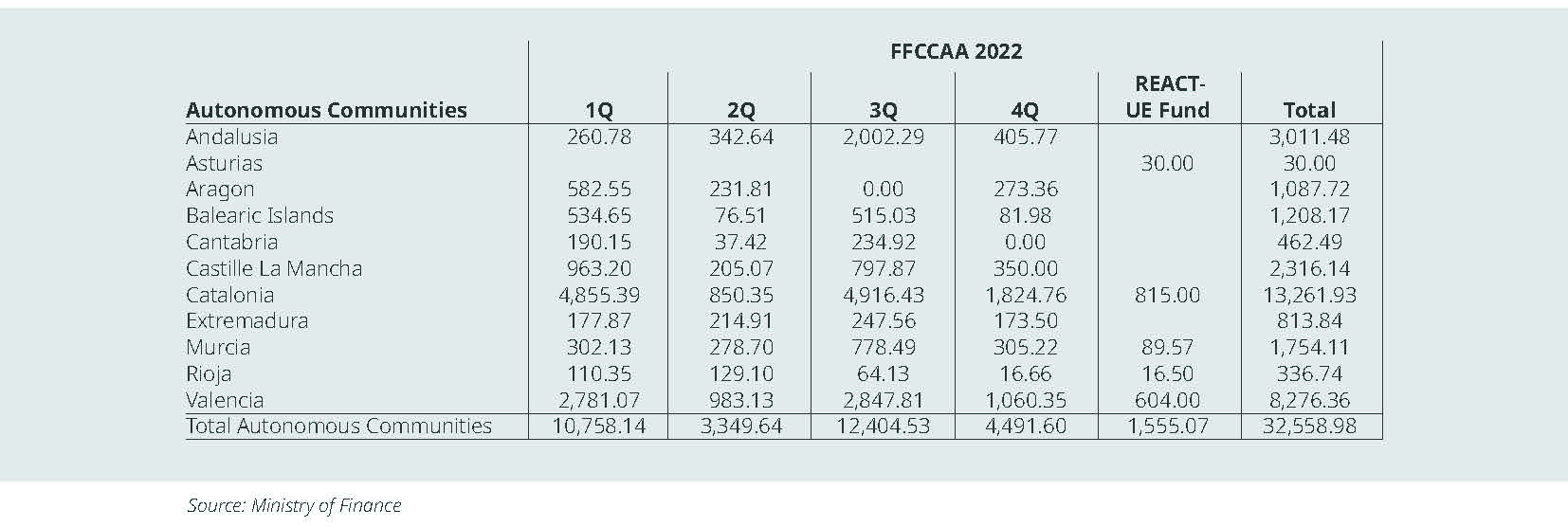

The extraordinary liquidity mechanism of the regions in 2022

To date, the Financing Fund for the Autonomous Communities has distributed a total of 32,558.98 million euros to the Autonomous Communities throughout 2022, including the REACT-

EU Liquidity Fund, as detailed in Figure 4.

The communities assigned to the Autonomous Liquidity Fund (FLA) compartment and that have requested an allocation for 4Q22 are Aragon, Balearic Islands, Castille-La Mancha, Catalonia, Extremadura, Murcia, La Rioja and Valencia.

For the 4Q22 and as occurred in previous quarters, no allocation is included for the Autonomous Communities of Asturias, the Canary Islands, Castille-Leon, Galicia, Madrid, Navarre and the Basque Country, since they have not requested financing charged to the FLA and FF from the 2022 Financing Fund.

FIGURE 4 Extraordinary liquidity funds disbursed in 2022 (EURmn)

Average Payment Time to suppliers

The Average Payment Period (PMP) of the Autonomous Communities as of July reached 23.05 days (Figure 5), which represents an increase of 0.71 days compared to June 2022, so that it has already been 20 consecutive months, since December 2020, below the 30 days threshold, which is the maximum period established by law.

FIGURE 5 Average payment time to suppliers of the regions as of July 2022 (days)

The average payment time of the Central Administration stands at 45.44 days; the ratio of transactions paid stood at 41.15 days, while the ratio of transactions pending payment reached 50.87 days. The Local Entities in the assignment model have an average payment time of 58.94 days in the first seventh months of the year, which represents a decrease of 10.81 days in relation to the same month

of the previous year.

As for the commercial debt of the Autonomous Communities, this is estimated at 3,417.42 million euros, equivalent to 0.26% of the national GDP. This represents an increase of 161.97 million euros with respect to the previous month. Payments of a commercial nature made in July amounted to 5,462.49 million euros, which represents a decrease of 5.61% compared to those made in the same month of 2021. Of these, 3,481.35 million correspond to healthcare payments, which represents a decrease of 9.66% in relation to July of the previous year.

With regard to local entities, there is a clear asymmetric distribution. Thus, while 115 local entities, which account for 75.7% of the total Spanish population, have a PMP less than or equal to 30 days, on the contrary, 17 of them have an excessive PMP given that they exceed the 60 days threshold regarding their payment to suppliers.

Request the full report by sending an email to [email protected]