Estará España ante un nuevo cisne negro? - BFF Banking Group

1Q 2022

Is Spain facing a new black swan? The impact of the crisis in Ukraine on the macro and fiscal scenarios

Executive Summary

The invasion of Ukraine by Russian troops marks a turning point in the international geopolitical context after the fall of the Berlin Wall. The consequences of an event of such magnitude (a “black swan” as it is called in financial terminology) are still difficult to anticipate, but they could change some of the underlying trends that have defined the behavior of the world economy in recent decades. The search for greater strategic autonomy (especially in Europe) will entail the reformulation of both foreign action in what comes to energy, defense or competition policies, which will impact the economic framework.

But while the underlying trends that will affect the configuration of the production structure in the medium term (digitalization, energy transition or new geopolitical situation) are being articulated, the reality is that we are facing a new event with significant disruptive potential, when we are barely out of a global health crisis. In the first place, because the importance of Russia as a producer (and exporter) of oil, natural gas, nickel, etc., is being reflected in the biggest increase in the price of raw materials in decades, which will mean a new supply disturbance that will negatively affect the combination of growth and inflation in the coming quarters, with the risk of consolidating the upward inertia that the prices of consumer baskets were showing in many OECD countries, reflecting significant imbalances between supply and demand caused by the pandemic.

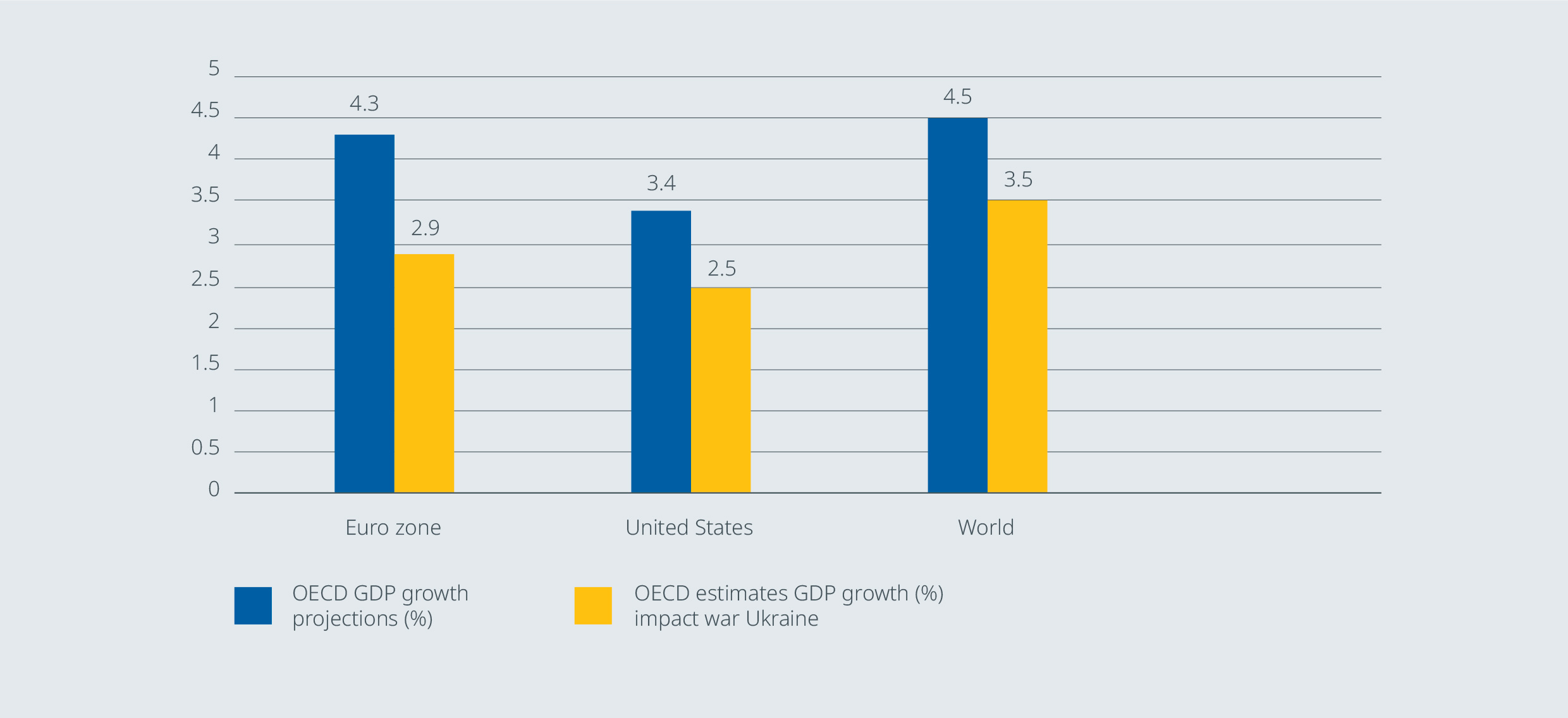

What we already know is that all of the above is going to imply a profound revision of growth forecasts (down) and inflation (up), as registered in the updated OECD estimates (Figure 1). Adding to the cost in human lives, a war invariably entails an economic cost and it is thus vital is to distribute the sacrifices equitably among the economic agents.

FIGURE 1 New OECD GDP growth estimates including the impact of the Russia-Ukraine war

Source: OECD

The effects will naturally be asymmetric, with a greater impact on the European economy and emerging countries dependent on raw materials and with liquidity problems. With an economic structure and a flexibility of production factors very different from those in the 1970s, the risk of stagflation seems moderate. This is especially true if the economic policy responses are suitable and accommodate the supply shock to soften the effects on families and companies while at the same time trying to avoid second-round effects on prices.

All this will have a fiscal cost that will probably imply a new suspension of the Stability and Growth Pact in 2023, while the ECB will not rush its way to monetary normalization until it has more visibility over the implications of the current crisis.

While oil prices have been front and center in the headlines, the impact of the war on the world’s food supply should not be forgotten. Russia, Ukraine, and Belarus together comprise the world’s breadbasket,

accounting for a quarter of the world’s wheat supply, as well as a large share of world production of other grains. In addition, Russia is also a large exporter of certain types of fertilizers.

An unexpected post-pandemic scenario

The global economy remains on a robust growth path, although the conflict in Ukraine and, to a lesser extent, the spread of the Omicron coronavirus variant, do cloud the outlook. At the turn of the year, the spread of the new Omicron variant caused an unprecedented increase in the number of coronavirus (COVID-19) infections worldwide. Provided that available evidence suggests that the Omicron wave will be shorter than previous waves, the impact on the global economy is expected to be rather moderate and limited to the first quarter of 2022.

At the same time, the Russian invasion of Ukraine is weighing on the global economy. In addition to being channeled by trade linkages, knock-on effects are being felt by other countries, namely through higher energy prices that will further reduce households’ disposable incomes as well as the negative confidence effects that will surely weigh on domestic demand and trade.

Supply bottlenecks remain a headwind to growth, but they are assumed to ease gradually in the course of 2022 and to have fully unwound by 2023 as consumer demand switches back from goods to services and the shipping capacity and supply of semiconductors increase on the back of planned investment.

Over the medium term, the global economy is projected to continue its expansionary path, albeit at more moderate rates, amid geopolitical tensions and the unwinding of pandemic-related policy stimulus, with a global GDP growth forecast in 2022 still slightly above the 3% YoY mark. From 2022 onwards, real global GDP (excluding the euro area) is projected to converge to more moderate growth rates. Besides the impact of the Omicron variant and the Russian invasion of Ukraine, private consumption is expected to remain subdued amid rising inflation.

The main channels of contagion: trade, commodities and confidence

The Russian invasion of Ukraine is expected to significantly affect the euro area economy through three main channels: trade, commodities, and confidence. Firstly, trade with Russia is affected by bans on imports and exports, as well as the adverse effects of the war on the Russian economy. The exclusion of Russian banks from the SWIFT system impairs trade financing of Russian firms, translating into extensive trade disruptions. In addition, a combination of higher interest rates, capital outflows, financing constraints, deterioration of business sentiment, rising import prices and roble depreciation are all weighing on Russian GDP.

Combined with the sanctions and the deterioration in global risk sentiment, an energy supply disruption is estimated to weigh on the real GDP growth of the euro area in 2022 and to hamper activity still in 2023, before a small upward impact in 2024 on account of catch-up effects.

The baseline scenario would avoid stagflation, but in the adverse & severe ones the recession risk would be elevated

In the baseline scenario, soaring energy prices and negative confidence effects imply significant headwinds to domestic demand in the near term, while the announced sanctions and sharp deterioration in the prospects for the Russian economy will weaken euro area trade growth.

The baseline projections are built on the assumptions that current disruptions to energy supplies and negative impacts on confidence linked to the conflict are temporary and that global supply chains are not significantly affected.

Nevertheless, given the starting point for the euro area economy - with a strong labor market and headwinds related to the pandemic and supply bottlenecks assumed to fade -, economic activity is still projected to expand at a relatively strong pace in the coming quarters.

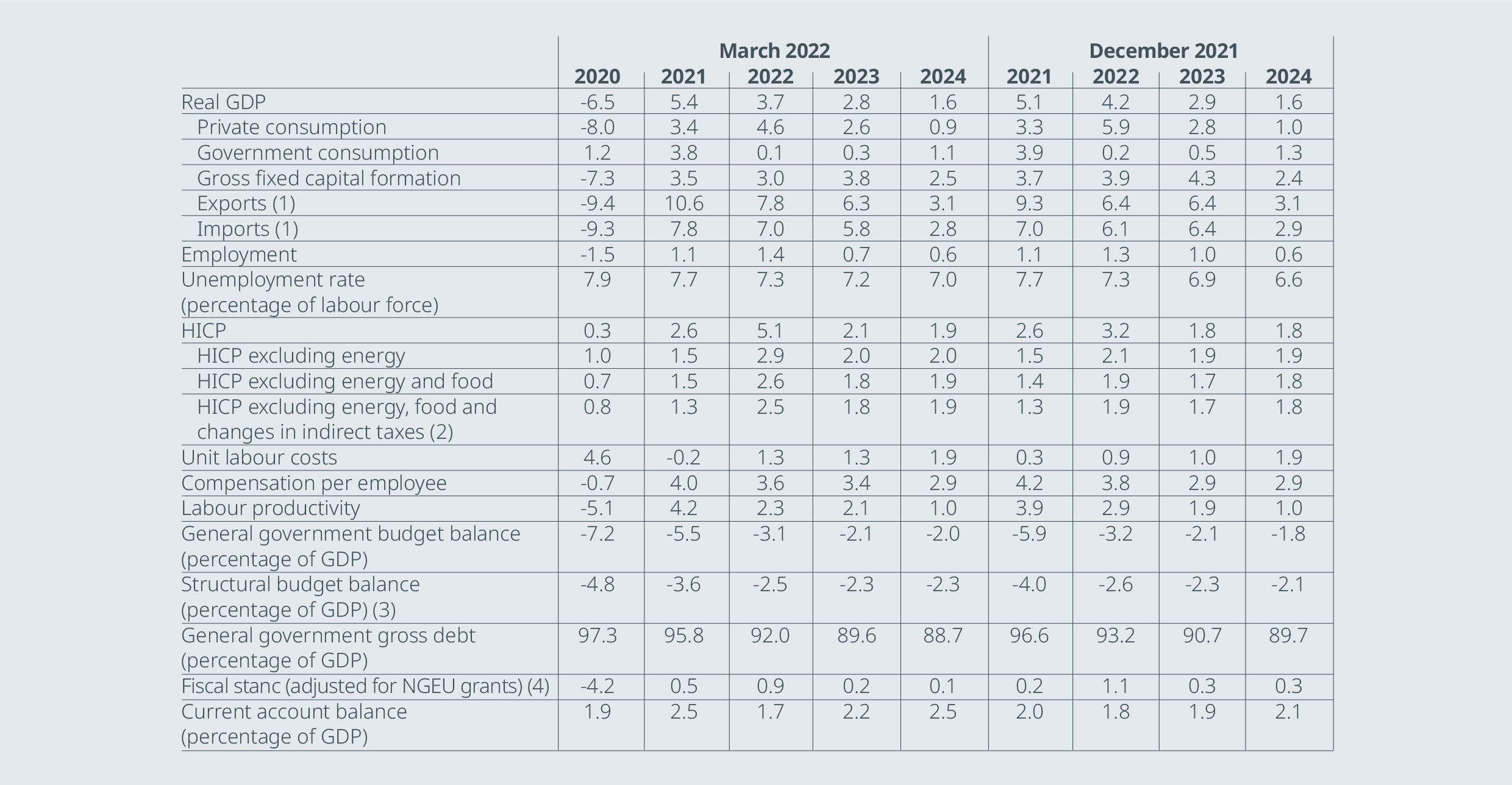

FIGURE 2 Macroeconomic projections for the euro area in 2021-2024 (baseline scenario)

Source: ECB, March 2022

Notes: Real GDP and components, unit labor costs, compensation per employee and labour productivity refer to seasonally and working day-adjusted data. Historical data may differ from the latest Eurostat publications due to data releases after the cut-off date for the projections.

(1) This includes intra-euro area trade.

(2) The sub-index is based on estimates of actual impacts of indirect taxes. This may differ from Eurostat data, which assume a full and immediate pass-through of indirect tax impactsto the HICP.

(3) Calculated as the government balance net of transitory effects of the economic cycle and measures classified under the European System of Central Banks definition as temporary.

(4) The fiscal policy stance is measured as the change in the cyclically adjusted primary balance net of gov ernment support to the financial sector. The figures shown are also adjusted for expected Next Generation EU (NGEU) grants on the revenue side. A negative figure implies a loosening of the fiscal stance.

In the absence of further upward shocks to commodity prices, energy inflation is projected to drop significantly over the projection horizon. In the short term, this decline relates to base effects, while the technical assumptions based on future prices embed a decline in oil and wholesale gas prices resulting in a negligible contribution from the energy component to headline inflation in 2024.

The adverse scenario assumes a worsening in all three channels - trade, commodities and confidence - and constraints in the production capacity of the euro area. On the trade channel, more stringent sanctions entail a more severe drag on the Russian economy. These sanctions also create broad supply constraints and disruptions to global value chains.

In addition to the assumptions encapsulated in the adverse scenario, the severe scenario entails a steeper and more persistent rise in commodity prices, triggering second-round effects from higher inflation and broader financial amplification effects. In the severe scenario, gas prices are assumed to be twice as sensitive to Russian gas supplies being cut off than in the adverse scenario, given the drawdown of inventory stocks and a continued tight gas market.

How can the crisis in Ukraine affect Spain?

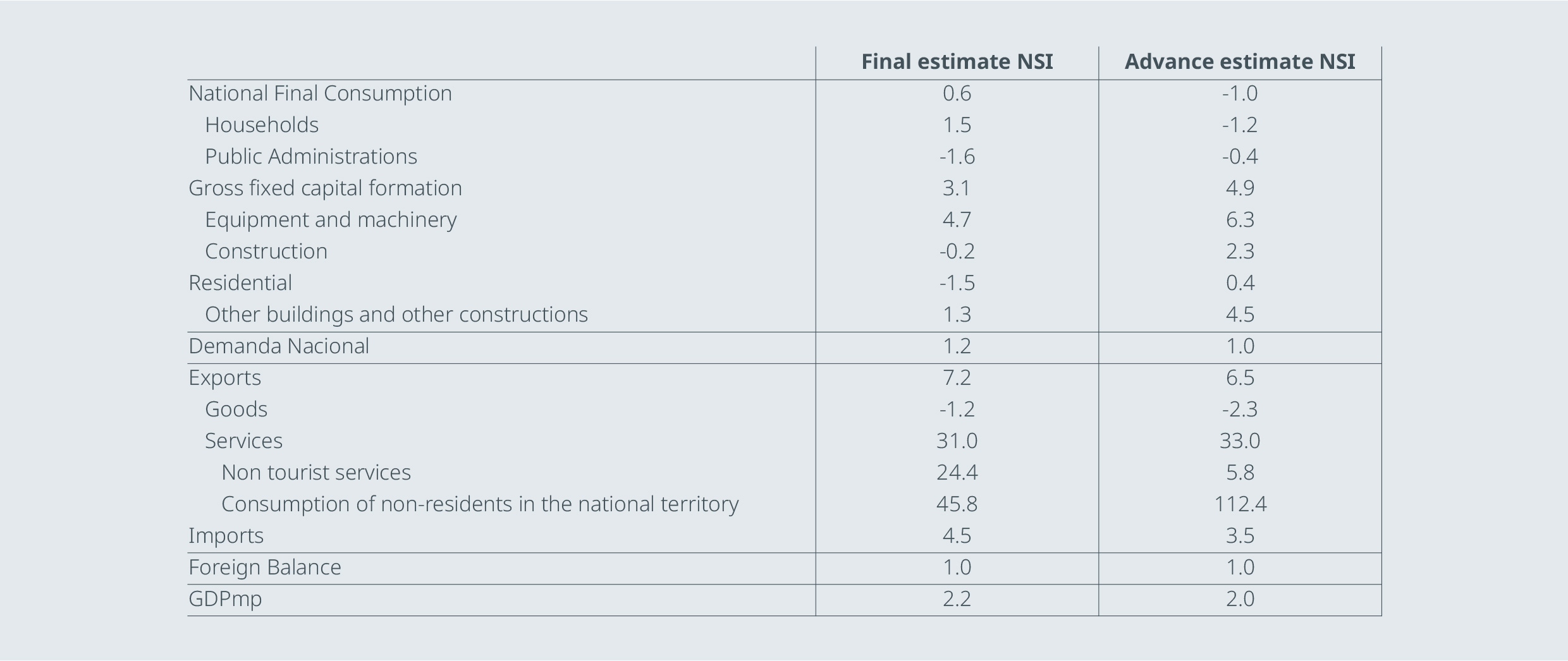

The Spanish economy slowed down slightly in 4Q21 to 2.2% QoQ (Figure 3), according to the second estimate of the Quarterly National Accounts (QNA), slightly less than in the previous

quarter (2.6% QoQ), but above that indicated in the advanced estimate of the National Statistics Institute (INE) published at the end of January (2.0% QoQ). Thus, the level of activity was 5.5% higher

than that registered in 4Q20, and there was 3.8pp left to reach the pre-crisis maximum. Taking 2021 as a whole, the Spanish economy grew by 5.1% YoY, somewhat above what was expected in our

September report.

FIGURE 3 Spain: economic forecasts and observed data 4Q21 (% of GDP)

Source: National Statistics Institute (INE)

The war that has broken out between Russia and Ukraine makes it very difficult to predict the course that economic activity will follow, but with each passing day it seems more difficult for the growth trajectory of Spanish GDP in 2021 to reach the 5% threshold, which we expected to be exceeded in the last quarterly publication of December.

Within the precautions that must be taken when analyzing such volatile circumstances, two types of effects can be distinguished: a) first-round effects, of a real nature, derived from restrictions on the supply of energy products, raw materials and industrial products (both from Russia - due to sanctions; and Ukraine - for the suffered effects of war); and b) second-round effects, of a financial nature, derived from the impact on prices and interest rates. We can anticipate that, in the case of Spain, the latter will be considerably more important than the former.

Regarding the first- round effects, Spain does not have a high exposure to Russia in terms of energy dependency. In 2019, less than 11% of our oil imports came from Russia, well below the 37% from Germany or 22% from Italy. As for gas, barely 6% of our purchases come from Russia, well below the EU average of 40%, which includes a 37% dependency on Italy, 58% on Hungary and 84% on the Czech Republic (Germany does not distinguish between the origins of its gas imports, but it is estimated to be between a third and 40%).

At a macroeconomic level, the most worrying thing for Spain, however, will be the effects of the second round. Oil and gas prices are already rising, which will have a direct impact on the final price of the products and therefore on inflation and the monetary policy normalization expected by the European Central Bank in 2H22. In fact, the acceleration of energy inflation could contribute to raising inflation expectations in the medium term, which could trigger an inflationary spiral on prices

and wages.

Considering our average inflation forecast of 5,6% in 2022 for the Eurozone, we estimate that the average inflation in Spain in 2022 could range between 50-75bp higher than the one in the eurozone (Figure 7). In this token, the underlying inflation in Spain in 2022 would likely go slightly above the 3% threshold.

On a very preliminary basis, we would estimate GDP growth of the Spanish economy in 2022 to stand in the 4.0- 4,5% range vs. our initial 5.6-6,0% estimate. This stands significantly below the 7% YoY GDP growth for Spain in 2022 that was included in the 2022 State Budget and that, in our view, was rather too optimistic since the beginning; Spanish press reports that the Economy Minister could update the expected 2022 GDP growth of the Spanish economy to the 5% range in 2022.

The bulk of the downgrade of the Spanish GDP forecasts is on the back of the negative impact on internal demand (household consumption) that would now grow in a range of 2,0-2,5% in 2022 vs an initial range of 4,0% YoY growth, which was more in line with the 4,6% YoY growth in 2021 from household consumption.

The ongoing uncertainties make even more complicated to give an accurate estimate of the Spanish economy GDP growth in 2023; before the Russia-Ukraine war, all the estimates pointed to a further deacceleration of growth of the Spanish economy in 2023 vs 2022 down to the low 4% range vs the high 5% range in 2021.

Considering all the factors we have already explained in this note, we would pencil in the Spanish growth rate in 2023 to be around 100bp lower than in 2022, thus a very cautious initial guess

would place the Spanish GDP growth in 2023 in the low 3% range, approximately.

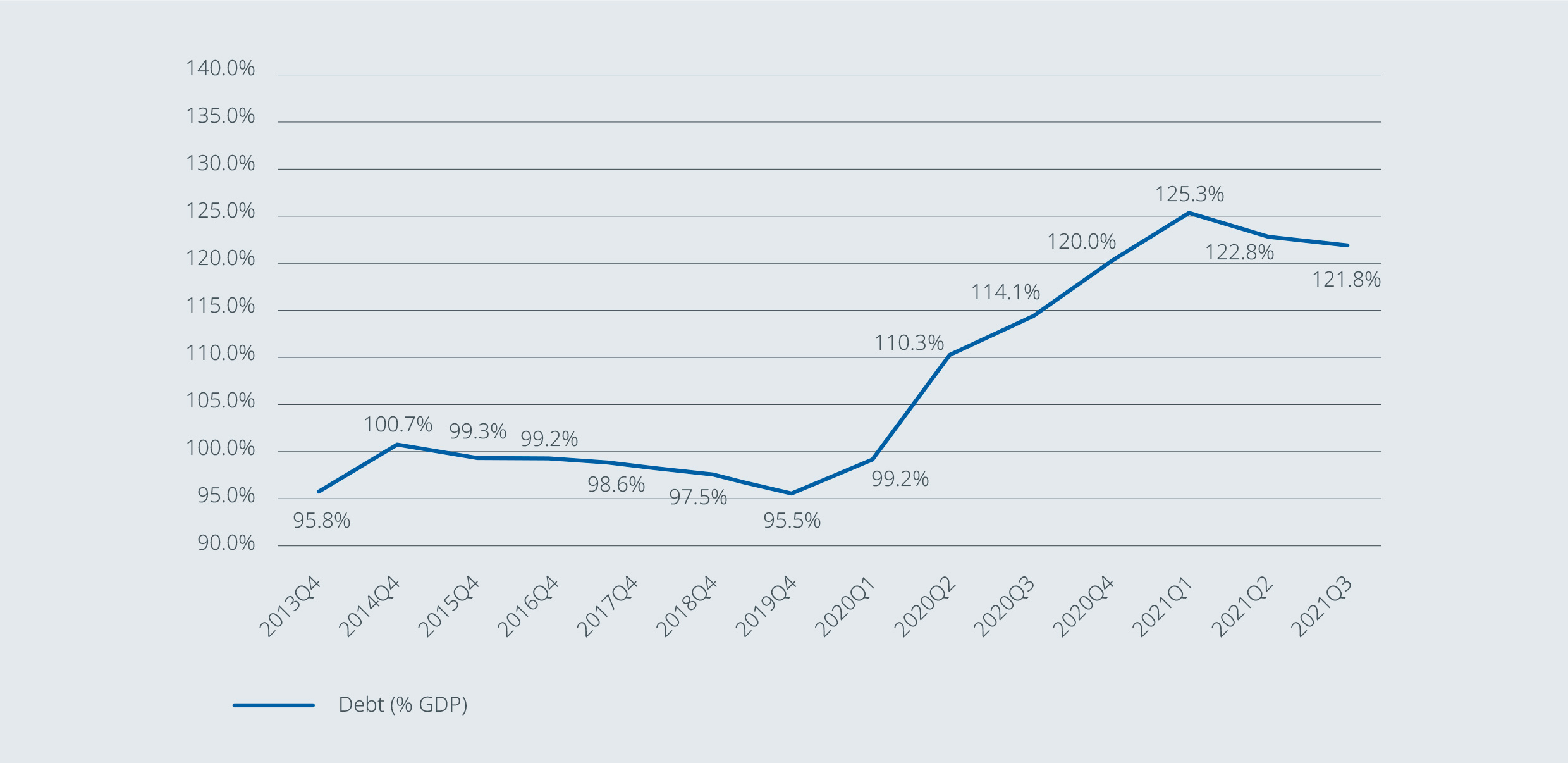

Spain: the fiscal outlook in 2021-2022

The Independent Fiscal Authority (AIReF) estimates the debt/GDP ratio of the Spanish Public Administrations at the end of 2021 to stand around 118.7%, which represents a reduction of 1.3 points in the year. Although this closing level for 2021 represents an improvement compared to the initial estimates from both national and international organizations, it should be noted that it represents an increase of 23.1 points compared to the level registered prior to the pandemic

(Figure 4).

FIGURE 4 Quarterly evolution of the Spanish debt/GDP ratio since 2013 (% of GDP)

Source: Bank of Spain

As for the risks to sustainability, the invasion of Ukraine raises the risk of a stagflation scenario in the European Union, where high inflation could become more persistent, unleashing upward spirals and second-round effects that would complicate the normalization process of monetary policy.

The foreseeable increase in health and pension spending as a result of population aging is one of the main risks for the sustainability of public finances in the medium and long term. The strategy of lengthening the average life of debt issues has generated a certain margin of protection against possible rises in interest rates which, if they occur, would take eight years to completely transfer to the average rate of the portfolio.

It is straightforward to say that a weaker growth points to marginal fiscal improvement in 2022, with deficit and debt hovering very close to the 2021 levels, standing around the mark of 6% of GDP.

The impact that this new economic scenario will have on public accounts is yet to be determined until we know more of the fiscal measures that the Government can take to cushion the rise in energy prices. Beyond the cyclical impact that lower growth rates can have on budget balance, we tentatively incorporate an incremental fiscal easing worth 0.5% of GDP in order to finance targeted measures aimed at offsetting part of the energy price shock to vulnerable households and energy-intensive businesses, as well as measures to moderate the retail price of gasoline/diesel.

Request the full report by sending an email to [email protected]