Spain and its territorial entities in 2Q2022: from the health emergency to the energy emergency - BFF Banking Group

2Q 2022

Spain and its territorial entities in 2Q2022: from the health emergency to the energy emergency

EXECUTIVE SUMMARY

From the health emergency to the energy emergency

Two years after the outbreak of the COVID-19 pandemic, the Spanish economy has been hit by a succession of global supply shocks that have shifted the focus of uncertainty from the health sector to the economy’s supply and whose development and economic implications are difficult to predict (Figure 1).

FIGURE 1 An extraordinarily uncertain scenario: main sources of uncertainty

Source: Bank of Spain

The development of the armed conflict between Russia and Ukraine and the possibility that it could lead to a scenario of energy scarcity has caused the main focus of uncertainty to shift from the health emergency to the energy emergency. The potential future intermittent increases in the COVID incidence due to the lower effectiveness of the domestic vaccines (no mRNA vaccines has been deployed) and the “zero coronavirus” policy in the People’s Republic of China may accentuate supply problems in the manufacturing industry, given the importance of this country in global value chains.

In addition, the appearance of new variants that could slow down the pace of normalization of international tourism cannot yet be ruled out.

The war in Ukraine has meant, in addition to a humanitarian crisis of enormous magnitude, a very severe economic disturbance that has had a substantial impact on the prospects for world growth and for the Spanish economy. In the first weeks of 2022, before the start of the conflict, expectations pointed to a continuation of the global economic recovery after the pandemic, against the background of advances in the vaccination process and the support of economic policies.

In the short term, the negative repercussions of the war in Ukraine on the economy are being offset by the virtual elimination of the restrictions associated with the health crisis.

In a context in which there are no additional significant disturbances, activity could gain more dynamism from the end of this year, supported by the gradual improvement in confidence, the gradual

attenuation of bottlenecks, the moderation of inflationary pressures and the progressive deployment of funds linked to the NGEU programme. Having said this, our base case scenario considers a significant slowdown to take place in 4Q22 as the energy crisis worsens as we approach the winter season.

Uncertainty about the availability of intermediate goods and their price could intensify interruptions in production chains. It is assumed that the bottlenecks in the industry will continue until the first quarter of the following year as a result of various factors. This is justified by various factors. In China, the “zero tolerance” policy with COVID-19 continues to lead to lockdowns and factory closures, which will maintain delays in the arrival of essential inputs for the production of certain

manufactures.

On the more positive side, we must consider the boost provided by the fiscal aid package to mitigate the impact of the war approved at the end of March, the deployment of investment projects associated with the Next Generation EU (NGEU) programme, the maintenance of favorable financing conditions, although somewhat less comfortable than those that have been present in recent quarters and the decrease in uncertainty regarding the evolution of the pandemic.

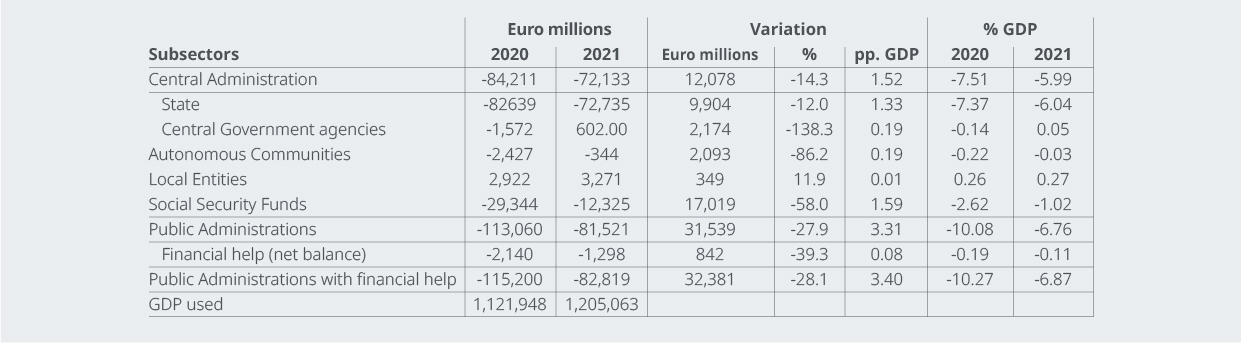

From the fiscal point of view, the AAPP closed 2021 with a deficit of 6.9% of GDP (Figure 2), 1.5 points below the reference rate and the Government’s forecasts. This higher-than-expected reduction in the deficit was mainly based on an increase in revenues above what was foreseen in the General State Budgets.

FIGURE 2 Need (-)/Capacity (+) of financing of the Public Administrations: 2020-2021

Source: Ministry of Finance

Downward revision of growth; risks remain to the downside

The scenario that we propose for 2022 considers that the growth of the gross domestic product of the Spanish economy will maintain its recovery path in this complex environment, although at a rate of around 4% in 2022, notably lower than what the Government expected last autumn (7%). For 2023 and 2024, growth would be around the long-term potential of the Spanish economy, at 1.4% in 2023 and 1.6% in 2024. The projected trajectory would imply that the recovery of the level of output prior to the pandemic would be delayed until the first quarter of 2024.

Our growth projections are in line with those of the Bank of Spain for 2022 (Figure 3) and with the updated forecasts of the Government of Spain (Figure 4), but they are clearly lower in 2023 and 2024, due to the significant reduction in disposable income by the households as the high and persistent inflation levels outpaces the negotiated increase in wages.

Turning to inflation, on an annual average basis, HICP growth is projected to rise to 7.2% in 2022. The war has exacerbated inflationary pressures that were previously affecting commodity markets. On the other hand, there is a certain pass-through of the increases in energy and food prices to other components of consumer prices. In the rest of the projection horizon, inflation would decrease gradually, to 2.6% in 2023 and 1.8% in 2024, under the assumption that energy prices will moderate as indicated by futures markets and that the feedback phenomena between price and wage inflation will have a very contained scope.

Fiscal scenario 2022-2025

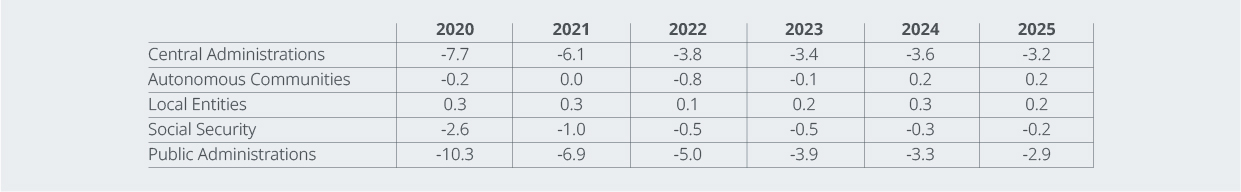

Despite the best fiscal year compared to the forecasts of the Public Administrations in 2021, with a deficit of 6.9% of GDP, the Government maintains for 2022 a deficit forecast for all the AAPPs of 5% of GDP (Figure 3), 8 tenths above the AIReF forecast and a surplus of two tenths in 2024, which would be maintained in 2025. The AIReF maintains a similar profile until 2024, but forecasts a worsening of the balance in 2025, which could close with a deficit close to one tenth of GDP. We do bear in mind that in 2022 the fiscal rules are still suspended.

FIGURE 3 Government of Spain: Fiscal Forecasts 2022-2025

Source: Government of Spain

The Government forecasts (APE) foresee a significant worsening of the autonomous communities (CCAAs) fiscal balance in 2022 and a gradual fiscal consolidation in 2023 and 2024 until reaching budgetary balance in 2025.

Challenges that are appreciated from the point of view of sustainability of public finances

The significant increase in the stock of public debt places the sustainability of public finances in a position of greater vulnerability in the medium term.

The scars of the previous financial and sovereign crisis, together with the sharp increase in financing needs caused by the pandemic, have placed the debt-to-GDP ratio at maximum values. Specifically, the debt-to-GDP ratio stood at 118.4% at the end of 2021 (Figure 4), which represents an increase of 20.1 points compared to the level prior to the pandemic, but was reduced by 6, 8 points from the peak level reached in the first quarter of 2021 (125.2%).

FIGURE 4 Quarterly evolution of debt (% GDP)

Source: Bank of Spain

The Central Administration and the Social Security Funds have assumed 90 percent of the increase in debt in the last two years by financing most of the expenses associated with the pandemic. Extraordinary transfers and the non-repercussion of the fall in tax revenues on the account transfers to the normal status CCAAs have cushioned the increase in the debt ratio of the Autonomous Communities, which has increased by only 2.2 points-up to 25.9% of GDP - of which 0.7 points are attributable to the denominator effect. For their part, the Local Corporations did not see their debt increase.

In the next four years, under the macro-fiscal forecasts prepared by AIReF, a decrease in the debt to GDP ratio of 9.6 points is projected, which would place it at 108.8% in 2025 and in the environment 114% at the end of this year. This projection is in line with the reduction of 8.7 points presented by the Government in the 2022-2025 APE, which is considered feasible. The reduction in the ratio will be supported mainly by nominal GDP growth, where the deflator will have a very notable

contribution.

At the subsector level, the greatest reduction in the debt ratio will be registered in the Autonomous Communities. According to the forecasts prepared by AIReF, the Autonomous Communities will register the greatest reduction in debt (4.6 points), placing their ratio at 21.4% of GDP in 2025.

The AC and the FSS will reduce their ratio to a lesser extent (3. 6 points) and the CCLLs by 1.5 points.

Beyond a certain improvement in the short-term fiscal situation, AIReF’s projections show unfavorable dynamics in the debt ratio under a scenario of constant policies. The simulations carried out by AIReF show that maintaining a constant structural primary deficit between 1.5 and 2.5% of GDP, in line with the estimates of the Government and AIReF, would initiate an upward dynamic in the path of the ratio of debt, with a growing total deficit as a result of higher interest spending.

The high level of indebtedness, together with higher financing rates, will require a sustained structural adjustment to place the debt at more prudent levels, contain the financial burden and generate fiscal space to face future risks. The simulations carried out by AIReF show that reaching public accounts in balance in the next decade will require a sustained structural fiscal adjustment of between 0.25 and 0.5 points per year. In this way, an annual adjustment of 0.35 points would allow the debt ratio to be reduced to 80% in 2040, reaching budget balance in 2035 and maintaining a contained interest expense of around 2.5% of GDP.

The war in Ukraine generates new investment needs in the short and medium term associated with both defense spending and the greater urgency to increase renewable energy production capacity and reduce energy dependence on Russia. To this must be added the known challenge of the aging of the population and the increased spending on pensions, which, if not financed with additional income, will translate into a very significant increase in indebtedness from historically very high levels.

Autonomous Communities: macro forecast 2022-2023

As a consequence of the downward revision of the growth prospects for Spain in 2022-2023, the Autonomous Communities that, in principle, would be most intensely affected by this decrease in expectations would be those in the north of Spain due to their greater energy intensity. In addition, the lower recovery in Europe and the international trade in goods also had a greater impact on these CCAAs.

As a consequence, the communities that could see their growth most limited are those of Aragon, Castile-Leon, Cantabria, the Basque Country, Galicia, Asturias and Navarre. These are, in fact, the ones that stand out for the use of imported intermediate goods and the energy intensity of their production, the sensitivity of their activity to the price of oil and the weight of foreign trade in goods in their GDP. In all of them, the average annual growth in the biennium will be slightly below 3%, with downward revisions that exceed, on average for both years, 1.7 percentage points.

With all this, it is expected that the highest GDP growth will be observed in the island communities: both the Canary Islands and the Balearic Islands could increase their activity at an average annual rate of over 6%. Madrid could benefit, in addition to the recovery of urban tourism, from sectoral diversification and the lower energy intensity of its production, which would make it easier for its annual growth to reach 4.5% in the biennium. The recovery of tourism and sectoral diversification will also drive progress in Catalonia (3.6%) and, to a lesser extent, in Valencia (3.4% on average).

A final factor supporting growth is the NGEU funds. Although in 2021 the execution of these funds started slowly, the calls and tenders known for this first semester point to a considerable acceleration in spending. Until now, although it is not the main objective, the distribution of these funds seems to coincide with the objectives of regional convergence. This boost to growth, which partially offsets the aforementioned negative impacts, will be especially noticeable in communities with a high weight of the public sector in their activity, such as Extremadura (3.9%) or Andalusia (3.6%).

Request the full report by sending an email to [email protected]