Report Macro Perspectives Spain 2Q2021 - BFF Banking Group

Macro perspectives on Spain and its regional governments' finances

2Q 2021

Extraordinary State transfers: uncertainties about regional deficits in 2022?

Executive Summary

Spain: macro and fiscal scenario in 2021-2024

The macroeconomic scenario of the Stability Program 2021-2024 (APE) sent by the government to the European Commission contemplates a GDP growth of 6.5% in 2021, almost three percentage points lower than the growth of 9.8% included in the 2021 State Budget only half a year ago.

In the medium term, the Spanish government's forecasts assume that GDP registers a period of high growth, peaking at 7% in 2022, to return at the end of the forecast horizon towards rates of 3.5% in 2023 and 2.1% in 2024 - still higher than pre-crisis estimates of potential growth.

The Independent Fiscal Monitor (AIReF) estimates are a tad lower than the updated government estimates. Under the assumption that a gradual control of the pandemic is achieved, AIReF forecasts a growth of the gross domestic product (GDP) of 6.6% in 2021, followed by an expansion of 7.0% in 2022. In 2023-2024 the growth path would gradually return to the pre-pandemic potential growth rates. In this scenario, the economy would regain pre-pandemic activity levels by the end of 2022.In the labor market, the unemployment rate falls to below pre-crisis levels at the end of the forecast horizon.

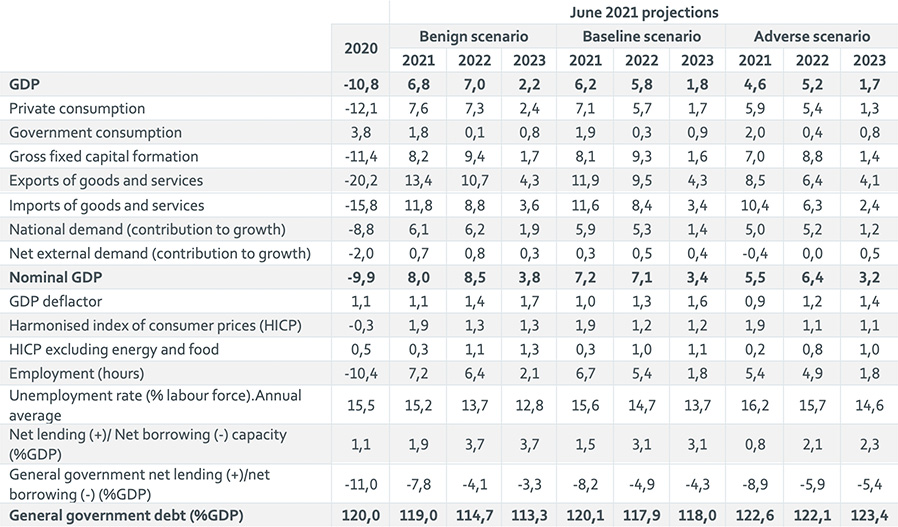

According to updated estimates by the Bank of Spain, the Spanish GDP is expected to grow by 6.2% in annual average terms in 2021. Furthermore, this notable growth in the second half of the year will give rise to a sizeable carry-over effect in 2022, resulting in GDP also posting a high growth rate next year (5.8%) before easing in 2023 (1.8%). Spain is expected to return to its pre-pandemic GDP level towards the end of 2022.

Figure 1 Bank of Spain: macro scenario 2021-2023

Source: Bank of Spain

Note: Latest QNA figure published: 2021 Q1.

Projections cut-off date: 27th May 2021.

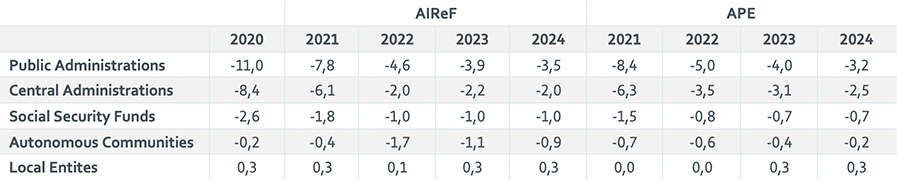

On the fiscal side, AIReF estimates a gradual reduction in the deficit of Spanish public administrations in its central scenario for 2021-2024, until reaching 3.5% of GDP in 2024, 3 tenths higher than the one included by the government in the 2021-2024 APE.

Figure 2 Evolution of the budgetary balance by public administration: AIReF vs APE (2021-2024)

Source: AIReF 2021

The fiscal path forecasted by AIReF presents an uneven evolution in the first and second half of the period analyzed. In the first two years, 2021 and 2022, there is an improvement in the deficit of 3.1 and 3.2 points, from 11% to 7.8% in 2021 and 4.6% in 2022. The factors that would drive this reduction are: a) the gradual withdrawal of the COVID measures (3.4 points); b) the strong growth in income due to the high rates of economic growth partially offset by the inertial evolution of expenses (1.4 points); c) certain non-recurring operations (1.2 points); and d) to a lesser extent, the growth in income derived from the measures included in the 2021 State Budget (0.5 points). The second half of the period, with a softer growth in activity and with a lower level of expenses linked to the effects of COVID, would drive a slower reduction in public deficits of 6 and 4 tenths for 2023 and 2024 respectively, until reaching 3,5% of GDP in 2024.Under AIReF's macro-fiscal forecasts, a reduction in the debt-to-GDP ratio of 7.6 points is projected in 2021-2024, up to 112.4%.

Local entities: budgetary surpluses to continue in 2021

AIReF estimates that local corporations could reach a budget surplus of 0.3% of GDP in 2021, largely motivated by the better-than-expected closing in 2020, which seems to be mainly due to the lower negative impact of the health, social and economic crisis scenario, especially in local expenses that, although they have been increased by more than one tenth of GDP as a consequence of the pandemic, these have been compensated by the non-realization of other expenses. In addition, the lower expected increase in spending and the slight improvement in revenues determine the rest of the expected improvement in the local entities balance in 2021.

Regarding the 24 largest local entities in Spain - and despite the negative effect on their 2021 accounts of the decline in their revenues more directly linked to economic activity and the discretionary measures adopted in this matter of expenses and income to alleviate the negative effects of the pandemic -, the expected fiscal performance in 2021 anticipates the consecution of a surplus of at least the same level of the previous year.

AIReF maintains its December deficit forecasts in 2021 for the Barcelona and Bilbao city councils, and the three DD.FF. (Provincial Councils) and incorporates the city councils of Palma and Valladolid within the group of local entities with projected deficit.

Spanish regions' fiscal performance in 2020: extraordinary State transfers key to understand the reported figures

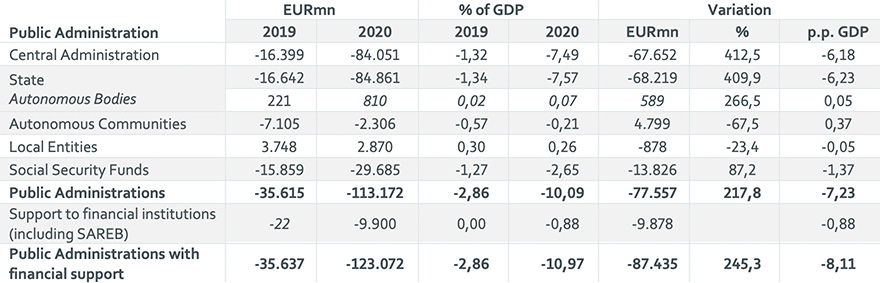

The total deficit of the Spanish regions stood at EUR2.31bn at YE20 (0.21% of GDP), down 67.5% YoY from YE19 when the deficit was 0.57% of GDP. Therefore, the regional public administrations are the only group to have improved their public finances compared to the end of 2019. Although the Spanish regions’ aggregate non-financial expenditure increased by 6.6% YoY (mainly due to higher health care spending), the significant increase in revenues (+ 9.4% YoY) derived from state transfers (mainly the COVID-19 Fund) and resources from the financing system (SFA) helped the regional deficit to post a lower figure than in 2019.

The central government has voluntarily assumed the highest cost of the pandemic in fiscal terms and has financed a large part of the expenses incurred by the Spanish regions. The decisions taken by the central government in 2020 have allowed the regions to reduce their budget deficits despite their higher spending.

Figure 3 Budgetary deficit/surplus of the Spanish public administrations in 2019-20 (EURmn, % of GDP)

Source: AFI, Ministry of Finance

Another significant aspect is that the central administration has paid or financed 90% of all public spending linked to COVID-19 through transfers to other administrations. More specifically, the central administration has provided up to EUR40.44bn to enable administrations to deal with the health and social effects of the pandemic.

Despite the apparent continuity of the deficit path, 2020 was a very atypical year, characterised by a very strong upturn in both expenditure and regional income measured as a percentage of GDP. In addition to the sharp increase in revenues, the increase in expenditure reflects the increase in ;spending needs linked to the pandemic, while the increased revenues were driven by the central government’s decision to absorb the bulk of the shock caused by the crisis in the first instance. This maintained the account transfers calculated with the pre-COVID-19 forecasts and provided additional resources to the regions through extraordinary non-returnable transfers outside the normal regional financing system.

Regional financial debt as of YE20 stood at EUR303.62bn, up EUR8.54bn (+2.9% YoY) from YE19. In relative terms, the aggregate debt-toGDP ratio has increased to 27.1% from 23.7% as of 2019 YE. The increase in the debt-to-GDP ratio was not caused by growth in debt stock - which, ;thanks to the extraordinary resources granted to the regions in 2020, has been contained -, but rather by the sharp drop in nominal GDP.

Although all the regions increased their debt substantially during the previous sovereign crisis in 2009-2013, there are some very important differences between these communities that have registered such increase over time, in both absolute and relative terms. As of today, the regions with the least debt in relation to their GDP are the Canary Islands, Madrid and the foral territories, while those with the highest debt are Murcia, Catalonia, Castille-la Mancha and, above all, Valencia (close to a worrying figure of 50% of GDP).

Regional deficits in 2021 will continue at the lower end of the historical range

AIReF estimates an aggregate regional deficit in 2021 of 0.4% of GDP, below the reference rate of 1.1%, as the extraordinary support from the state continues to boost regional revenues. At the individual level, 15 Spanish regions would close 2021 with a deficit below the 1.1% reference target, with the exception of Murcia and Valencia. If there had been no extraordinary transfers from the central administration related to COVID-19, we believe the Spanish regions’ deficit could have increased to 1.7% in 2020 and 2% in 2021.

The jury is out of what might happen to regional deficits from 2022. Extraordinary State transfers might continue beyond 2021

In 2022-23, everything else being equal, we expect the regional fiscal balance to deteriorate due to the liquidation of the 2020-21 state account transfers in favour of the state. However, we also think it is possible that the extraordinary state transfers will continue until the new regional financing system is agreed upon and becomes operational.

The government expects the public administration’s deficit over 2021-24 to be in line with ongoing extraordinary state transfers; it has explicitly stated that “the path of fiscal consolidation of the Spanish regions (...) is strongly conditioned by the support measures provided by the state in favour of the regions”.

The main fiscal risks for the Spanish regions are: a) the high stock of debt that most of the Spanish regions have accumulated; and b) the fact that the improvement in the regional budget balance registered in recent years is partly supported by factors that are anomalous and difficult to sustain, including atypically low investment and strong interest subsidies from the FLA/FFCA and other state liquidity mechanisms.

The perverse incentives of the extraordinary liquidity mechanisms

A number of Spanish regions have not been active in the capital markets for almost a decade despite the very favourable conditions both in terms of yields and relative spreads vs the SPGB. These regions now have limited incentives to meet their fiscal targets, as the financing conditions of the loans granted by the government’s extraordinary liquidity mechanisms are highly favourable.

Moreover, Spanish regions’ finance departments now expect some type of debt restructuring in the future (tenor extension or haircuts to principal) in relation to the loans granted under the government’s extraordinary liquidity mechanism, likely preceding the implementation of the new regional financing system. As a result, and due to the delay in implementing a new financing model and also, by extension, the continued debate about what to do with the growing regional debt pile from the extraordinary liquidity mechanisms, some regions are openly rejecting the idea of tapping the capital markets despite the very affordable rates and tight spreads at present. Instead, they are opting to maintain their significant exposure to the extraordinary liquidity mechanisms to make sure they do not miss out on having their extraordinary liquidity loans being restructured.

Regional average payment time to suppliers and commercial debt hit new lows

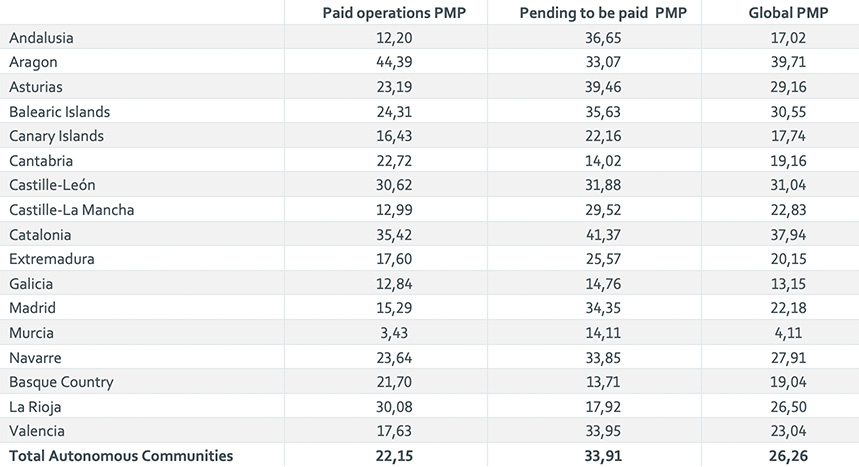

The latest available APT data from March 2021 shows that the Spanish regions’ Average Payment Period to Suppliers (PMP) came in below 30 days for a fourth consecutive month at 26 days – the lowest-ever figure since the series began in April 2018 and the first time this situation has occurred.

The successive record low PMPs are in large part due to the resources transferred by the central government to the Spanish regions, which have managed to offset the impact of the crisis on companies and SMEs that supply these administrations.

As a result, in March no region presented a PMP greater than 60 days – the limit at which the Ministry of Finance begins to apply the measures provided for in the stability regulations. In addition, only four regions have failed to comply with the 30-day period.

Figure 4 Average payment time to suppliers (PMP) by region as of March 2021

Source: Ministry of Finance

Regional commercial debt is estimated at EUR2.99bn, equal to 0.25% of national GDP. Global commercial debt and also the one linked to healthcare is once again nearing an all-time low in the entire series published since April 2018, even improving on January’s low. The main cause of this decline is the liquidity measures that the state implemented to help the Spanish regions. Back in December 2020, commercial debt was already down almost 30% YoY, and this trend was maintained in January and February. In other words, although commercial operations have increased as a result of the pandemic, payments have increased to a greater extent due to the state's liquidity measures, helping to reduce Spain’s overall level of commercial debt.

Extraordinary liquidity funds in 2021

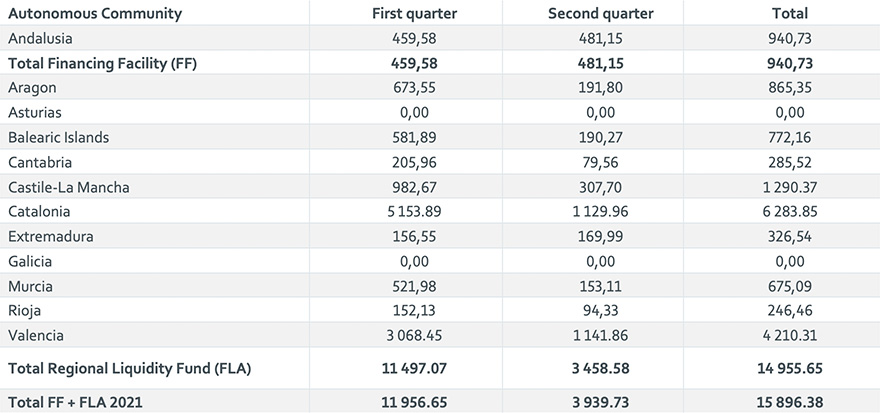

The Spanish Finance Ministry estimates the initial needs of the Financing Fund for Spanish regions (FFCA) for FY21 to stand at EUR34.92bn. This amount would increase to EUR36.80bn if the amount granted to the temporary REACT-EU Liquidity Fund Compartment is also accounted for. In 2021, only one region (Andalusia) is in the financial facility compartment, and it will also be the only region using both capital market financing and financing from the extraordinary liquidity mechanisms. Nine regions: Aragon, the Balearic Islands, Cantabria, Castille-la Mancha, Catalonia, Extremadura, Murcia, Rioja and Valencia - will be part of the FLA compartment in 2021 and will therefore meet their entire funding needs through extraordinary liquidity mechanisms.

Figure 5 Disbursement by region of the extraordinary liquidity funds in 1H2021

Source: Ministry of Finance

Request the full report by sending an email to [email protected]