4Q 2022 - BFF Banking Group

4Q 2022

Spain and its territorial entities in 4Q2022: Spain faces the global slowdown in 2023 from a solid fiscal & macro starting position

Executive Summary

A global scenario marked by the economic slowdown and still high levels of inflation, although gradually decreasing.

The world economy has lost dynamism in the final stretch of the year as a consequence, mainly, of the adverse effects of the war in Ukraine on activity, of the high inflation rates and of the response of monetary policies to the strong and persistent rebound in prices.

In any case, in a backdrop characterized by extraordinary uncertainty and by the simultaneous occurrence of multiple adverse shocks, global economic activity has been showing, in recent months, an appreciable level of resilience. To the latter would have contributed, among other factors, the considerable dynamism that the labor markets have shown in many of the main world economies and the fiscal policy measures deployed by the different national authorities to face the energy crisis and the rebound in prices.

The slowdown in world economic activity has favored, in recent months, a certain weakening of the inflationary pressures that have been emanating from the evolution of the prices of raw materials. Indeed, metallic and food raw materials have tended, for the most part, to become cheaper in the autumn months. Among energy companies, the price of oil has also fallen in that period. In the case of gas, the price declines in the European markets were very pronounced at the beginning of the autumn, against the background of relatively high temperatures for that time of year, although in late - November and December, the increase in demand, under less favorable weather conditions, led to a new increase in the price of this fuel and has once again highlighted the high volatility to which its price is subject. Gas prices has been also declining again lately due to the mild weather conditions in late - December that will extend whole first month of January in 2023.

The sustained deterioration in activity, the high levels of uncertainty and the headwinds present in the global economic path have led to the downward revision of the economic outlook for 2023 of the different international organizations. Thus, the International Monetary Fund (IMF) foresees an increase in global GDP of 2,7% per year compared to the projected last July of2.9%, keeping its growth forecast for 2022 unchanged at 3, 2% per year. The forecasts reflect that approximately 30% of the economies could enter a recession in 2023, especially in Europe if the energy and geopolitical scenario worsens, and in the case of the US depending on the degree of ersistence of inflationary tensions and the tightening of monetary policy.

Following the sharp increase in sovereign debt on a global basis as a result of the fiscal policy measures adopted to deal with the Covid-19 pandemic, debt ratios have begun a downward path driven by the notable nominal growth.

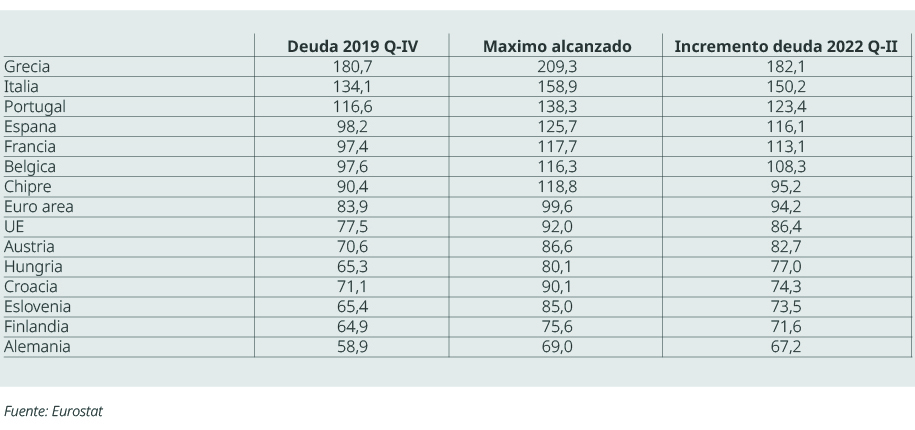

In the case of the Euro area, six countries continue with debt/GDP ratios above 100% (Greece, Italy, Portugal, Spain, France and Belgium, see Figure 1), with the public debt of the Euro area as a whole close to that level. (94.2%). It is worth noting the reduction in the debt ratio in countries such as Greece and Cyprus, 27 and 23 points from its peak value. In the case of Portugal, Spain and Italy, this reduction has been equally notable, amounting to 14.9, 9.6 and 8.7 points respectively. On the other hand, it should be noted that Germany has reduced only 1.8 points from its peak, although its debt ratio is much lower (67.2%).

FIGURE 1 Debt (% GDP) of the EU countries with a ratio above 60%, 2022 Q-II

Looking ahead to 2023, we still have to see exactly what the broad economic and financial ramifications of the unprecedented global hiking cycle will be. We see 2023 as a year of transition from policy risk to recession risk. Central banks are committed to fighting inflation, having embarked on one of the most intense interest rate hike cycles to curb the highest rate of inflation in decades. Despite an expected moderation in the latter, inflation is likely to remain above central bank targets in 2023.

Uncertainties remain very high. While there is significant uncertainty on the timing and severity of this downturn, we think that financial markets may react sooner and more violently than the economy itself. A mild recession in Europe still looks likely over the winter as the economy adjusts to much higher gas and electricity prices and as a result of central bank over tightening. As the intensity of this adjustment abates in the spring, uncertainty over the external backdrop is likely to increase with US growth slowing throughout 2023 and a potential recession later in 2023 and the UK largely stalling.

The longer the US labour market and inflation dynamics take to adjust, the higher the odds of a hard-landing scenario. Regarding inflation dynamics, and although the decline in the months to come will mostly be the low-hanging fruit, with transitory factors likely to fade, the medium to longerterm dynamics are much more difficult to gauge.

According to market consensus, China’s GDP will rebound in 2023 to 4.5-5.0% YoY, in line with its pre-pandemic growth trend, even considering the relaxation of the zero-COVID rules in 2023, but with a back loaded profile as a shorter transitional period in 1Q23-2Q23, to be followed by above-trend sustained recovery from 2Q23 onwards which would drive a recovery in services and retail sales vs. 2022 with the release of pent-up consumption demand and service spending and with corporates beginning to kick-start capex plans amid greater clarity on economic and business outlooks, while supply chain activity returns to normal.

Central Banks: we are still far from a monetary policy “pivot”

We do not see the downshift in the rates hikes pace as a dovish development. With rates in restrictive territory, central banks can afford to move more carefully. This does not change the outlook for either the peak in rates or the persistence of that peak. We believe the markets continue to underestimate how determined central banks are to control the inflation dynamics. Looking ahead we expect more differentiation both across central banks and between hawks and doves within central banks, with the ECB as the developed central banks with the most aggressive rate hikes pace in 2023 (125-150bp of pending hikes).

The Fed closes 2022 with a hawkish tilt

The Fed’s last meeting in 2022 brought another hawkish turn, albeit a more moderate one that the one that the ECB delivered the day after. This is a Fed that remains determined to slow the economy and ease labor market pressures in order to bring the inflation rate sustainably to its 2% target.

A reference to the monetary policy mistakes of the 70s was also delivered a warning, with Chairman Powell stating that the “historical record cautions strongly against prematurely loosening policy. We’ll stay the course until the job is done.”

For the Fed there still appears to be a disconnect between market expectations and its own communication, in terms of both level and duration. The easing of financial conditions since mid-October featured prominently in Powell’s press conference, as it was referenced multiple times, highlighting the importance that financial conditions more broadly reflect the policy restraint. Clearly policymakers are frustrated by an easing of conditions running contrary to their objectives. A key focus at the start of 2023 will be on how Fed officials continue to emphasize this narrative and the fact there would be no pivot by the Fed even as economic conditions begin to deteriorate more appreciably in the first half of 2023.

Powell emphasized the Committee’s “strong view” that rates would stay at their peak until FOMC members are “really confident that inflation is coming down in a sustained way.” Mr Powell added that it would take some time, as it depends in large part of the labor market softening enough for the inflation in the non-housing core services to moderate.

ECB’s December’s meeting shows hawks are in control

The last ECB meeting in 2022 delivered quite a hawkish surprise after it signaled a more aggressive rate hike path in the coming months. The ECB hiked its policy rates by 50bp, slowing down the pace of rate hikes after two consecutive 75bp increases, bringing the deposit facility rate (DFR) to 2.0% and the main refinancing rate to 2.5%. In the press conference, President Lagarde pointed to at least two further 50bp rate hikes and her communication suggested further rate hikes beyond 1Q23, although decisions will be data dependent and taken meeting-by-meeting. The Monetary Policy Decision Statement completely overlooked the downside risks to economic activity that were introduced in October. It did not include any discussion on the lags with which monetary policy operates.

It looks clear to us that that the ECB has become more impatient with the prolonged period of inflation overshooting and felt the necessity to communicate that it wants to bring inflation back to target faster, which would explain why it now qualifies that inflation will stay above the target “for too long” while previously it was comfortable using the more descriptive language that inflation will stay above target “for an extended period”.

We raise our terminal depo rate forecast to 3.25% by June, with overtightening risks on the rise, potentially destroying more demand than is necessary to bring inflation back to target. Two further 50bp hikes seems plausible1, and possibly even a third, with no pivot in sight. This compares to market pricing of 40bp for Feb, 30bp for March and 15bp for May pre-ECB meeting.

The Spanish economy faces 2023 in a solid starting position

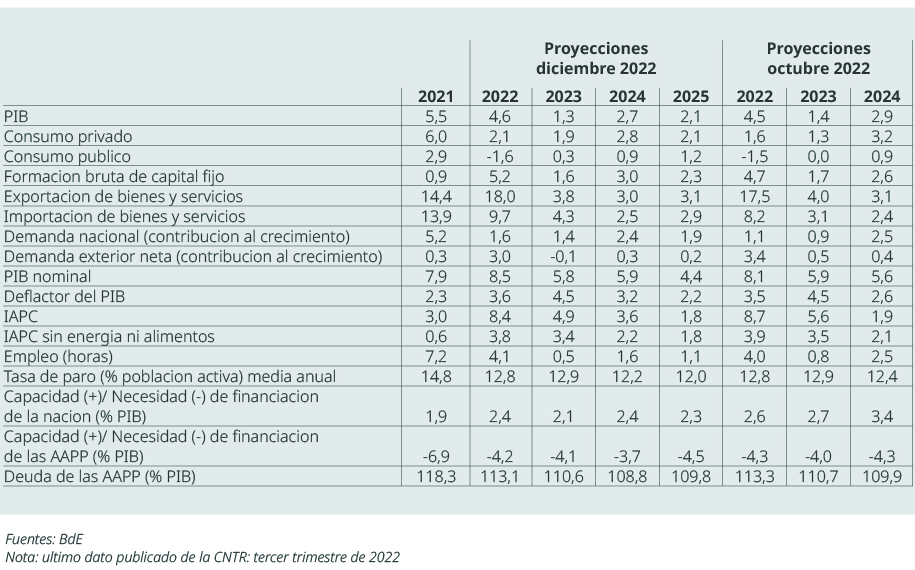

In a highly uncertain macro-financial and geopolitical situation, the Bank of Spain’s macroeconomic projections in Figure 2 contemplate growth rates in real terms of GDP of 4.6% in 2022, 1.3% in 2023, 2.7% in 2024 and 2.1% in 2025; In nominal terms, growth would be around 8.8% in 2022 and 5.1% in 2023, with GDP deflator growth of 4% in 2022 and around 3.8% in 2023. In these forecasts, the weakness of economic activity would still be significant in the first quarter of 2023, as a consequence of the same adverse factors that have penalized the growth of GDP in the second half of 2022.

FIGURE 2 Projection of the main macromagnitudes of the Spanish economy. Annual variation rates on volume (%) and as a percentage of GDP

In the short term, the risks surrounding the growth projections are fundamentally biased to the downside, while, in the case of the inflation projections, the upside risks predominate. However, towards the end of the considered time horizon, the risks are, in general terms, balanced.

The main sources of uncertainty are linked to the evolution of the war in Ukraine and, in particular, to the materialization of developments in the energy markets that may differ significantly from those contemplated in the central scenario of these projections. In this sense, in the gas market, which is subject to particularly pronounced uncertainty, there could be favorable or adverse disturbances in the coming quarters that would imply a considerable impact both on the prices of this raw material and on those of the electricity and potentially also on the volume of gas available in relation to its demand.

Among the rest of the risk elements, the uncertainty about the degree of dynamism that global economic activity could show in the short term, a horizon in which some of the main economies of the Economic and Monetary Union could enter into recession and others, such as China, have significant macrofinancial imbalances. A China re-opening would likely have an inflationary effect on the global economy, casting renewed doubts on the peak inflation and policy pivot narrative.

Given that the Spanish economy is holding up somewhat better than expected and the probability of a contraction in activity is slightly reduced, we are revising our growth forecast upwards for both 2022 (4.6%) and 2023 (1.2%, slightly lower than that of the BdE), while for 2024 we estimate less vigorous growth than that forecast by the BdE, although above the potential long-term growth of the Spanish economy, in the range of 2.1-2.3%, by recovering both private consumption as investment more momentum in 2024.Under the projected trajectory, the GDP of the Spanish economy will recover its pre-pandemic level between the end of 2023 and the beginning of 2024.

These upward revisions to our GDP scenario forecast for 2022-2024 compared to those presented in our September report are due to a combination of factors, among which we would highlight that private consumption and exports continue to increase demand, although a significant part of the impulse is diluted by the higher imports. The labor reform is contributing to the evolution of employment being different, although there are doubts about what this implies for the total number of hours worked and effective unemployment.

For the first quarter of 2023, the dynamics of Spanish economic activity are expected to continue to be characterized by considerable weakness. All this to the extent that, at the beginning of 2023, inflationary pressures are expected to continue to be high, that the tightening of financial conditions continue, that relatively low levels of confidence persist and that global economic activity and, in especially, the European one, presents little dynamism. In contrast to these unfavorable dynamics, the measures deployed by the authorities to deal with the energy crisis and the rise in inflation would provide some support for activity during the first months of next year.

Beyond the first quarter of 2023, starting in spring, activity will recover growing dynamism, when it will be driven by the combination of various factors. These include the gradual easing of tensions in the energy markets and of inflationary pressures, which will bring about a gradual recovery of real incomes and the confidence of national agents, and a strengthening of external demand, the continued deployment of funds linked to the Next Generation EU (NGEU) program and the gradual resolution of distortions in global supply chains.

The Spanish Public Administrations will close 2022 with a deficit that could be lower than the contemplated in the Budgetary Plan

In September, the balance of the Public Administrations, excluding local entities, stood at –3.9% of GDP in the accumulated figure of the last twelve months. This deficit is 3 pp below that observed at the end of 2021 and is also 1.1 pp below the reference established in the Budget Plan.

In this way, the deficit of the Public Administrations in 2023 would be around 4.3% including the extension of the extraordinary measures announced by the Government at the end of December 2022 (around EUR11bn), slightly above the reference rate set by the government of 3.9% for 2023.

Although it is true that there has been a reduction in the fiscal deficit and despite the fact that the difference between the 2019 deficit and that of 2022 may be more or less one point of GDP, the reversal of the fiscal imbalance towards levels similar to those of 2019 occurs with income and expenses exceeding by 5 and 6 pp of GDP, respectively, those observed in 2019. Regarding tax collection, there are reasonable doubts about how much of the increase may be temporary and how much structural.

AIReF estimates that the deficit of the Spanish public administrations will stabilize at around 3.2% of GDP, with a slight upturn being observed in 2026 to 3.3% of GDP. Assuming the temporary nature of the measures adopted both on the spending and revenue sides, once the current crisis is over, the margin for reducing the deficit if additional measures are adopted is exhausted, resulting in a level higher than the 3% limit set in the Stability and Growth Pact.

Autonomous Communities: due to conjunctural factors, we expect a balanced budget/slight surplus in 2023

According to our forecasts, the fiscal execution of the autonomous communities would improve substantially in 2023, reaching a deficit of 0.1% of GDP after closing 2022 with a deficit of around - 1% of GDP. This improvement is mainly explained by the evolution of the resources of the financing system, which grew by 23.9% driven by the growth of the State account transfers and, to a greater extent, by the liquidation that was once again positive after the exceptional negative value in 2022. A 10% year-on-year increase in regional revenues outside the PRTR is expected, with a 24% increase in resources of the financing system, conditioned by the positive settlement of 2021 compared to the negative amount of the settlement of 2020 and a more moderate rise in tax revenue of around 4%, while on the expenditure side we expect growth of 5% in expenditure not associated with the PRTR incorporating the impact of inflation, the update of the remuneration of public employees provided for in the 2023 General State Budget and other measures adopted at the regional level, especially in terms of personnel, especially in the areas of health and education.

In the medium term, this irregular evolution of the resources of the financing system linked to the liquidation of previous years will provide extraordinary resources of a mainly shortterm nature2, exceptionally large in 2024 and which will normalize in subsequent years. Thus, in 2024, the Spanish autonomous communities could record a surplus of 0.4% of GDP, which will deteriorate until reaching equilibrium in 2026, where there would already be a liquidation of the financing system at normal levels and where a much more moderate increase in the expected financing system resources that the autonomous communities will receive, around 1.5%-2% for 2025 and 2026. As for expenses, after a stronger growth in 2023, AIReF projects more moderate growth once the inflationary episode has been overcome and due to the return to the binding fiscal rules.

Public debt sustainability

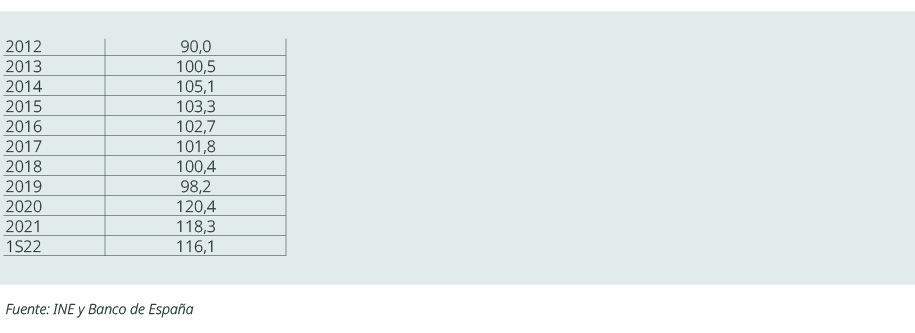

After the strong increase caused by the COVID-19 crisis, the debt ratio has chained a period of five consecutive quarters of reduction, standing in the first half of 2022 at 116.1% of GDP (see Figure 3), which represents a net increase compared to the end of 2019 of 17.9 points. The debt to GDP ratio registered its maximum value (125.7%) in the first quarter of 2021, with an increase of 27.5 points compared to the pre-pandemic level. From that turning point, there have been five consecutive quarters of reduction that accumulate a total of 9.6 points, and that have placed the ratio at 116.1% of GDP in June 2022. The net debt ratio increase compared to the end of of 2019 is 17.9 points.

FIGURE 3 Debt (GDP) quarterly evolution

This significant reduction accumulated in recent quarters is mainly due to the denominator effect, given the strong rebound in economic activity and prices. In nominal terms, public debt has continued to grow, through the first eight months of 2022, reaching a new all-time high that situates it at 1,491 trillion. The GDP, the denominator of the ratio, has already stopped contributing negatively to the increase in the ratio experienced since the pandemic, with the public deficit being the cause of almost all the variation.

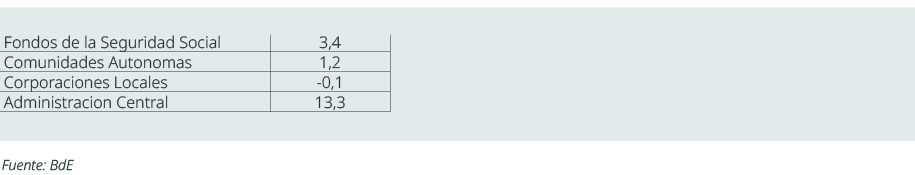

At the subsector level, the greatest increase in the debt ratio has occurred in the Central Administration and the Social Security Funds, which have assumed 93.5 percent of the increase in debt in the last two and a half years (Figure 4) by financing most of the expenses associated with the pandemic. The debt ratio of local entities has remained stable, while that of the regions has experienced a slight increase.

FIGURE 4 Increase in debt (% GDP) between 2022-II and 2019, by subsector

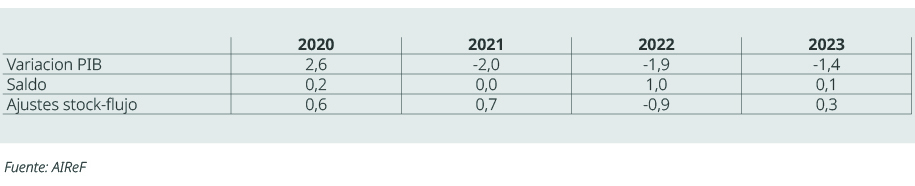

In a context of high nominal growth, the debt ratio maintains a downward path, which AIReF expects to continue in the coming years. Specifically, for the year 2023, AIReF estimates a reduction in the debt ratio of 6.9 points of GDP compared to the level of 2021, mainly supported by the growth of nominal GDP (15.3 points), where the deflator will have a very notable contribution (8.8 pp). The public deficit will continue to contribute significantly to the increase in debt, with a financial burden that will increase in absolute terms, but which will remain contained in relation to GDP despite the deterioration in financing conditions, due to the strong nominal increase in the GDP (Figure 5).

FIGURE 5 Accumulated contribution 2022-2023 to the variation of the debt to GDP ratio (pp)

The significant stock of public debt inherited from the health crisis, added to a high previous level, places the sustainability of public finances in the medium term in a position of vulnerability. The favorable evolution both in the last year and in the short-term projection of the denominator of the debt ratio should not mask the need to achieve a path of budget rebalancing in the medium term that allows for the generation of greater fiscal space in an environment of great uncertainty and demographic pressures.

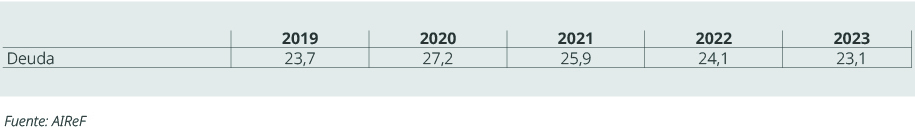

We anticipate that the autonomous communities will reduce their level of indebtedness by almost 3 points from 2021, reaching 23.1% of GDP in 2023 (Figure 6). Starting from 25.9% in 2021, the ratio would improve in 2022 due to the expected GDP growth and the application of excess financing from previous years, elements that would be partly offset by the deficit forecast for the subsector.

In 2023, the expected GDP growth would imply a further reduction in the ratio.

FIGURE 6a Expected evolution of the indebtedness of the Autonomous Communities (% GDP) by component

FIGURE 6b Expected evolution of regional debt 2019-2023 (% GDP)

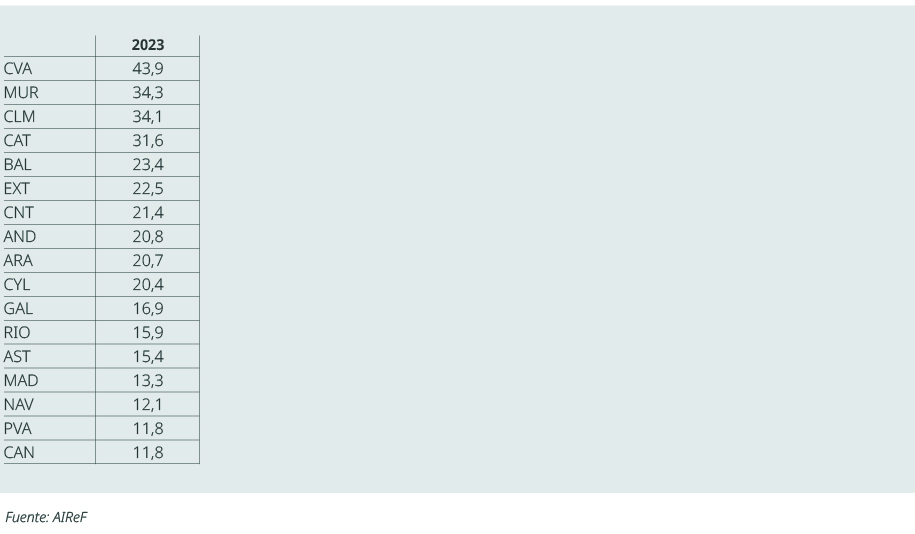

At the individual level (Figure 7), four regions could have a debt ratio above 30%, while another four ones could be at 13%. The Valencian Community, the Region of Murcia, Castile - La Mancha and Catalonia could be above 30% debt/GDP in 2023. The Balearic Islands, which started from a level above that reference in 2021, would see its ratio reduced to levels substantially lower. The autonomous communities of Navarre, the Canary Islands, the Basque Country and Madrid could place their debt at the end of 2023 at around 13% of GDP.

FIGURE 7 Regional debt to GDP ratio (%) in 2023